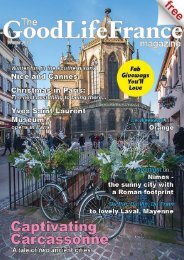

Issue No. 13

A fun and festive edition: Provence, Christmas markets, brilliant book nooks in Paris, recipes, expat stories to inspire and a whole lot more - fall in love with France with us.

A fun and festive edition: Provence, Christmas markets, brilliant book nooks in Paris, recipes, expat stories to inspire and a whole lot more - fall in love with France with us.

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Health Cover<br />

If your family member is not already in the<br />

French health system, but has a CEAM<br />

(Carte Européene d'Assurance Maladie )<br />

you can add them to your own health cover<br />

as a dependent.<br />

How: Use form cerfa 14411*01 and send it<br />

on to the French organisation which<br />

oversees your own cover (CPAM, RSI,…).<br />

Home Help<br />

You need to apply for an Allocation<br />

Personalisée d’Autonomie or APA (at the<br />

local Mairie). A home visit will be made by<br />

a doctor and social worker. They will<br />

establish the needs of your relative and<br />

assess your involvement in their day-today<br />

life. You may be remunerated for your<br />

assistance, or get support for home help.<br />

<strong>No</strong>te: 1 month after you receive confirmation<br />

APA is approved, you must declare if<br />

you have engaged help. (cerfa 10544*02).<br />

The amount of support you get depends on<br />

the revenues of the person you are caring<br />

for as well as how much help they need.<br />

Tax implications & reductions<br />

As far as the French taxman is concerned<br />

your family member is now one of your<br />

household for tax purposes; even if their<br />

pension or disability income is taxed at<br />

source it should be declared on your<br />

household tax return. If not it should be<br />

added as the income of a dependent. If<br />

your dependent has no income, then you<br />

should reduce your total household<br />

revenue by 3.407€ per dependent, per<br />

annum. Your annual taxe d’habitation may<br />

also be reduced if your dependent is over<br />

the age of 70, lives with you and in the<br />

previous year had a declared taxable<br />

income below 10.697€ (16.409€ for two<br />

people).<br />

The list of de-taxed installations is a long<br />

one, so get in touch to check if your<br />

planned works are eligible –<br />

info@frenchadminsolutions.com