I. Table of Contents - ISS

I. Table of Contents - ISS

I. Table of Contents - ISS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

tatiana\Bank Book\Public Bank Book\FINAL <strong>ISS</strong> PUBLIC Bank IM - Press Release to EMTN_1.doc 9 Nov 2005 10:32 76/91<br />

Capex and Operating Leases<br />

76<br />

Historical Financial Information<br />

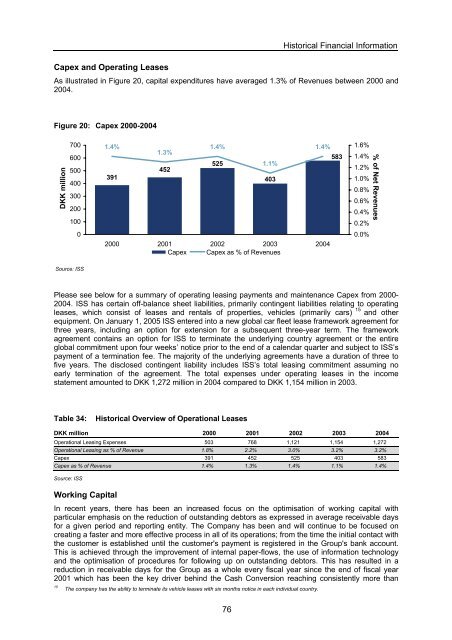

As illustrated in Figure 20, capital expenditures have averaged 1.3% <strong>of</strong> Revenues between 2000 and<br />

2004.<br />

Figure 20: Capex 2000-2004<br />

DKK million<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

Source: <strong>ISS</strong><br />

1.4%<br />

391<br />

1.3%<br />

452<br />

1.4%<br />

525<br />

1.1%<br />

403<br />

1.4%<br />

2000 2001 2002 2003 2004<br />

Capex Capex as % <strong>of</strong> Revenues<br />

Please see below for a summary <strong>of</strong> operating leasing payments and maintenance Capex from 2000-<br />

2004. <strong>ISS</strong> has certain <strong>of</strong>f-balance sheet liabilities, primarily contingent liabilities relating to operating<br />

leases, which consist <strong>of</strong> leases and rentals <strong>of</strong> properties, vehicles (primarily cars) 15 and other<br />

equipment. On January 1, 2005 <strong>ISS</strong> entered into a new global car fleet lease framework agreement for<br />

three years, including an option for extension for a subsequent three-year term. The framework<br />

agreement contains an option for <strong>ISS</strong> to terminate the underlying country agreement or the entire<br />

global commitment upon four weeks’ notice prior to the end <strong>of</strong> a calendar quarter and subject to <strong>ISS</strong>’s<br />

payment <strong>of</strong> a termination fee. The majority <strong>of</strong> the underlying agreements have a duration <strong>of</strong> three to<br />

five years. The disclosed contingent liability includes <strong>ISS</strong>’s total leasing commitment assuming no<br />

early termination <strong>of</strong> the agreement. The total expenses under operating leases in the income<br />

statement amounted to DKK 1,272 million in 2004 compared to DKK 1,154 million in 2003.<br />

<strong>Table</strong> 34: Historical Overview <strong>of</strong> Operational Leases<br />

DKK million 2000 2001 2002 2003 2004<br />

Operational Leasing Expenses 503 768 1,121 1,154 1,272<br />

Operational Leasing as % <strong>of</strong> Revenue 1.8% 2.2% 3.0% 3.2% 3.2%<br />

Capex 391 452 525 403 583<br />

Capex as % <strong>of</strong> Revenue 1.4% 1.3% 1.4% 1.1% 1.4%<br />

Source: <strong>ISS</strong><br />

Working Capital<br />

In recent years, there has been an increased focus on the optimisation <strong>of</strong> working capital with<br />

particular emphasis on the reduction <strong>of</strong> outstanding debtors as expressed in average receivable days<br />

for a given period and reporting entity. The Company has been and will continue to be focused on<br />

creating a faster and more effective process in all <strong>of</strong> its operations; from the time the initial contact with<br />

the customer is established until the customer's payment is registered in the Group's bank account.<br />

This is achieved through the improvement <strong>of</strong> internal paper-flows, the use <strong>of</strong> information technology<br />

and the optimisation <strong>of</strong> procedures for following up on outstanding debtors. This has resulted in a<br />

reduction in receivable days for the Group as a whole every fiscal year since the end <strong>of</strong> fiscal year<br />

2001 which has been the key driver behind the Cash Conversion reaching consistently more than<br />

15 The company has the ability to terminate its vehicle leases with six months notice in each individual country.<br />

583<br />

1.6%<br />

1.4%<br />

1.2%<br />

1.0%<br />

0.8%<br />

0.6%<br />

0.4%<br />

0.2%<br />

0.0%<br />

% <strong>of</strong> Net Revenues