HELP Hydrocarbon Exploration and Licensing Policy

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Tamil Research Institution (TRI)<br />

India's <strong>Hydrocarbon</strong> Outlook : 2015-16<br />

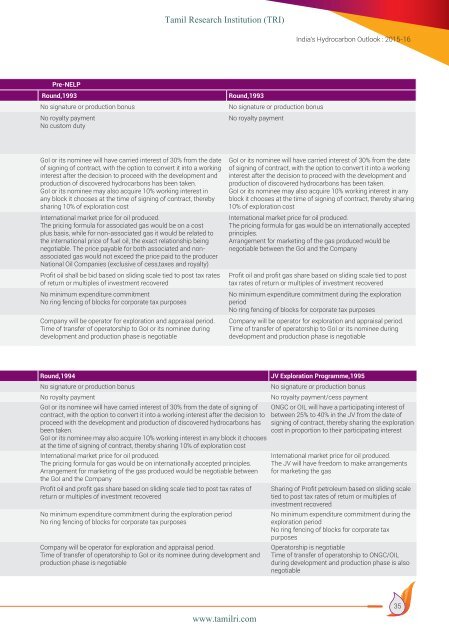

Pre-NELP<br />

Round,1993<br />

No signature or production bonus<br />

No royalty payment<br />

No custom duty<br />

Round,1993<br />

No signature or production bonus<br />

No royalty payment<br />

GoI or its nominee will have carried interest of 30% from the date<br />

of signing of contract, with the option to convert it into a working<br />

interest after the decision to proceed with the development <strong>and</strong><br />

production of discovered hydrocarbons has been taken.<br />

GoI or its nominee may also acquire 10% working interest in<br />

any block it chooses at the time of signing of contract, thereby<br />

sharing 10% of exploration cost<br />

International market price for oil produced.<br />

The pricing formula for associated gas would be on a cost<br />

plus basis, while for non-associated gas it would be related to<br />

the international price of fuel oil, the exact relationship being<br />

negotiable. The price payable for both associated <strong>and</strong> nonassociated<br />

gas would not exceed the price paid to the producer<br />

National Oil Companies (exclusive of cess,taxes <strong>and</strong> royalty)<br />

Profit oil shall be bid based on sliding scale tied to post tax rates<br />

of return or multiples of investment recovered<br />

No minimum expenditure commitment<br />

No ring fencing of blocks for corporate tax purposes<br />

Company will be operator for exploration <strong>and</strong> appraisal period.<br />

Time of transfer of operatorship to GoI or its nominee during<br />

development <strong>and</strong> production phase is negotiable<br />

GoI or its nominee will have carried interest of 30% from the date<br />

of signing of contract, with the option to convert it into a working<br />

interest after the decision to proceed with the development <strong>and</strong><br />

production of discovered hydrocarbons has been taken.<br />

GoI or its nominee may also acquire 10% working interest in any<br />

block it chooses at the time of signing of contract, thereby sharing<br />

10% of exploration cost<br />

International market price for oil produced.<br />

The pricing formula for gas would be on internationally accepted<br />

principles.<br />

Arrangement for marketing of the gas produced would be<br />

negotiable between the GoI <strong>and</strong> the Company<br />

Profit oil <strong>and</strong> profit gas share based on sliding scale tied to post<br />

tax rates of return or multiples of investment recovered<br />

No minimum expenditure commitment during the exploration<br />

period<br />

No ring fencing of blocks for corporate tax purposes<br />

Company will be operator for exploration <strong>and</strong> appraisal period.<br />

Time of transfer of operatorship to GoI or its nominee during<br />

development <strong>and</strong> production phase is negotiable<br />

Round,1994<br />

No signature or production bonus<br />

No royalty payment<br />

GoI or its nominee will have carried interest of 30% from the date of signing of<br />

contract, with the option to convert it into a working interest after the decision to<br />

proceed with the development <strong>and</strong> production of discovered hydrocarbons has<br />

been taken.<br />

GoI or its nominee may also acquire 10% working interest in any block it chooses<br />

at the time of signing of contract, thereby sharing 10% of exploration cost<br />

International market price for oil produced.<br />

The pricing formula for gas would be on internationally accepted principles.<br />

Arrangement for marketing of the gas produced would be negotiable between<br />

the GoI <strong>and</strong> the Company<br />

Profit oil <strong>and</strong> profit gas share based on sliding scale tied to post tax rates of<br />

return or multiples of investment recovered<br />

No minimum expenditure commitment during the exploration period<br />

No ring fencing of blocks for corporate tax purposes<br />

Company will be operator for exploration <strong>and</strong> appraisal period.<br />

Time of transfer of operatorship to GoI or its nominee during development <strong>and</strong><br />

production phase is negotiable<br />

JV <strong>Exploration</strong> Programme,1995<br />

No signature or production bonus<br />

No royalty payment/cess payment<br />

ONGC or OIL will have a participating interest of<br />

between 25% to 40% in the JV from the date of<br />

signing of contract, thereby sharing the exploration<br />

cost in proportion to their participating interest<br />

International market price for oil produced.<br />

The JV will have freedom to make arrangements<br />

for marketing the gas<br />

Sharing of Profit petroleum based on sliding scale<br />

tied to post tax rates of return or multiples of<br />

investment recovered<br />

No minimum expenditure commitment during the<br />

exploration period<br />

No ring fencing of blocks for corporate tax<br />

purposes<br />

Operatorship is negotiable<br />

Time of transfer of operatorship to ONGC/OIL<br />

during development <strong>and</strong> production phase is also<br />

negotiable<br />

www.tamilri.com<br />

35