directors - Colombo Stock Exchange

directors - Colombo Stock Exchange

directors - Colombo Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ManageMent report<br />

FinanCial<br />

REvIEW<br />

Overview<br />

The group demonstrated its resilience in the financial year amidst most<br />

challenging domestic and external conditions, which changed for the<br />

better as the year progressed. The recovery was possible largely due to the<br />

favorable changes that took place in the local economic landscape since the<br />

second quarter of the year, marked by an increase in demand in the vehicle<br />

market, lower interest rates, lower inflation rates and relative stabilization<br />

in exchange rates. The first quarter of the financial year recorded a loss<br />

and each ensuing three month period showed a marked improvement in<br />

Profit before Tax, finally ending the year with an outstanding fourth quarter.<br />

In order to provide the readers with a balanced view and the trend that<br />

prevailed during the year, quarterly data have been used, where appropriate.<br />

The operations of the telecommunication sales and service business was<br />

discontinued during the year under review. SLAS 38 on ‘Non-Current Assets<br />

held for sale and discontinued operations’ was followed in accounting for the<br />

discontinuation and preparation of Financial Statements.<br />

Financial Environment<br />

The following extracts from the Central Bank Annual Report 2009 provides a<br />

brief account of the economic background for the calendar year 2009, against<br />

which the group achieved its results of the first three quarters of the financial<br />

year. It also provides vital economic data that prevailed at the kick off of the<br />

fourth quarter of the financial year. The table that follows the extracts from<br />

the Central Bank Report 2009 provides some relevant economic data for the<br />

quarter ended 31st March 2010, which have also been extracted from data<br />

published by the Central Bank.<br />

“Inflation, as measured by the year-on-year change in the <strong>Colombo</strong><br />

Consumers’ Price Index (CCPI), which was 14.4 per cent at end 2008,<br />

continued to decline during much of the first three quarters of the year,<br />

to reach a five year low of 0.7 per cent by September 2009. Annual<br />

average inflation, which was 22.6 per cent at year end 2008, also declined<br />

continuously, to reach 3.4 per cent by end 2009.”<br />

“The entire market interest rate structure gradually shifted downwards<br />

following the reduction in the policy rates. Short term money market interest<br />

rates remained at a low level with much of the volatility smoothened out<br />

during 2009.”<br />

“The Average Weighted Prime Lending Rate (AWPR) showed a marked<br />

decline of over 800 basis points to 11.12 per cent at end December 2009.<br />

The Average Weighted Lending Rate (AWLR) has gradually declined during<br />

the year by a total of 272 basis points to 17.41 per cent, with a marked<br />

decline observed in the final quarter of 2009.”<br />

“Although the exchange rate remained relatively steady at around Rs. 114.80<br />

against the US dollar until end October 2009, as a result of the strong<br />

external sector performance during the latter part of 2009 and benefitting<br />

from further investments in Treasury bills and bonds, and the issuance of<br />

the second sovereign bond of US dollars 500 million, the rupee appreciated<br />

further against the US dollar.”<br />

“By end 2009, the rupee appreciated to Rs. 114.38 resulting in an overall<br />

depreciation of 1.09 per cent against the US dollar when compared to<br />

a depreciation of 3.91 per cent in 2008. Meanwhile the annual average<br />

48<br />

ANNUAL REPORT 2009/10 DIESEL & MOTOR ENGINEERING PLC<br />

exchange rate in 2009 was Rs. 114.94 against the US dollar when compared<br />

with Rs. 108.33 recorded in 2008. During the year, the rupee depreciated<br />

against the Euro (2.60 per cent), Indian rupee (4.13 per cent) and the Sterling<br />

pound (10.16 per cent) while it appreciated against the Japanese yen<br />

(0.89 per cent).”<br />

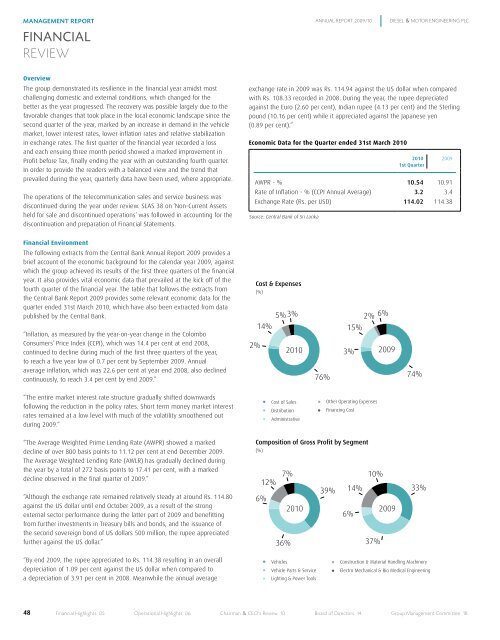

Economic Data for the Quarter ended 31st March 2010<br />

2010<br />

1st Quarter<br />

2009<br />

AWPR - % 10.54 10.91<br />

Rate of Inflation - % (CCPI Annual Average) 3.2 3.4<br />

<strong>Exchange</strong> Rate (Rs. per USD) 114.02 114.38<br />

Source: Central Bank of Sri Lanka<br />

Financial highlights 05 Operational highlights 06 Chairman & CEO's Review 10 Board of Directors 14 Group Management Committee 18