AFHU_News_Vol.21_9.13.18 Spreads (1)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

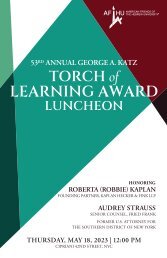

PAGE 18<br />

AMERICAN FRIENDS OF THE HEBREW UNIVERSITY<br />

<strong>AFHU</strong> NEWS VOL. 21 PAGE 19<br />

The Advantages of Planned<br />

Giving Under New Tax Laws<br />

By Neal Myerberg<br />

Principal, Myerberg Philanthropic Advisors<br />

There are many reasons to be philanthropic and<br />

support the nonprofit missions that we believe in,<br />

such as American Friends of the Hebrew University<br />

(<strong>AFHU</strong>). Charitable giving can be personally fulfilling<br />

when contributions pave the way for research<br />

achievements or the success of talented, hard-working<br />

students. Planned gifts such as Charitable Gift<br />

Annuities (CGA) enable individuals to create legacies<br />

that will benefit the Hebrew University community in<br />

future years, essentially “paying it forward” and helping<br />

new generations while receiving a high fixed-rate,<br />

lifetime income.<br />

Recent changes to tax laws are providing donors<br />

with added financial incentives to make outright gifts<br />

and planned gifts. Signed into law on December 22,<br />

2017, the Tax Cuts and Jobs Act (TCJA) that amended<br />

the Internal Revenue Code of 1986 presents opportunities<br />

for income tax savings when planning includes<br />

charitable giving.<br />

Reduced income tax rates<br />

For many individuals and couples, tax rates will<br />

be lower in 2018. That alone would suggest that the<br />

new tax law offers savings when compared to the law<br />

applicable in 2017.<br />

Reduced itemized deductions & the charitable<br />

deduction<br />

However, moving into more favorable tax brackets<br />

may depend upon the amount of itemized deductions<br />

that taxpayers may make use of in determining<br />

taxable income. With state and local taxes (SALT)<br />

and mortgage interest deductions capped, it may be<br />

that increasing one’s deductions for various types<br />

of charitable giving will have even greater economic<br />

value than charitable gifts have provided in recent<br />

years.<br />

Increase in the standard deduction<br />

Will raising the amount of the standard deduction<br />

for individuals and joint filers affect philanthropy?<br />

Many individuals who have traditionally made annual<br />

charitable gifts did not itemize deductions. Their<br />

contributions, as with those who itemize, were motivated<br />

by their desire to support organizations carrying<br />

out important charitable missions that were dear<br />

to them. Add to that the fact that moving above the<br />

standard deduction amount may be good tax planning,<br />

taxpayers may give more, not less, to charities<br />

in 2018 to reduce Adjusted Gross Income (AGI) and<br />

pay less income tax while contributing to the good<br />

that charities provide to society.<br />

Increase in the AGI limits for deducting cash contributions<br />

An additional benefit under the new law is the<br />

increase from 50% to 60% in the percentage of<br />

AGI one can deduct for cash gifts to charities in the<br />

year made. In 2018 this can be significant for some<br />

taxpayers. The five-year carryover remains in the law<br />

to the extent that the full amount of contributions in<br />

a particular year cannot be fully deducted.<br />

What types of charitable gifts might individuals<br />

use in 2018?<br />

Outright gifts remain the easiest way to support<br />

charities and are deducted at full value in the year<br />

made. However, the more tax-efficient way to make<br />

outright gifts (unrestricted or designated) is to use<br />

appreciated property (e.g., marketable securities) to<br />

make contributions. In the case of appreciated stocks<br />

(long-term capital gain property), the transfer directly<br />

to charity generates not only a full value charitable<br />

deduction but also full avoidance of any tax on the<br />

long-term capital gain.<br />

For those who want to generate lifetime<br />

income from their gifts and obtain<br />

an income tax charitable deduction,<br />

consider high fixed lifetime rate charitable<br />

gift annuities (CGA) or fixed rate charitable<br />

remainder trusts (CRT). A contribution<br />

of investment real estate that has<br />

exhausted its tax benefits and has a low<br />

adjusted basis might prove economically<br />

beneficial when either donated outright or<br />

when used to fund a CRT. In some cases,<br />

funding a CGA with real estate may also<br />

prove beneficial from both income and tax<br />

perspectives.<br />

As 2018 continues to unfold, we will<br />

review planning trends resulting from the<br />

new tax law and provide updates.<br />

Charitable giving can provide tax<br />

benefits and lifetime income, contribute<br />

to sound estate planning, and furnish<br />

additional financial advantages. Equally<br />

important, philanthropic investments<br />

support the Hebrew University of Jerusalem,<br />

enabling the university to conduct<br />

pioneering research and meet global challenges<br />

in future years.<br />

For further information, please visit:<br />

afhu.org/plannedgiving<br />

IT PAYS<br />

TO<br />

<br />

PAY IT<br />

FORWARD<br />

By creating a secure American Friends of the Hebrew<br />

University Gift Annuity, not only do you get great rates,<br />

you also water the seeds of innovation.<br />

<strong>AFHU</strong> HEBREW UNIVERSITY GIFT ANNUITY RETURNS<br />

AGE 65 70 75 80 85 90<br />

RATE 6.0% 6.5% 7.1% 8.0% 9.5% 11.3%<br />

Rates are based on single life. Cash contributions produce<br />

annuity payments that are substantially tax-free.<br />

For more information on the Hebrew University of Jerusalem and<br />

<strong>AFHU</strong> Hebrew University Gift Annuities, please call <strong>AFHU</strong> National<br />

Director of Development, Monica Loebl.<br />

CALL OR EMAIL NOW.<br />

Receive excellent returns, and<br />

secure a brighter future for all.<br />

T: 212.607.8502<br />

E: mloebl@afhu.org<br />

WWW.<strong>AFHU</strong>.ORG