Jewellery World Magazine - April 2022

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

polishes 90 percent of the world’s diamonds,<br />

meaning polished diamonds can be imported<br />

to the US as an Indian product, not a Russian<br />

one.<br />

Government officials in India have received<br />

promises from Russia that the sanctions<br />

will not affect the flow of rough. Colin Shah,<br />

chairman of the Indian government’s Gem and<br />

<strong>Jewellery</strong> Export Promotion Council, told the<br />

India’s Economic Times that “Alrosa has assured<br />

us that they are running their business as usual<br />

... They will be fulfilling all their obligations to<br />

their clients in any part of the world,” he said.<br />

As for other governments around the world,<br />

the EU and the G7 (US, UK, France, Canada,<br />

Italy, Japan and Germany) have all indicated<br />

that tougher sanctions would be imposed on<br />

Russia, including the prohibition of jewellery<br />

and diamonds.<br />

Australia has also announced sanctions which<br />

will affect Russian mining companies and the<br />

dealings of 33 Russian oligarchs and prominent<br />

businesses. The Australian ban focuses mainly<br />

on fuel and energy products and makes no<br />

mention of diamonds.<br />

But will they be enough?<br />

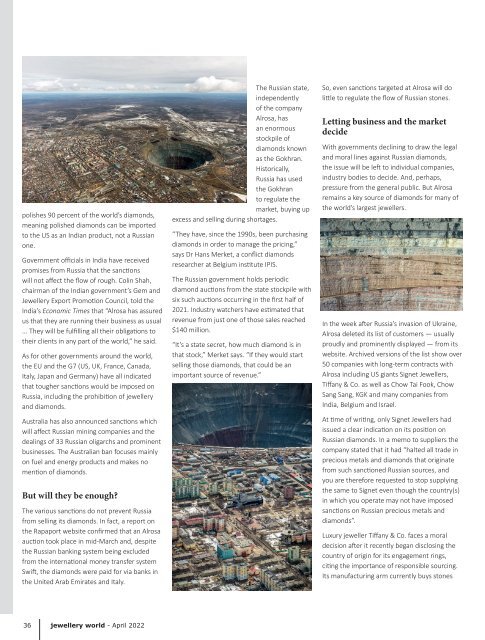

The various sanctions do not prevent Russia<br />

from selling its diamonds. In fact, a report on<br />

the Rapaport website confirmed that an Alrosa<br />

auction took place in mid-March and, despite<br />

the Russian banking system being excluded<br />

from the international money transfer system<br />

Swift, the diamonds were paid for via banks in<br />

the United Arab Emirates and Italy.<br />

The Russian state,<br />

independently<br />

of the company<br />

Alrosa, has<br />

an enormous<br />

stockpile of<br />

diamonds known<br />

as the Gokhran.<br />

Historically,<br />

Russia has used<br />

the Gokhran<br />

to regulate the<br />

market, buying up<br />

excess and selling during shortages.<br />

“They have, since the 1990s, been purchasing<br />

diamonds in order to manage the pricing,”<br />

says Dr Hans Merket, a conflict diamonds<br />

researcher at Belgium institute IPIS.<br />

The Russian government holds periodic<br />

diamond auctions from the state stockpile with<br />

six such auctions occurring in the first half of<br />

2021. Industry watchers have estimated that<br />

revenue from just one of those sales reached<br />

$140 million.<br />

“It’s a state secret, how much diamond is in<br />

that stock,” Merket says. “If they would start<br />

selling those diamonds, that could be an<br />

important source of revenue.”<br />

So, even sanctions targeted at Alrosa will do<br />

little to regulate the flow of Russian stones.<br />

Letting business and the market<br />

decide<br />

With governments declining to draw the legal<br />

and moral lines against Russian diamonds,<br />

the issue will be left to individual companies,<br />

industry bodies to decide. And, perhaps,<br />

pressure from the general public. But Alrosa<br />

remains a key source of diamonds for many of<br />

the world’s largest jewellers.<br />

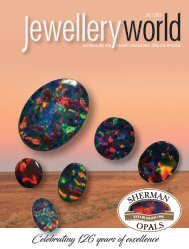

In the week after Russia’s invasion of Ukraine,<br />

Alrosa deleted its list of customers — usually<br />

proudly and prominently displayed — from its<br />

website. Archived versions of the list show over<br />

50 companies with long-term contracts with<br />

Alrosa including US giants Signet Jewellers,<br />

Tiffany & Co. as well as Chow Tai Fook, Chow<br />

Sang Sang, KGK and many companies from<br />

India, Belgium and Israel.<br />

At time of writing, only Signet Jewellers had<br />

issued a clear indication on its position on<br />

Russian diamonds. In a memo to suppliers the<br />

company stated that it had “halted all trade in<br />

precious metals and diamonds that originate<br />

from such sanctioned Russian sources, and<br />

you are therefore requested to stop supplying<br />

the same to Signet even though the country(s)<br />

in which you operate may not have imposed<br />

sanctions on Russian precious metals and<br />

diamonds”.<br />

Luxury jeweller Tiffany & Co. faces a moral<br />

decision after it recently began disclosing the<br />

country of origin for its engagement rings,<br />

citing the importance of responsible sourcing.<br />

Its manufacturing arm currently buys stones<br />

36<br />

jewellery world - <strong>April</strong> <strong>2022</strong>