EL Magazine JAN-FEB 2019 PAGE TURNER

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

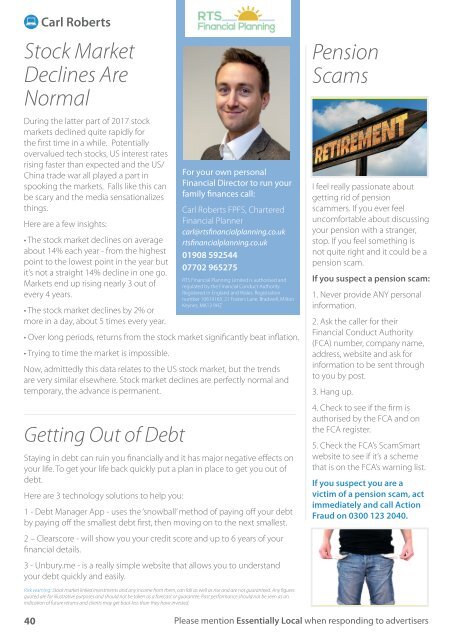

Carl Roberts<br />

Stock Market<br />

Declines Are<br />

Normal<br />

During the latter part of 2017 stock<br />

markets declined quite rapidly for<br />

the first time in a while. Potentially<br />

overvalued tech stocks, US interest rates<br />

rising faster than expected and the US/<br />

China trade war all played a part in<br />

spooking the markets. Falls like this can<br />

be scary and the media sensationalizes<br />

things.<br />

Here are a few insights:<br />

• The stock market declines on average<br />

about 14% each year - from the highest<br />

point to the lowest point in the year but<br />

it’s not a straight 14% decline in one go.<br />

Markets end up rising nearly 3 out of<br />

every 4 years.<br />

• The stock market declines by 2% or<br />

more in a day, about 5 times every year.<br />

• Over long periods, returns from the stock market significantly beat inflation.<br />

• Trying to time the market is impossible.<br />

Now, admittedly this data relates to the US stock market, but the trends<br />

are very similar elsewhere. Stock market declines are perfectly normal and<br />

temporary, the advance is permanent.<br />

Getting Out of Debt<br />

Staying in debt can ruin you financially and it has major negative effects on<br />

your life. To get your life back quickly put a plan in place to get you out of<br />

debt.<br />

Here are 3 technology solutions to help you:<br />

For your own personal<br />

Financial Director to run your<br />

family finances call:<br />

Carl Roberts FPFS, Chartered<br />

Financial Planner<br />

carl@rtsfinancialplanning.co.uk<br />

rtsfinancialplanning.co.uk<br />

01908 592544<br />

07702 965275<br />

RTS Financial Planning Limited is authorised and<br />

regulated by the Financial Conduct Authority.<br />

Registered in England and Wales. Registration<br />

number 10619163. 21 Fosters Lane, Bradwell, Milton<br />

Keynes, MK13 9HZ<br />

1 - Debt Manager App - uses the ‘snowball’ method of paying off your debt<br />

by paying off the smallest debt first, then moving on to the next smallest.<br />

2 – Clearscore - will show you your credit score and up to 6 years of your<br />

financial details.<br />

3 - Unbury.me - is a really simple website that allows you to understand<br />

your debt quickly and easily.<br />

Pension<br />

Scams<br />

I feel really passionate about<br />

getting rid of pension<br />

scammers. If you ever feel<br />

uncomfortable about discussing<br />

your pension with a stranger,<br />

stop. If you feel something is<br />

not quite right and it could be a<br />

pension scam.<br />

If you suspect a pension scam:<br />

1. Never provide ANY personal<br />

information.<br />

2. Ask the caller for their<br />

Financial Conduct Authority<br />

(FCA) number, company name,<br />

address, website and ask for<br />

information to be sent through<br />

to you by post.<br />

3. Hang up.<br />

4. Check to see if the firm is<br />

authorised by the FCA and on<br />

the FCA register.<br />

5. Check the FCA’s ScamSmart<br />

website to see if it’s a scheme<br />

that is on the FCA’s warning list.<br />

If you suspect you are a<br />

victim of a pension scam, act<br />

immediately and call Action<br />

Fraud on 0300 123 2040.<br />

Risk warning: Stock market linked investments and any income from them, can fall as well as rise and are not guaranteed. Any figures<br />

quoted are for illustrative purposes and should not be taken as a forecast or guarantee. Past performance should not be seen as an<br />

indication of future returns and clients may get back less than they have invested.<br />

40<br />

Please mention Essentially Local when responding to advertisers