bioplasticsMAGAZINE_0901

bioplasticsMAGAZINE_0901

bioplasticsMAGAZINE_0901

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

From Science & Research<br />

Article contributed by<br />

Toby Heppenstall, Lucite Intl.,<br />

Southampton, UK<br />

The availability of<br />

fermentable carbohydrate<br />

as a feedstock for bio-based platform chemicals and bioplastics<br />

Price [€/t]<br />

Many chemicals and plastics manufacturers are<br />

beginning to consider the opportunities presented<br />

by Industrial Biotechnology; the biosynthesis<br />

of bulk and fine chemicals mainly by fermentation processes<br />

from renewable agricultural feedstocks.<br />

Due to the widespread commercial interest in<br />

bioethanol, much has been written about feedstock type<br />

and availability forecasts. In general however, studies have<br />

estimated feedstock quantities by computing ‘necessary<br />

amounts’ from demand-side projections. A new study<br />

by a manager in the chemical industry attempts for the<br />

first time to derive a supply-side view of the availability<br />

in Europe of fermentable feedstocks for the biosynthetic<br />

industries.<br />

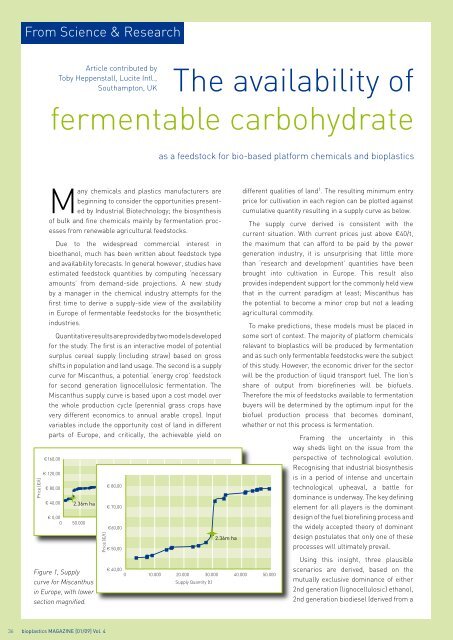

Quantitative results are provided by two models developed<br />

for the study. The first is an interactive model of potential<br />

surplus cereal supply (including straw) based on gross<br />

shifts in population and land usage. The second is a supply<br />

curve for Miscanthus, a potential ‘energy crop’ feedstock<br />

for second generation lignocellulosic fermentation. The<br />

Miscanthus supply curve is based upon a cost model over<br />

the whole production cycle (perennial grass crops have<br />

very different economics to annual arable crops). Input<br />

variables include the opportunity cost of land in different<br />

parts of Europe, and critically, the achievable yield on<br />

€160,00<br />

€ 120,00<br />

€ 80,00<br />

€ 40,00<br />

2.36m ha<br />

€ 0,00<br />

0 50.000<br />

Figure 1, Supply<br />

curve for Miscanthus<br />

in Europe, with lower<br />

section magnified.<br />

Price [€/t]<br />

€ 80,00<br />

€ 70,00<br />

€60,00 Supply Quantity / ktes<br />

€ 50,00<br />

30m ha<br />

2.36m ha<br />

2.36m ha<br />

€ 40,00<br />

0 10.000 20.000 30.000 40.000 50.000<br />

Supply Quantity [t]<br />

different qualities of land 1 . The resulting minimum entry<br />

price for cultivation in each region can be plotted against<br />

cumulative quantity resulting in a supply curve as below.<br />

The supply curve derived is consistent with the<br />

current situation. With current prices just above €40/t,<br />

the maximum that can afford to be paid by the power<br />

generation industry, it is unsurprising that little more<br />

than ‘research and development’ quantities have been<br />

brought into cultivation in Europe. This result also<br />

provides independent support for the commonly held view<br />

that in the current paradigm at least; Miscanthus has<br />

the potential to become a minor crop but not a leading<br />

agricultural commodity.<br />

To make predictions, these models must be placed in<br />

some sort of context. The majority of platform chemicals<br />

relevant to bioplastics will be produced by fermentation<br />

and as such only fermentable feedstocks were the subject<br />

of this study. However, the economic driver for the sector<br />

will be the production of liquid transport fuel. The lion’s<br />

share of output from biorefineries will be biofuels.<br />

Therefore the mix of feedstocks available to fermentation<br />

buyers will be determined by the optimum input for the<br />

biofuel production process that becomes dominant,<br />

whether or not this process is fermentation.<br />

Framing the uncertainty in this<br />

way sheds light on the issue from the<br />

perspective of technological evolution.<br />

Recognising that industrial biosynthesis<br />

is in a period of intense and uncertain<br />

technological upheaval, a battle for<br />

dominance is underway. The key defining<br />

element for all players is the dominant<br />

design of the fuel biorefining process and<br />

the widely accepted theory of dominant<br />

design postulates that only one of these<br />

processes will ultimately prevail.<br />

Using this insight, three plausible<br />

scenarios are derived, based on the<br />

mutually exclusive dominance of either<br />

2nd generation (lignocellulosic) ethanol,<br />

2nd generation biodiesel (derived from a<br />

36 bioplastics MAGAZINE [01/09] Vol. 4