PDF (10.9MB) - ThyssenKrupp AG

PDF (10.9MB) - ThyssenKrupp AG

PDF (10.9MB) - ThyssenKrupp AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

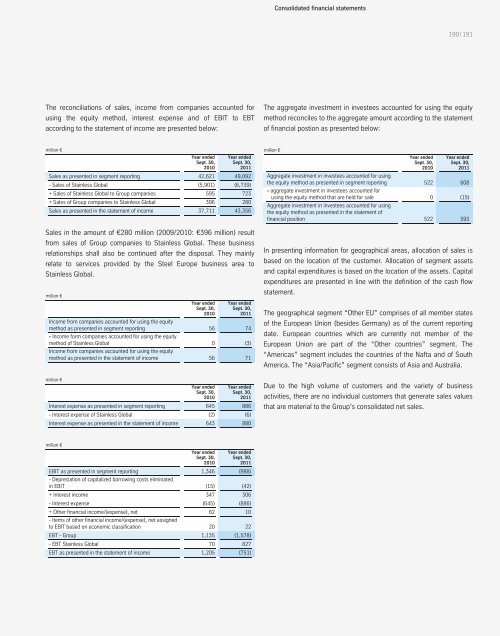

The reconciliations of sales, income from companies accounted for<br />

using the equity method, interest expense and of EBIT to EBT<br />

according to the statement of income are presented below:<br />

million €<br />

Year ended<br />

Sept. 30,<br />

2010<br />

Year ended<br />

Sept. 30,<br />

2011<br />

Sales as presented in segment reporting 42,621 49,092<br />

- Sales of Stainless Global (5,901) (6,739)<br />

+ Sales of Stainless Global to Group companies 595 723<br />

+ Sales of Group companies to Stainless Global 396 280<br />

Sales as presented in the statement of income 37,711 43,356<br />

Sales in the amount of €280 million (2009/2010: €396 million) result<br />

from sales of Group companies to Stainless Global. These business<br />

relationships shall also be continued after the disposal. They mainly<br />

relate to services provided by the Steel Europe business area to<br />

Stainless Global.<br />

million €<br />

Year ended<br />

Sept. 30,<br />

2010<br />

Year ended<br />

Sept. 30,<br />

2011<br />

Income from companies accounted for using the equity<br />

method as presented in segment reporting 56 74<br />

- Income form companies accounted for using the equity<br />

method of Stainless Global 0 (3)<br />

Income from companies accounted for using the equity<br />

method as presented in the statement of income 56 71<br />

million €<br />

Year ended<br />

Sept. 30,<br />

2010<br />

Year ended<br />

Sept. 30,<br />

2011<br />

Interest expense as presented in segment reporting 645 886<br />

- Interest expense of Stainless Global (2) (6)<br />

Interest expense as presented in the statement of income 643 880<br />

million €<br />

Year ended<br />

Sept. 30,<br />

2010<br />

Year ended<br />

Sept. 30,<br />

2011<br />

EBIT as presented in segment reporting<br />

- Depreciation of capitalized borrowing costs eliminated<br />

1,346 (988)<br />

in EBIT (15) (42)<br />

+ Interest income 347 306<br />

- Interest expense (645) (886)<br />

+ Other financial income/(expense), net<br />

- Items of other financial income/(expense), net assigned<br />

82 10<br />

to EBIT based on economic classification 20 22<br />

EBT - Group 1,135 (1,578)<br />

- EBT Stainless Global 70 827<br />

EBT as presented in the statement of income 1,205 (751)<br />

Consolidated financial statements<br />

190 | 191<br />

The aggregate investment in investees accounted for using the equity<br />

method reconciles to the aggregate amount according to the statement<br />

of financial postion as presented below:<br />

million €<br />

Year ended<br />

Sept. 30,<br />

2010<br />

Year ended<br />

Sept. 30,<br />

2011<br />

Aggregate investment in investees accounted for using<br />

the equity method as presented in segment reporting 522 608<br />

- aggregate investment in investees accounted for<br />

using the equity method that are held for sale 0 (15)<br />

Aggregate investment in investees accounted for using<br />

the equity method as presented in the statement of<br />

financial position 522 593<br />

In presenting information for geographical areas, allocation of sales is<br />

based on the location of the customer. Allocation of segment assets<br />

and capital expenditures is based on the location of the assets. Capital<br />

expenditures are presented in line with the definition of the cash flow<br />

statement.<br />

The geographical segment “Other EU” comprises of all member states<br />

of the European Union (besides Germany) as of the current reporting<br />

date. European countries which are currently not member of the<br />

European Union are part of the “Other countries” segment. The<br />

“Americas” segment includes the countries of the Nafta and of South<br />

America. The “Asia/Pacific” segment consists of Asia and Australia.<br />

Due to the high volume of customers and the variety of business<br />

activities, there are no individual customers that generate sales values<br />

that are material to the Group’s consolidated net sales.