Climate Action 2016-2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

BUSINESS & FINANCE<br />

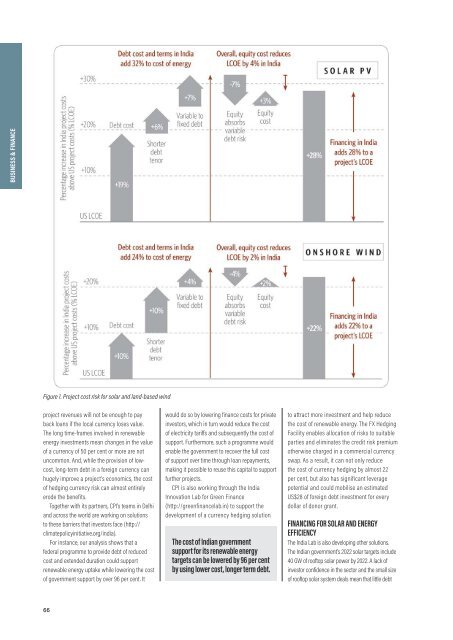

Figure 1. Project cost risk for solar and land-based wind<br />

project revenues will not be enough to pay<br />

back loans if the local currency loses value.<br />

The long time-frames involved in renewable<br />

energy investments mean changes in the value<br />

of a currency of 50 per cent or more are not<br />

uncommon. And, while the provision of lowcost,<br />

long-term debt in a foreign currency can<br />

hugely improve a project’s economics, the cost<br />

of hedging currency risk can almost entirely<br />

erode the benefits.<br />

Together with its partners, CPI’s teams in Delhi<br />

and across the world are working on solutions<br />

to these barriers that investors face (http://<br />

climatepolicyinitiative.org/india).<br />

For instance, our analysis shows that a<br />

federal programme to provide debt of reduced<br />

cost and extended duration could support<br />

renewable energy uptake while lowering the cost<br />

of government support by over 96 per cent. It<br />

would do so by lowering finance costs for private<br />

investors, which in turn would reduce the cost<br />

of electricity tariffs and subsequently the cost of<br />

support. Furthermore, such a programme would<br />

enable the government to recover the full cost<br />

of support over time through loan repayments,<br />

making it possible to reuse this capital to support<br />

further projects.<br />

CPI is also working through the India<br />

Innovation Lab for Green Finance<br />

(http://greenfinancelab.in) to support the<br />

development of a currency hedging solution<br />

The cost of Indian government<br />

support for its renewable energy<br />

targets can be lowered by 96 per cent<br />

by using lower cost, longer term debt.<br />

to attract more investment and help reduce<br />

the cost of renewable energy. The FX Hedging<br />

Facility enables allocation of risks to suitable<br />

parties and eliminates the credit risk premium<br />

otherwise charged in a commercial currency<br />

swap. As a result, it can not only reduce<br />

the cost of currency hedging by almost 22<br />

per cent, but also has significant leverage<br />

potential and could mobilise an estimated<br />

US$28 of foreign debt investment for every<br />

dollar of donor grant.<br />

FINANCING FOR SOLAR AND ENERGY<br />

EFFICIENCY<br />

The India Lab is also developing other solutions.<br />

The Indian government’s 2022 solar targets include<br />

40 GW of rooftop solar power by 2022. A lack of<br />

investor confidence in the sector and the small size<br />

of rooftop solar system deals mean that little debt<br />

66