Europe

From Crisis to opportunity Global Investor, 01/2014 Credit Suisse

From Crisis to opportunity

Global Investor, 01/2014

Credit Suisse

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GLOBAL INVESTOR 1.14 — <br />

ADJUSTMENT REFORM AND RECOVERY<br />

<br />

As noted above, the competitiveness of the periphery countries had<br />

cy’s<br />

existence. Labor costs had shot up substantially, and productivity<br />

growth had not kept up with costs. As a result, unit labor costs<br />

among the EMU countries drifted apart: between 2000 and 2008,<br />

French, Italian and Spanish unit labor costs had risen relative to<br />

Germany’s by 20%, 30% and 35%, respectively. The consequence<br />

was that these economies were affected far more severely by the<br />

global downturn in 2008– 09<br />

within the Eurozone had not yet really erupted. When they did after<br />

2010<br />

was accentuated. Between the trough in the global economy in mid-<br />

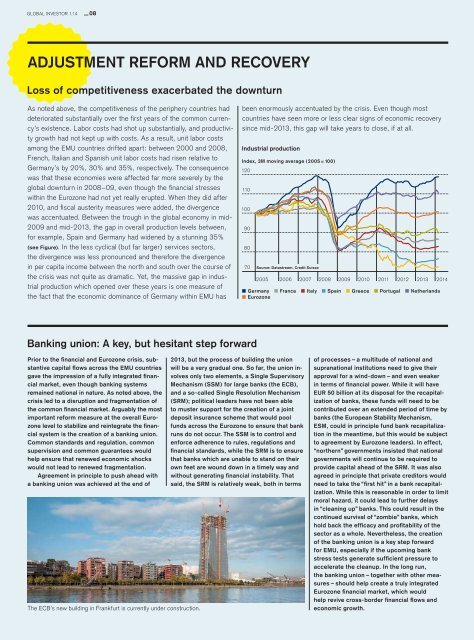

2009 and mid-2013, the gap in overall production levels between,<br />

for example, Spain and Germany had widened by a stunning 35%<br />

. In the less cyclical (but far larger) services sectors,<br />

the divergence was less pronounced and therefore the divergence<br />

in per capita income between the north and south over the course of<br />

the crisis was not quite as dramatic. Yet, the massive gap in industrial<br />

production which opened over these years is one measure of<br />

the fact that the economic dominance of Germany within EMU has<br />

been enormously accentuated by the crisis. Even though most<br />

countries have seen more or less clear signs of economic recovery<br />

since mid-2013, this gap will take years to close, if at all.<br />

Industrial production<br />

<br />

120<br />

110<br />

100<br />

90<br />

80<br />

70<br />

Source: Datastream, Credit Suisse<br />

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014<br />

Germany France Italy Spain Greece Portugal Netherlands<br />

Eurozone<br />

<br />

<br />

EMU countries<br />

<br />

<br />

<br />

crisis led to a disruption and fragmentation of<br />

<br />

<br />

<br />

<br />

Common standards and regulation, com mon<br />

<br />

<br />

would not lead to renewed fragmentation.<br />

Agreement in principle to push ahead with<br />

<br />

The ECB’s new building in Frankfurt is currently under construction.<br />

<br />

<br />

<br />

SSMECB<br />

<br />

SRM<br />

<br />

deposit insurance scheme that would pool<br />

<br />

runs do not occur. The SSM is to control and<br />

enforce adherence to rules, regulations and<br />

SRM is to ensure<br />

<br />

own feet are wound down in a timely way and<br />

<br />

said, the SRM<br />

<br />

<br />

<br />

<br />

EUR 50 billion at its disposal for the recapital<br />

<br />

<br />

<br />

ESM<br />

<br />

<br />

<br />

<br />

SRM. It was also<br />

<br />

<br />

<br />

moral hazard, it could lead to further delays<br />

<br />

<br />

<br />

<br />

<br />

for EMU<br />

<br />

accelerate the cleanup. In the long run,<br />

<br />

<br />

<br />

<br />

economic growth.