directors - Colombo Stock Exchange

directors - Colombo Stock Exchange

directors - Colombo Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

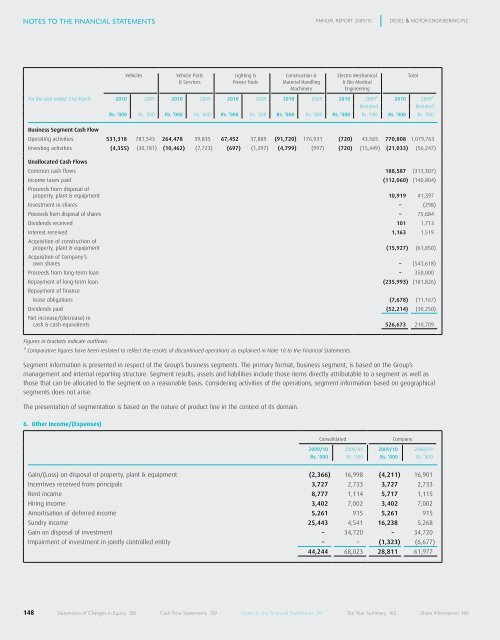

notes to the Financial statements<br />

148<br />

Vehicles<br />

Vehicle Parts<br />

& Services<br />

Lighting &<br />

Power Tools<br />

Construction &<br />

Material Handling<br />

Machinery<br />

ANNUAL RepoRt 2009/10 DIeseL & MotoR eNGINeeRING pLC<br />

Electro Mechanical<br />

& Bio Medical<br />

Engineering<br />

For the year ended 31st March 2010 2009 2010 2009 2010 2009 2010 2009 2010 2009* 2010 2009*<br />

Total<br />

Restated Restated<br />

Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’000<br />

Business Segment Cash Flow<br />

Operating activities 531,318 781,543 264,478 39,835 67,452 37,889 (91,720) 176,931 (720) 43,565 770,808 1,079,763<br />

Investing activities (4,355) (30,781) (10,462) (7,723) (697) (1,297) (4,799) (997) (720) (15,449) (21,033) (56,247)<br />

Unallocated Cash Flows<br />

Common cash flows 188,587 (313,307)<br />

Income taxes paid<br />

Proceeds from disposal of<br />

(112,060) (140,804)<br />

property, plant & equipment 10,919 41,397<br />

Investment in shares – (298)<br />

Proceeds from disposal of shares – 75,684<br />

Dividends received 101 1,713<br />

Interest received<br />

Acquisition of construction of<br />

1,163 1,519<br />

property, plant & equipment<br />

Acquisition of Company’s<br />

(15,927) (61,850)<br />

own shares – (543,618)<br />

Proceeds from long-term loan – 350,000<br />

Repayment of long-term loan<br />

Repayment of finance<br />

(235,993) (181,826)<br />

lease obligations (7,678) (11,167)<br />

Dividends paid<br />

Net increase/(decrease) in<br />

(52,214) (30,250)<br />

cash & cash equivalents 526,673 210,709<br />

Figures in brackets indicate outflows.<br />

* Comparative figures have been restated to reflect the results of discontinued operations as explained in Note 10 to the Financial Statements.<br />

Segment information is presented in respect of the Group’s business segments. The primary format, business segment, is based on the Group’s<br />

management and internal reporting structure. Segment results, assets and liabilities include those items directly attributable to a segment as well as<br />

those that can be allocated to the segment on a reasonable basis. Considering activities of the operations, segment information based on geographical<br />

segments does not arise.<br />

The presentation of segmentation is based on the nature of product line in the context of its domain.<br />

6. Other Income/(Expenses)<br />

Consolidated Company<br />

2009/10 2008/09 2009/10 2008/09<br />

Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’000<br />

Gain/(Loss) on disposal of property, plant & equipment (2,366) 16,998 (4,211) 16,901<br />

Incentives received from principals 3,727 2,733 3,727 2,733<br />

Rent income 8,777 1,114 5,717 1,115<br />

Hiring income 3,402 7,002 3,402 7,002<br />

Amortisation of deferred income 5,261 915 5,261 915<br />

Sundry income 25,443 4,541 16,238 5,268<br />

Gain on disposal of investment – 34,720 – 34,720<br />

Impairment of investment in jointly controlled entity – – (1,323) (6,677)<br />

44,244 68,023 28,811 61,977<br />

statements of Changes in equity 138 Cash flow statements 139 Notes to the financial statements 141 ten year summary 165 share Information 166