November/December 2020

November/December 2020 issue of Foodservice and Hospitality magazine.

November/December 2020 issue of Foodservice and Hospitality magazine.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

During the height of shutdowns,<br />

many, including Liberty<br />

Entertainment Group, took<br />

the time to assess their options<br />

before implementing an offpremise<br />

strategy. Its first focus<br />

was its casual Italian-food brand<br />

Cibo Wine Bar, which already<br />

had some delivery presence.<br />

“[We] increased the offers we<br />

had, did things to make it better<br />

[and] we even went into things<br />

that were never offered before,”<br />

says Di Donato, explaining that<br />

Cibo began selling cook-athome<br />

meals.<br />

While JRG also implemented<br />

new offerings — including meal<br />

and cocktail kits — as it shifted to<br />

off-site dining, Moreno says the<br />

company found itself in a somewhat<br />

more favourable position<br />

than some of its competitors, as<br />

its portfolio of public houses and<br />

upscale-casual restaurants already<br />

had established digital-ordering<br />

channels. The company had<br />

also launched its ghost-kitchen<br />

platform, Meal Ticket Brands, in<br />

2019, which Moreno credits with<br />

helping get the company through<br />

the shutdowns.<br />

“We were extremely lucky we<br />

had launched this delivery concept<br />

prior [to the pandemic],” he<br />

says. “We didn’t have to lay off<br />

any of our management across<br />

the company…they were the<br />

ones, from the front and back<br />

of the restaurant, operating the<br />

delivery out of our stores.”<br />

Moreno also credits its focus<br />

on more suburban locations in<br />

the Fraser Valley with helping JRG<br />

maintain demand at its restaurants,<br />

explaining these locations are<br />

more community focused and<br />

less reliant on tourism or office/<br />

business clientele.<br />

Di Donato points out that,<br />

generally, fine-dining restaurants<br />

were not well equipped to quickly<br />

pivot their operations during<br />

shutdown. But, after enhancing<br />

Cibo’s delivery offerings, the<br />

company began testing delivery<br />

for its Blue Blood Steak House.<br />

“We weren’t sure it would resonate,<br />

FOODSERVICEANDHOSPITALITY.COM<br />

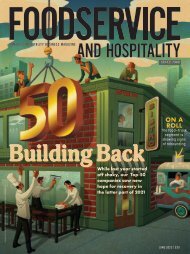

Commercial Foodservice Sales, march and april <strong>2020</strong><br />

(vs. March and April 2019)<br />

-37.1%<br />

Total<br />

March<br />

-61.4%<br />

April<br />

because [it’s] high end, very<br />

expensive,” he says. But the company<br />

was ultimately surprised by<br />

its success. “People were getting<br />

tired of the same old food and<br />

were ready to have a special meal<br />

at home, so we filled that gap with<br />

Blue Blood.”<br />

“[COVID-19 has] forced a<br />

lot of restaurants that were<br />

never interested in online<br />

ordering [to] all of a sudden<br />

start scrambling and looking<br />

for a solution,” says Hopkins.<br />

“Now, if you don’t have that,<br />

you’re behind.”<br />

With the re-opening of<br />

on-premise dining, FSRs<br />

saw a significant increase in<br />

sales (dollars), which grew<br />

58.3 per cent in June from<br />

the previous month, according<br />

to Statistics Canada.<br />

However, the segment’s<br />

unadjusted sales for June<br />

<strong>2020</strong> were still down 51.8<br />

per cent in year-over-year<br />

comparison.<br />

And, with the return of cooler<br />

weather, full service is expected<br />

to see renewed challenges. “In the<br />

table-service [segment], whether<br />

it’s upscale-casual, casual-family<br />

or high-end dining, we’re going<br />

to see price increases over the<br />

next little while,” says Hopkins,<br />

citing the end of patio season and<br />

decreasing government support.<br />

“The only way that restaurants<br />

with reduced capacity can remain<br />

Full-Service<br />

Restaurants<br />

-49.3%<br />

-78.1%<br />

profitable is to increase prices.”<br />

ALTERNATIVE CHANNELS<br />

Given the current uncertainty<br />

and ongoing shifts in consumer<br />

behaviour, Charlebois says, “This<br />

blurring line we’ve been talking<br />

about for many years, between<br />

service and retail, is going to<br />

become even more interesting…<br />

COVID-19 just blew everything<br />

up — there’s no line anymore, it’s<br />

just food.”<br />

As an example, he points<br />

to Loblaws’ recent collaboration<br />

with Toronto<br />

restaurants for meal-kit<br />

offerings, adding<br />

he expects to see<br />

more initiatives<br />

Quick-Service<br />

Restaurants Caterers Drinking places<br />

-23.6%<br />

-40.6%<br />

-33.3%<br />

-74.7%<br />

-58.1%<br />

-90.5%<br />

Source: Canada/Foodservice Facts <strong>2020</strong><br />

like this in the future. The launch<br />

saw Loblaws add dishes from<br />

Burger’s Priest, La Carnita, Fresh<br />

Restaurants, Fat Lamb Kouzina,<br />

General Assembly Pizza, Kinton<br />

Ramen and Sala Modern Thai to<br />

its PC Chef Meal Kits direct-tohome<br />

delivery service.<br />

“Probably the most important<br />

While loosened<br />

restrictions and<br />

warmer weather<br />

created more<br />

opportunities for<br />

restaurants, many<br />

full-service<br />

restaurants continued to face<br />

challenges. Statistics Canada<br />

reported 32 per cent of FSRs<br />

were closed for part of June<br />

(compared with 44 per cent in<br />

May and 65 per cent in April)<br />

and 11 per cent were closed<br />

for the entire month of June.<br />

NOVEMBER/DECEMBER <strong>2020</strong> FOODSERVICE AND HOSPITALITY 25