directors - Colombo Stock Exchange

directors - Colombo Stock Exchange

directors - Colombo Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

notes to the Financial statements<br />

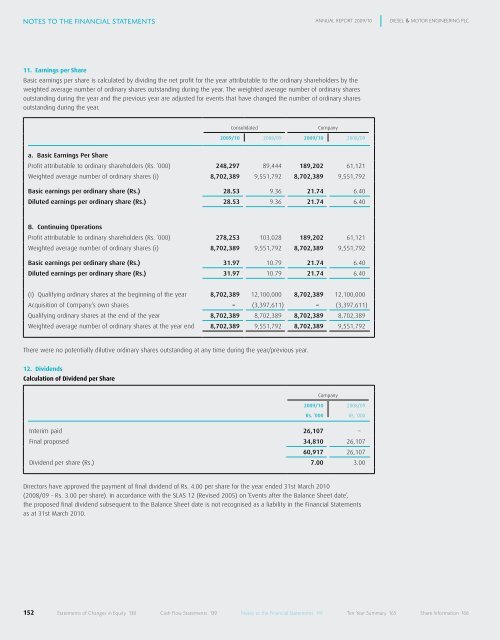

11. Earnings per Share<br />

Basic earnings per share is calculated by dividing the net profit for the year attributable to the ordinary shareholders by the<br />

weighted average number of ordinary shares outstanding during the year. The weighted average number of ordinary shares<br />

outstanding during the year and the previous year are adjusted for events that have changed the number of ordinary shares<br />

outstanding during the year.<br />

152<br />

Consolidated Company<br />

2009/10 2008/09 2009/10 2008/09<br />

a. Basic Earnings Per Share<br />

Profit attributable to ordinary shareholders (Rs. ’000) 248,297 89,444 189,202 61,121<br />

Weighted average number of ordinary shares (i) 8,702,389 9,551,792 8,702,389 9,551,792<br />

Basic earnings per ordinary share (Rs.) 28.53 9.36 21.74 6.40<br />

Diluted earnings per ordinary share (Rs.) 28.53 9.36 21.74 6.40<br />

B. Continuing Operations<br />

Profit attributable to ordinary shareholders (Rs. ’000) 278,253 103,028 189,202 61,121<br />

Weighted average number of ordinary shares (i) 8,702,389 9,551,792 8,702,389 9,551,792<br />

Basic earnings per ordinary share (Rs.) 31.97 10.79 21.74 6.40<br />

Diluted earnings per ordinary share (Rs.) 31.97 10.79 21.74 6.40<br />

(i) Qualifying ordinary shares at the beginning of the year 8,702,389 12,100,000 8,702,389 12,100,000<br />

Acquisition of Company’s own shares – (3,397,611) – (3,397,611)<br />

Qualifying ordinary shares at the end of the year 8,702,389 8,702,389 8,702,389 8,702,389<br />

Weighted average number of ordinary shares at the year end 8,702,389 9,551,792 8,702,389 9,551,792<br />

There were no potentially dilutive ordinary shares outstanding at any time during the year/previous year.<br />

12. Dividends<br />

Calculation of Dividend per Share<br />

ANNUAL RepoRt 2009/10 DIeseL & MotoR eNGINeeRING pLC<br />

Company<br />

2009/10 2008/09<br />

Rs. ’000 Rs. ’000<br />

Interim paid 26,107 –<br />

Final proposed 34,810 26,107<br />

60,917 26,107<br />

Dividend per share (Rs.) 7.00 3.00<br />

Directors have approved the payment of final dividend of Rs. 4.00 per share for the year ended 31st March 2010<br />

(2008/09 - Rs. 3.00 per share). In accordance with the SLAS 12 (Revised 2005) on ‘Events after the Balance Sheet date’,<br />

the proposed final dividend subsequent to the Balance Sheet date is not recognised as a liability in the Financial Statements<br />

as at 31st March 2010.<br />

statements of Changes in equity 138 Cash flow statements 139 Notes to the financial statements 141 ten year summary 165 share Information 166