Europe

From Crisis to opportunity Global Investor, 01/2014 Credit Suisse

From Crisis to opportunity

Global Investor, 01/2014

Credit Suisse

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GLOBAL INVESTOR 1.14 — 05<br />

THE CRISIS<br />

<br />

<br />

4<br />

SPAIN<br />

GERMANY<br />

EUROZONE<br />

FRANCE<br />

ITALY<br />

GREECE<br />

2007<br />

2011<br />

2014<br />

<br />

2<br />

0<br />

Debt less than<br />

60% of GDP<br />

and budget<br />

below<br />

% of GDP<br />

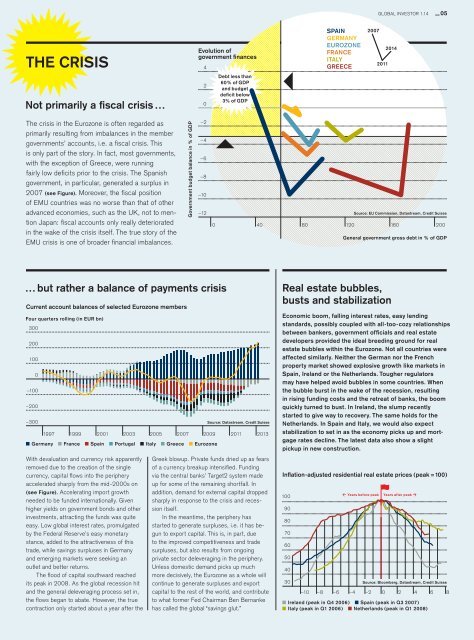

The crisis in the Eurozone is often regarded as<br />

primarily resulting from imbalances in the member<br />

<br />

is only part of the story. In fact, most governments,<br />

with the exception of Greece, were running<br />

<br />

government, in particular, generated a surplus in<br />

2007 <br />

of EMU countries was no worse than that of other<br />

advanced economies, such as the UK, not to men-<br />

<br />

in the wake of the crisis itself. The true story of the<br />

EMU<br />

<br />

–2<br />

–4<br />

–6<br />

–8<br />

–10<br />

–12<br />

Source: EU Commission, Datastream, Credit Suisse<br />

0 40 80 120 160 200<br />

<br />

… but rather a balance of payments crisis<br />

Current account balances of selected Eurozone members<br />

<br />

300<br />

200<br />

100<br />

0<br />

–100<br />

–200<br />

–300<br />

Germany France Spain Greece Eurozone<br />

Source: Datastream, Credit Suisse<br />

1997 1999 2001 2003 2005 2007 2009 2011 2013<br />

With devaluation and currency risk apparently<br />

removed due to the creation of the single<br />

<br />

accelerated sharply from the mid-2000s on<br />

Accelerating import growth<br />

needed to be funded internationally. Given<br />

higher yields on government bonds and other<br />

investments, attracting the funds was quite<br />

easy. Low global interest rates, promulgated<br />

by the Federal Reserve’s easy monetary<br />

stance, added to the attractiveness of this<br />

trade, while savings surpluses in Germany<br />

and emerging markets were seeking an<br />

outlet and better returns.<br />

<br />

its peak in 2008. As the global recession hit<br />

and the general deleveraging process set in,<br />

<br />

contraction only started about a year after the<br />

Greek blowup. Private funds dried up as fears<br />

<br />

via the central banks’ Target2 system made<br />

up for some of the remaining shortfall. In<br />

addition, demand for external capital dropped<br />

sharply in response to the crisis and recession<br />

itself.<br />

In the meantime, the periphery has<br />

started to generate surpluses, i.e. it has begun<br />

to export capital. This is, in part, due<br />

to the improved competitiveness and trade<br />

surpluses, but also results from ongoing<br />

private sector deleveraging in the periphery.<br />

Unless domestic demand picks up much<br />

more decisively, the Eurozone as a whole will<br />

continue to generate surpluses and export<br />

capital to the rest of the world, and contribute<br />

to what former Fed Chairman Ben Bernanke<br />

has called the global “savings glut.”<br />

Real estate bubbles,<br />

busts and stabilization<br />

Economic boom, falling interest rates, easy lending<br />

<br />

<br />

<br />

estate bubbles within the Eurozone. Not all countries were<br />

affected similarly. Neither the German nor the French<br />

<br />

Spain, Ireland or the Netherlands. Tougher regulators<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

gage rates decline. The latest data also show a slight<br />

<br />

<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

<br />

<br />

30<br />

Source: Bloomberg, Datastream, Credit Suisse<br />

–10 –8 –6 –4 –2 0 2 4 6 8