Best Practices & Learning from Implementing OTM in LATAM

Best Practices & Learning from Implementing OTM in LATAM

Best Practices & Learning from Implementing OTM in LATAM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

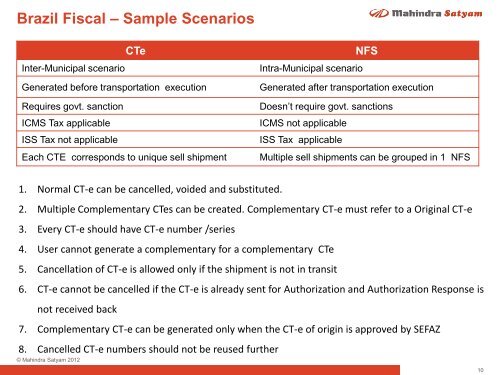

Brazil Fiscal – Sample Scenarios<br />

1. Normal CT-e can be cancelled, voided and substituted.<br />

2. Multiple Complementary CTes can be created. Complementary CT-e must refer to a Orig<strong>in</strong>al CT-e<br />

3. Every CT-e should have CT-e number /series<br />

4. User cannot generate a complementary for a complementary CTe<br />

5. Cancellation of CT-e is allowed only if the shipment is not <strong>in</strong> transit<br />

6. CT-e cannot be cancelled if the CT-e is already sent for Authorization and Authorization Response is<br />

not received back<br />

© Mah<strong>in</strong>dra Satyam 2012<br />

CTe NFS<br />

Inter-Municipal scenario Intra-Municipal scenario<br />

Generated before transportation execution Generated after transportation execution<br />

Requires govt. sanction Doesn’t require govt. sanctions<br />

ICMS Tax applicable ICMS not applicable<br />

ISS Tax not applicable ISS Tax applicable<br />

Each CTE corresponds to unique sell shipment Multiple sell shipments can be grouped <strong>in</strong> 1 NFS<br />

7. Complementary CT-e can be generated only when the CT-e of orig<strong>in</strong> is approved by SEFAZ<br />

8. Cancelled CT-e numbers should not be reused further<br />

10