directors - Colombo Stock Exchange

directors - Colombo Stock Exchange

directors - Colombo Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

DIeseL & MotoR eNGINeeRING pLC ANNUAL RepoRt 2009/10<br />

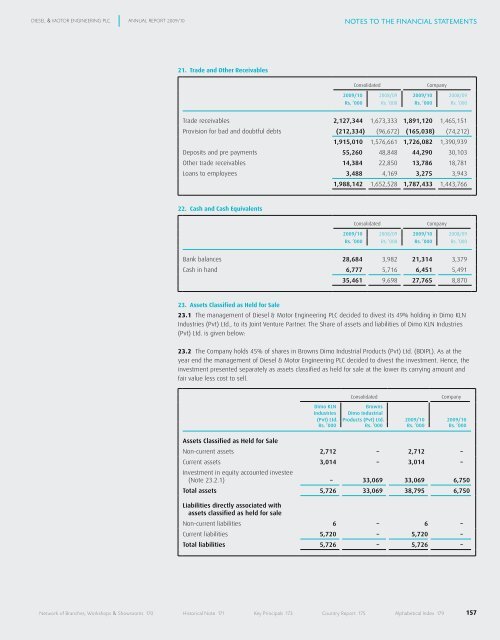

21. Trade and Other Receivables<br />

Consolidated Company<br />

2009/10 2008/09 2009/10 2008/09<br />

Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’000<br />

Trade receivables 2,127,344 1,673,333 1,891,120 1,465,151<br />

Provision for bad and doubtful debts (212,334) (96,672) (165,038) (74,212)<br />

1,915,010 1,576,661 1,726,082 1,390,939<br />

Deposits and pre payments 55,260 48,848 44,290 30,103<br />

Other trade receivables 14,384 22,850 13,786 18,781<br />

Loans to employees 3,488 4,169 3,275 3,943<br />

22. Cash and Cash Equivalents<br />

1,988,142 1,652,528 1,787,433 1,443,766<br />

Consolidated Company<br />

2009/10 2008/09 2009/10 2008/09<br />

Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’000<br />

Bank balances 28,684 3,982 21,314 3,379<br />

Cash in hand 6,777 5,716 6,451 5,491<br />

23. Assets Classified as Held for Sale<br />

35,461 9,698 27,765 8,870<br />

23.1 The management of Diesel & Motor Engineering PLC decided to divest its 49% holding in Dimo KLN<br />

Industries (Pvt) Ltd., to its Joint Venture Partner. The Share of assets and liabilities of Dimo KLN Industries<br />

(Pvt) Ltd. is given below:<br />

23.2 The Company holds 45% of shares in Browns Dimo Industrial Products (Pvt) Ltd. (BDIPL). As at the<br />

year end the management of Diesel & Motor Engineering PLC decided to divest the investment. Hence, the<br />

investment presented separately as assets classified as held for sale at the lower its carrying amount and<br />

fair value less cost to sell.<br />

Dimo KLN<br />

Industries<br />

(Pvt) Ltd.<br />

notes to the Financial statements<br />

Consolidated Company<br />

Browns<br />

Dimo Industrial<br />

Products (Pvt) Ltd. 2009/10 2009/10<br />

Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’000<br />

Assets Classified as Held for Sale<br />

Non-current assets 2,712 – 2,712 –<br />

Current assets<br />

Investment in equity accounted investee<br />

3,014 – 3,014 –<br />

(Note 23.2.1) – 33,069 33,069 6,750<br />

Total assets 5,726 33,069 38,795 6,750<br />

Liabilities directly associated with<br />

assets classified as held for sale<br />

Non-current liabilities 6 – 6 –<br />

Current liabilities 5,720 – 5,720 –<br />

Total liabilities 5,726 – 5,726 –<br />

Network of branches, Workshops & showrooms 170 historical Note 171 Key principals 173 Country Report 175 Alphabetical Index 179<br />

157