The 10 Most Trusted Non-Banking Financial Companies to Watch in 2019_compressed

Insights Success introduces "The 10 Most Trusted Non-Banking Financial Companies to Watch in 2019", in order to assist the business to choose the right companies.

Insights Success introduces "The 10 Most Trusted Non-Banking Financial Companies to Watch in 2019", in order to assist the business to choose the right companies.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

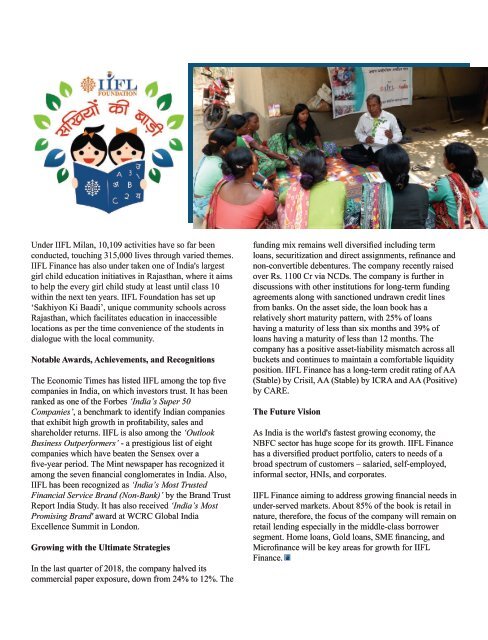

Under IIFL Milan, <strong>10</strong>,<strong>10</strong>9 activities have so far been<br />

conducted, <strong>to</strong>uch<strong>in</strong>g 315,000 lives through varied themes.<br />

IIFL F<strong>in</strong>ance has also under taken one of India's largest<br />

girl child education <strong>in</strong>itiatives <strong>in</strong> Rajasthan, where it aims<br />

<strong>to</strong> help the every girl child study at least until class <strong>10</strong><br />

with<strong>in</strong> the next ten years. IIFL Foundation has set up<br />

‘Sakhiyon Ki Baadi’, unique community schools across<br />

Rajasthan, which facilitates education <strong>in</strong> <strong>in</strong>accessible<br />

locations as per the time convenience of the students <strong>in</strong><br />

dialogue with the local community.<br />

Notable Awards, Achievements, and Recognitions<br />

<strong>The</strong> Economic Times has listed IIFL among the <strong>to</strong>p five<br />

companies <strong>in</strong> India, on which <strong>in</strong>ves<strong>to</strong>rs trust. It has been<br />

ranked as one of the Forbes ‘India’s Super 50<br />

<strong>Companies</strong>’, a benchmark <strong>to</strong> identify Indian companies<br />

that exhibit high growth <strong>in</strong> profitability, sales and<br />

shareholder returns. IIFL is also among the ‘Outlook<br />

Bus<strong>in</strong>ess Outperformers’ - a prestigious list of eight<br />

companies which have beaten the Sensex over a<br />

five-year period. <strong>The</strong> M<strong>in</strong>t newspaper has recognized it<br />

among the seven f<strong>in</strong>ancial conglomerates <strong>in</strong> India. Also,<br />

IIFL has been recognized as ‘India’s <strong>Most</strong> <strong>Trusted</strong><br />

<strong>F<strong>in</strong>ancial</strong> Service Brand (<strong>Non</strong>-Bank)’ by the Brand Trust<br />

Report India Study. It has also received ‘India’s <strong>Most</strong><br />

Promis<strong>in</strong>g Brand' award at WCRC Global India<br />

Excellence Summit <strong>in</strong> London.<br />

Grow<strong>in</strong>g with the Ultimate Strategies<br />

In the last quarter of 2018, the company halved its<br />

commercial paper exposure, down from 24% <strong>to</strong> 12%. <strong>The</strong><br />

fund<strong>in</strong>g mix rema<strong>in</strong>s well diversified <strong>in</strong>clud<strong>in</strong>g term<br />

loans, securitization and direct assignments, ref<strong>in</strong>ance and<br />

non-convertible debentures. <strong>The</strong> company recently raised<br />

over Rs. 1<strong>10</strong>0 Cr via NCDs. <strong>The</strong> company is further <strong>in</strong><br />

discussions with other <strong>in</strong>stitutions for long-term fund<strong>in</strong>g<br />

agreements along with sanctioned undrawn credit l<strong>in</strong>es<br />

from banks. On the asset side, the loan book has a<br />

relatively short maturity pattern, with 25% of loans<br />

hav<strong>in</strong>g a maturity of less than six months and 39% of<br />

loans hav<strong>in</strong>g a maturity of less than 12 months. <strong>The</strong><br />

company has a positive asset-liability mismatch across all<br />

buckets and cont<strong>in</strong>ues <strong>to</strong> ma<strong>in</strong>ta<strong>in</strong> a comfortable liquidity<br />

position. IIFL F<strong>in</strong>ance has a long-term credit rat<strong>in</strong>g of AA<br />

(Stable) by Crisil, AA (Stable) by ICRA and AA (Positive)<br />

by CARE.<br />

<strong>The</strong> Future Vision<br />

As India is the world's fastest grow<strong>in</strong>g economy, the<br />

NBFC sec<strong>to</strong>r has huge scope for its growth. IIFL F<strong>in</strong>ance<br />

has a diversified product portfolio, caters <strong>to</strong> needs of a<br />

broad spectrum of cus<strong>to</strong>mers – salaried, self-employed,<br />

<strong>in</strong>formal sec<strong>to</strong>r, HNIs, and corporates.<br />

IIFL F<strong>in</strong>ance aim<strong>in</strong>g <strong>to</strong> address grow<strong>in</strong>g f<strong>in</strong>ancial needs <strong>in</strong><br />

under-served markets. About 85% of the book is retail <strong>in</strong><br />

nature, therefore, the focus of the company will rema<strong>in</strong> on<br />

retail lend<strong>in</strong>g especially <strong>in</strong> the middle-class borrower<br />

segment. Home loans, Gold loans, SME f<strong>in</strong>anc<strong>in</strong>g, and<br />

Microf<strong>in</strong>ance will be key areas for growth for IIFL<br />

F<strong>in</strong>ance.