directors - Colombo Stock Exchange

directors - Colombo Stock Exchange

directors - Colombo Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

notes to the Financial statements<br />

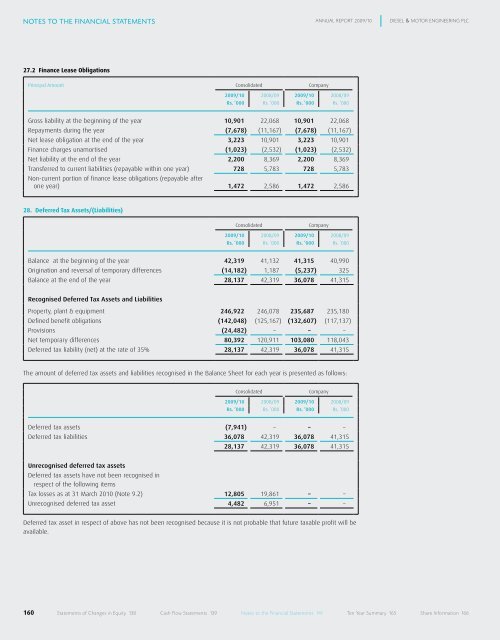

27.2 Finance Lease Obligations<br />

Principal Amount Consolidated Company<br />

160<br />

2009/10 2008/09 2009/10 2008/09<br />

Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’000<br />

Gross liability at the beginning of the year 10,901 22,068 10,901 22,068<br />

Repayments during the year (7,678) (11,167) (7,678) (11,167)<br />

Net lease obligation at the end of the year 3,223 10,901 3,223 10,901<br />

Finance charges unamortised (1,023) (2,532) (1,023) (2,532)<br />

Net liability at the end of the year 2,200 8,369 2,200 8,369<br />

Transferred to current liabilities (repayable within one year) 728 5,783 728 5,783<br />

Non-current portion of finance lease obligations (repayable after<br />

one year) 1,472 2,586 1,472 2,586<br />

28. Deferred Tax Assets/(Liabilities)<br />

Consolidated Company<br />

2009/10 2008/09 2009/10 2008/09<br />

Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’000<br />

Balance at the beginning of the year 42,319 41,132 41,315 40,990<br />

Origination and reversal of temporary differences (14,182) 1,187 (5,237) 325<br />

Balance at the end of the year 28,137 42,319 36,078 41,315<br />

Recognised Deferred Tax Assets and Liabilities<br />

Property, plant & equipment 246,922 246,078 235,687 235,180<br />

Defined benefit obligations (142,048) (125,167) (132,607) (117,137)<br />

Provisions (24,482) – – –<br />

Net temporary differences 80,392 120,911 103,080 118,043<br />

Deferred tax liability (net) at the rate of 35% 28,137 42,319 36,078 41,315<br />

The amount of deferred tax assets and liabilities recognised in the Balance Sheet for each year is presented as follows:<br />

Consolidated Company<br />

2009/10 2008/09 2009/10 2008/09<br />

Rs. ’000 Rs. ’000 Rs. ’000 Rs. ’000<br />

Deferred tax assets (7,941) – – –<br />

Deferred tax liabilities 36,078 42,319 36,078 41,315<br />

28,137 42,319 36,078 41,315<br />

Unrecognised deferred tax assets<br />

Deferred tax assets have not been recognised in<br />

respect of the following items<br />

Tax losses as at 31 March 2010 (Note 9.2) 12,805 19,861 – –<br />

Unrecognised deferred tax asset 4,482 6,951 – –<br />

Deferred tax asset in respect of above has not been recognised because it is not probable that future taxable profit will be<br />

available.<br />

ANNUAL RepoRt 2009/10 DIeseL & MotoR eNGINeeRING pLC<br />

statements of Changes in equity 138 Cash flow statements 139 Notes to the financial statements 141 ten year summary 165 share Information 166