You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

EXECUTIVE SUMMARY<br />

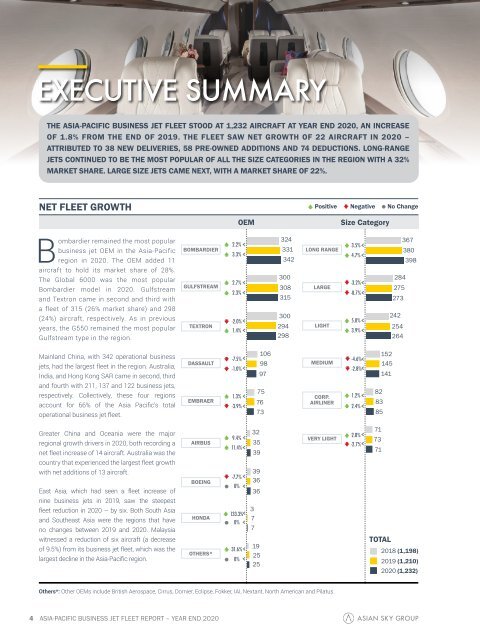

THE ASIA-PACIFIC BUSINESS JET FLEET STOOD AT 1,232 AIRCRAFT AT YEAR END 2020, AN INCREASE<br />

OF 1.8% FROM THE END OF 2019. THE FLEET SAW NET GROWTH OF 22 AIRCRAFT IN 2020 –<br />

ATTRIBUTED TO 38 NEW DELIVERIES, 58 PRE-OWNED ADDITIONS AND 74 DEDUCTIONS. LONG-RANGE<br />

JETS CONTINUED TO BE THE MOST POPULAR OF ALL THE SIZE CATEGORIES IN THE REGION WITH A 32%<br />

MARKET SHARE. LARGE SIZE JETS CAME NEXT, WITH A MARKET SHARE OF 22%.<br />

324<br />

NET FLEET GROWTH 2.2%<br />

Positive Negative No Change<br />

BOMBARDIER<br />

2.2%<br />

3.3%<br />

OEM<br />

331<br />

Size Category<br />

Bombardier remained the most popular<br />

business jet OEM in the Asia-Pacific<br />

region in 2020. The OEM added 11<br />

aircraft to hold its market share of 28%.<br />

The Global 6000 was the most popular<br />

Bombardier model in 2020. Gulfstream<br />

and Textron came in second and third with<br />

a fleet of 315 (26% market share) and 298<br />

(24%) aircraft, respectively. As in previous<br />

years, the G550 remained the most popular<br />

Gulfstream type in the region.<br />

BOMBARDIER<br />

GULFSTREAM<br />

GULFSTREAM<br />

BOMBARDIER<br />

BOMBARDIER<br />

TEXTRON<br />

GULFSTREAM<br />

GULFSTREAM<br />

DASSAULT<br />

TEXTRON<br />

2.2%<br />

2.7%<br />

3.3%<br />

2.3%<br />

2.7%<br />

2.2%<br />

2.2%<br />

-2.0%<br />

3.3% 2.3%<br />

3.3% 1.4%<br />

-2.0%<br />

-7.5%<br />

2.7%<br />

2.7%<br />

1.4%<br />

-1.0%<br />

2.3%<br />

2.3%<br />

106<br />

98<br />

97<br />

300<br />

324<br />

367<br />

3.5%<br />

LONG RANGE<br />

331<br />

308<br />

380<br />

4.7%<br />

342<br />

315<br />

398<br />

300<br />

284<br />

300<br />

324<br />

-3.2%<br />

308 LARGE<br />

275<br />

294<br />

331<br />

-0.7%<br />

315<br />

298<br />

273<br />

242<br />

300<br />

5.0%<br />

294 LIGHT<br />

308<br />

254<br />

3.9%<br />

298<br />

315<br />

264<br />

Mainland China, with 342 operational business<br />

jets, had the largest fleet in the region. Australia,<br />

India, and Hong Kong SAR came in second, third<br />

and fourth with 211, 137 and 122 business jets,<br />

respectively. Collectively, these four regions<br />

account for 66% of the Asia Pacific’s total<br />

operational business jet fleet.<br />

EMBRAER<br />

DASSAULT TEXTRON<br />

TEXTRON<br />

EMBRAER<br />

DASSAULT<br />

DASSAULT<br />

BOEING<br />

-7.5%<br />

-2.0%<br />

-2.0%<br />

1.3%<br />

-3.9%<br />

-1.0%<br />

1.4%<br />

1.4%<br />

1.3%<br />

-7.5%<br />

-7.5%<br />

-7.7%<br />

-3.9%<br />

-1.0%<br />

-1.0%<br />

75<br />

106<br />

98<br />

76<br />

73<br />

97<br />

39<br />

75<br />

106<br />

3676<br />

98<br />

36<br />

73<br />

97<br />

300<br />

294<br />

298<br />

MEDIUM<br />

CORP.<br />

AIRLINER<br />

-4.6%<br />

-2.8%<br />

1.2%<br />

2.4%<br />

152<br />

145<br />

141<br />

82<br />

83<br />

85<br />

Greater China and Oceania were the major<br />

regional growth drivers in 2020, both recording a<br />

net fleet increase of 14 aircraft. Australia was the<br />

country that experienced the largest fleet growth<br />

with net additions of 13 aircraft.<br />

East Asia, which had seen a fleet increase of<br />

nine business jets in 2019, saw the steepest<br />

fleet reduction in 2020 – by six. Both South Asia<br />

and Southeast Asia were the regions that have<br />

no changes between 2019 and 2020. Malaysia<br />

witnessed a reduction of six aircraft (a decrease<br />

of 9.5%) from its business jet fleet, which was the<br />

largest decline in the Asia-Pacific region.<br />

EMBRAER<br />

EMBRAER BOEING<br />

AIRBUS<br />

OTHERS* BOEING AIRBUS<br />

BOEING<br />

OTHERS*<br />

AIRBUS<br />

AIRBUS HONDA<br />

OTHERS*<br />

OTHERS* HONDA<br />

-7.7%<br />

9.4%<br />

1.3%<br />

1.3%<br />

0%<br />

11.4%<br />

-3.9%<br />

-3.9%<br />

31.6%<br />

-7.7% 9.4%<br />

-7.7%<br />

11.4%<br />

0%<br />

31.6%<br />

133.3% 9.4%<br />

9.4%<br />

0%<br />

11.4%<br />

11.4%<br />

0%<br />

133.3% 31.6%<br />

31.6%<br />

0%<br />

0%<br />

32 39<br />

75<br />

36<br />

35<br />

76<br />

36<br />

39<br />

73<br />

32<br />

19<br />

39<br />

36 35<br />

25<br />

39<br />

25 36<br />

32<br />

3<br />

19<br />

7<br />

25 35<br />

25<br />

7<br />

39<br />

319<br />

7<br />

25<br />

725<br />

VERY LIGHT<br />

2.8%<br />

-2.7%<br />

71<br />

73<br />

71<br />

TOTAL<br />

2018 (1,198)<br />

2019 (1,210)<br />

2020 (1,232)<br />

3<br />

Others*: Other OEMs include British Aerospace, Cirrus, Dornier, Eclipse, Fokker,<br />

133.3%<br />

IAI, Nextant, North American and Pilatus.<br />

HONDA<br />

HONDA 133.3% 7<br />

0%<br />

0%<br />

7<br />

4 ASIA-PACIFIC BUSINESS JET FLEET REPORT – YEAR END 2020