Europe

From Crisis to opportunity Global Investor, 01/2014 Credit Suisse

From Crisis to opportunity

Global Investor, 01/2014

Credit Suisse

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GLOBAL INVESTOR 1.14 — 37<br />

their purse strings<br />

For the most part, we believe today’s corporate sector is resilient<br />

and we think it is better positioned to weather an unexpected<br />

credit shock. Many corporates have used the prevailing low<br />

interest rate environment and strong demand for credit to<br />

<br />

<strong>Europe</strong>an economic recovery means better economic visibility<br />

or at least more certainty. During the height of the Eurozone<br />

crisis, management had to formulate contingency plans in case<br />

the common currency experienced an existential threat. Now, as<br />

forward visibility improves, companies may be more willing<br />

to engage in corporate actions to pursue growth opportunities.<br />

This could include raising capital expenditure, entering into<br />

mergers and acquisitions, or returning cash to shareholders via<br />

dividends or share buybacks. In reality, it is likely that we will see<br />

a combination of all these measures.<br />

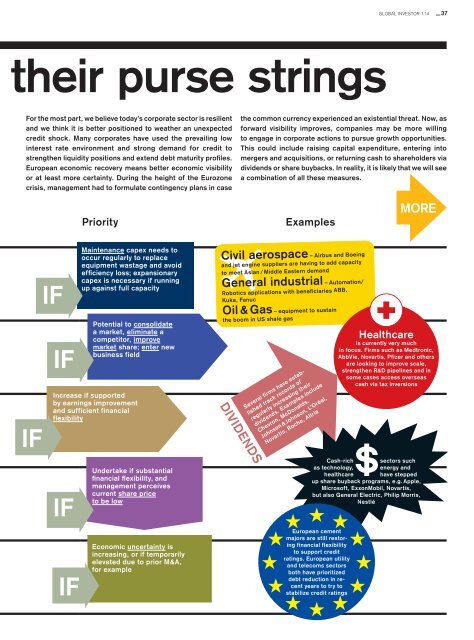

Priority<br />

Examples<br />

MORE<br />

IF<br />

IF<br />

IF<br />

Maintenance capex needs to<br />

occur regularly to replace<br />

equipment wastage and avoid<br />

<br />

capex is necessary if running<br />

up against full capacity<br />

Potential to consolidate<br />

a market, eliminate a<br />

competitor, improve<br />

market share; enter new<br />

business field<br />

Increase if supported<br />

by earnings improvement<br />

and sufficient financial<br />

flexibility<br />

IF<br />

IF<br />

Undertake if substantial<br />

<br />

management perceives<br />

current share price<br />

to be low<br />

Economic uncertainty is<br />

increasing, or if temporarily<br />

elevated due to prior M&A,<br />

for example<br />

Civil aerospace – Airbus and Boeing<br />

and jet engine suppliers are having to add capacity<br />

to meet Asian / Middle Eastern demand<br />

General industrial – Automation/<br />

Robotics applications with beneficiaries ABB,<br />

Kuka, Fanuc<br />

Oil & Gas – equipment to sustain<br />

the boom in US shale gas<br />

DIVIDENDS<br />

Several firms have established<br />

track records of<br />

regularly increasing their<br />

dividends. Examples include<br />

Chevron, McDonalds,<br />

Johnson & Johnson, L’Oréal,<br />

Novartis, Roche, Altria<br />

Healthcare<br />

is currently very much<br />

in focus. Firms such as Medtronic,<br />

AbbVie, Novartis, Pfizer and others<br />

are looking to improve scale,<br />

strengthen R&D pipelines and in<br />

some cases access overseas<br />

cash via tax inversions<br />

Cash-rich sectors such<br />

as technology, energy and<br />

healthcare have stepped<br />

up share buyback programs, e.g. Apple,<br />

Microsoft, ExxonMobil, Novartis,<br />

but also General Electric, Philip Morris,<br />

Nestlé<br />

<strong>Europe</strong>an cement<br />

majors are still restoring<br />

financial flexibility<br />

to support credit<br />

ratings. <strong>Europe</strong>an utility<br />

and telecoms sectors<br />

both have prioritized<br />

debt reduction in recent<br />

years to try to<br />

stabilize credit ratings