directors - Colombo Stock Exchange

directors - Colombo Stock Exchange

directors - Colombo Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ManageMent report<br />

Working Capital<br />

The group’s current ratio at the year-end was 1.28:1, which is a marginal<br />

improvement from corresponding ratio of 1.25:1. Prudent management<br />

of working capital continues to be a key focus area and receives focused<br />

attention on a priority basis. Inventories as at the year-end marginally<br />

decreased to Rs. 1.32 bn compared to the Rs. 1.33 bn previous year. Year end<br />

Trade receivables increased to Rs. 1.99 bn from a corresponding figure of<br />

Rs. 1.65 bn. The increase in Trade receivables can be mainly attributed to<br />

higher level of Turnover in March 2010 compared to March 2009.<br />

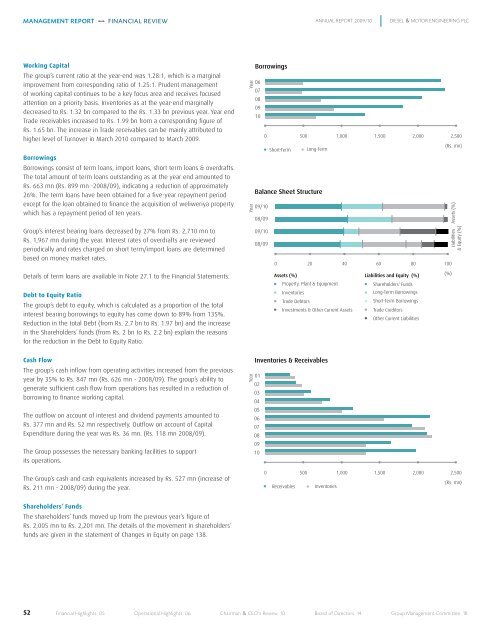

Borrowings<br />

Borrowings consist of term loans, import loans, short term loans & overdrafts.<br />

The total amount of term loans outstanding as at the year end amounted to<br />

Rs. 663 mn (Rs. 899 mn -2008/09), indicating a reduction of approximately<br />

26%. The term loans have been obtained for a five-year repayment period<br />

except for the loan obtained to finance the acquisition of weliweriya property<br />

which has a repayment period of ten years.<br />

Group’s interest bearing loans decreased by 27% from Rs. 2,710 mn to<br />

Rs. 1,967 mn during the year. Interest rates of overdrafts are reviewed<br />

periodically and rates charged on short term/import loans are determined<br />

based on money market rates.<br />

Details of term loans are available in Note 27.1 to the Financial Statements.<br />

Debt to Equity Ratio<br />

The group’s debt to equity, which is calculated as a proportion of the total<br />

interest bearing borrowings to equity has come down to 89% from 135%.<br />

Reduction in the total Debt (from Rs. 2.7 bn to Rs. 1.97 bn) and the increase<br />

in the Shareholders’ funds (from Rs. 2 bn to Rs. 2.2 bn) explain the reasons<br />

for the reduction in the Debt to Equity Ratio.<br />

Cash Flow<br />

The group’s cash inflow from operating activities increased from the previous<br />

year by 35% to Rs. 847 mn (Rs. 626 mn - 2008/09). The group’s ability to<br />

generate sufficient cash flow from operations has resulted in a reduction of<br />

borrowing to finance working capital.<br />

The outflow on account of interest and dividend payments amounted to<br />

Rs. 377 mn and Rs. 52 mn respectively. Outflow on account of Capital<br />

Expenditure during the year was Rs. 36 mn. (Rs. 118 mn 2008/09).<br />

The Group possesses the necessary banking facilities to support<br />

its operations.<br />

The Group’s cash and cash equivalents increased by Rs. 527 mn (increase of<br />

Rs. 211 mn - 2008/09) during the year.<br />

Shareholders’ Funds<br />

The shareholders’ funds moved up from the previous year’s figure of<br />

Rs. 2,005 mn to Rs. 2,201 mn. The details of the movement in shareholders’<br />

funds are given in the statement of Changes in Equity on page 138.<br />

52<br />

F i n a n C i a l r e v i e W<br />

ANNUAL REPORT 2009/10 DIESEL & MOTOR ENGINEERING PLC<br />

Financial highlights 05 Operational highlights 06 Chairman & CEO's Review 10 Board of Directors 14 Group Management Committee 18