Europe

From Crisis to opportunity Global Investor, 01/2014 Credit Suisse

From Crisis to opportunity

Global Investor, 01/2014

Credit Suisse

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GLOBAL INVESTOR 1.14 — 38<br />

Corporates have many choices available<br />

A step up in capex needs tighter capacity<br />

utilization rates<br />

The <strong>Europe</strong>an economic recovery may not be<br />

so vigorous as to require a material expansion<br />

in aggregate capital stock. Companies typically<br />

only add to their productive capacity once<br />

utilization rates rise toward full capacity and<br />

to avoid ceding market share to competitors.<br />

A weak growth environment may make raising<br />

capacity relatively uneconomical.<br />

Conditions look ripe for increased<br />

M&A activity …<br />

Instead, companies may seek to deliver the<br />

growth in revenues – and ultimately the earnings<br />

per share that the equity market is looking<br />

for – via mergers and acquisitions. And<br />

since the low inflationary environment has<br />

also left its mark on producer pricing, firms<br />

may well benefit from M&A activity if it consolidates<br />

the market and improves industry<br />

discipline in the process. Competition authorities<br />

will probably be reluctant to allow<br />

mergers that reduce competition and raise<br />

pricing, which explains why companies will<br />

never openly mention this as the motivation<br />

for M&A. Elaborate cost synergies will often<br />

be presented, even if the true rationale underlying<br />

M&A activity often involves improving<br />

market dynamics.<br />

… and may lead to deteriorating corporate<br />

credit quality<br />

We are seeing a marked step-up in M&A activity.<br />

So far, many transactions have been<br />

financed with a substantial equity component,<br />

which limits the potential negative credit<br />

impact. Nonetheless, the current cheap and<br />

plentiful financing available in the corporate<br />

bond market may well encourage corporates<br />

to increasingly use debt in their funding mix,<br />

ultimately leading to an increase in leverage.<br />

It seems likely that we are in the early stages<br />

of an increase in corporate leverage that will<br />

ultimately feed through to pressure on credit<br />

ratings. Sectors likely to see the most M&A<br />

activity include healthcare, telecommunications<br />

and materials, although in reality we<br />

think conditions are ripe for widespread activity<br />

across the board.<br />

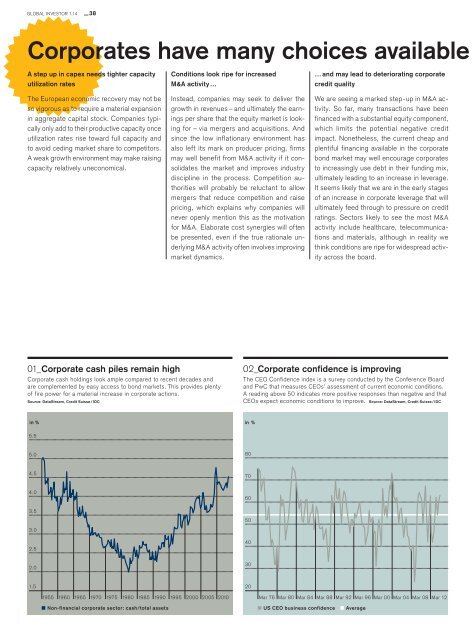

01_Corporate cash piles remain high<br />

Corporate cash holdings look ample compared to recent decades and<br />

are complemented by easy access to bond markets. This provides plenty<br />

of fire power for a material increase in corporate actions.<br />

Source: DataStream, Credit Suisse / IDC<br />

02_Corporate confidence is improving<br />

The CEO Confidence index is a survey conducted by the Conference Board<br />

and PwC that measures CEOs’ assessment of current economic conditions.<br />

A reading above 50 indicates more positive responses than negative and that<br />

CEOs expect economic conditions to improve. Source: DataStream, Credit Suisse / IDC<br />

in % in %<br />

5.5<br />

5.0<br />

80<br />

4.5<br />

70<br />

4.0<br />

60<br />

3.5<br />

50<br />

3.0<br />

2.5<br />

40<br />

2.0<br />

30<br />

1.5<br />

20<br />

1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010<br />

Mar 76 Mar 80 Mar 84 Mar 88 Mar 92 Mar 96 Mar 00 Mar 04 Mar 08 Mar 12<br />

Non-financial corporate sector: cash/total assets US CEO business confidence Average