ANNUAL REPORT - KORADO, as

ANNUAL REPORT - KORADO, as

ANNUAL REPORT - KORADO, as

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>KORADO</strong>, a.s.<br />

Financial Statements for the year ended 31 December 2010<br />

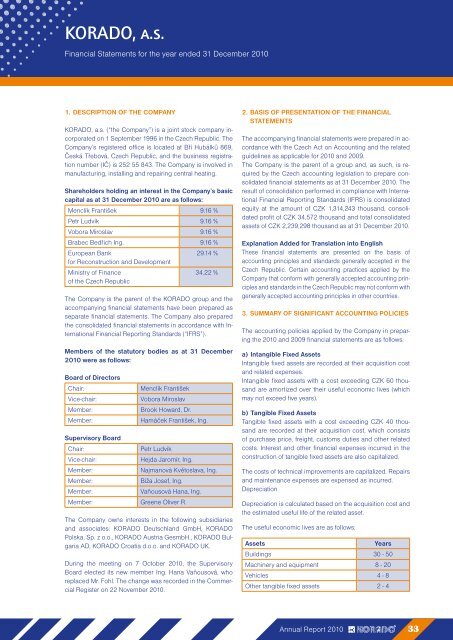

1. DESCRIPTION OF THE COMPANY<br />

<strong>KORADO</strong>, a.s. (“the Company”) is a joint stock company incorporated<br />

on 1 September 1996 in the Czech Republic. The<br />

Company’s registered office is located at Bří Hubálků 869,<br />

Česká Třebová, Czech Republic, and the business registration<br />

number (IČ) is 252 55 843. The Company is involved in<br />

manufacturing, installing and repairing central heating.<br />

Shareholders holding an interest in the Company’s b<strong>as</strong>ic<br />

capital <strong>as</strong> at 31 December 2010 are <strong>as</strong> follows:<br />

Menclík František 9.16 %<br />

Petr Ludvík 9.16 %<br />

Vobora Miroslav 9.16 %<br />

Brabec Bedřich Ing. 9.16 %<br />

European Bank<br />

29.14 %<br />

for Reconstruction and Development<br />

Ministry of Finance<br />

34.22 %<br />

of the Czech Republic<br />

The Company is the parent of the <strong>KORADO</strong> group and the<br />

accompanying financial statements have been prepared <strong>as</strong><br />

separate financial statements. The Company also prepared<br />

the consolidated financial statements in accordance with International<br />

Financial Reporting Standards (“IFRS”).<br />

Members of the statutory bodies <strong>as</strong> at 31 December<br />

2010 were <strong>as</strong> follows:<br />

Board of Directors<br />

Chair: Menclík František<br />

Vice-chair: Vobora Miroslav<br />

Member: Brook Howard, Dr.<br />

Member: Hamáček František, Ing.<br />

Supervisory Board<br />

Chair: Petr Ludvík<br />

Vice-chair: Hejda Jaromír, Ing.<br />

Member: Najmanová Květoslava, Ing.<br />

Member: Bíža Josef, Ing.<br />

Member: Vaňousová Hana, Ing.<br />

Member: Greene Oliver R.<br />

The Company owns interests in the following subsidiaries<br />

and <strong>as</strong>sociates: <strong>KORADO</strong> Deutschland GmbH, <strong>KORADO</strong><br />

Polska, Sp. z o.o., <strong>KORADO</strong> Austria GesmbH., <strong>KORADO</strong> Bulgaria<br />

AD, <strong>KORADO</strong> Croatia d.o.o. and <strong>KORADO</strong> UK.<br />

During the meeting on 7 October 2010, the Supervisory<br />

Board elected its new member Ing. Hana Vaňousová, who<br />

replaced Mr. Fohl. The change w<strong>as</strong> recorded in the Commercial<br />

Register on 22 November 2010.<br />

2. BASIS OF PRESENTATION OF THE FINANCIAL<br />

STATEMENTS<br />

The accompanying financial statements were prepared in accordance<br />

with the Czech Act on Accounting and the related<br />

guidelines <strong>as</strong> applicable for 2010 and 2009.<br />

The Company is the parent of a group and, <strong>as</strong> such, is required<br />

by the Czech accounting legislation to prepare consolidated<br />

financial statements <strong>as</strong> at 31 December 2010. The<br />

result of consolidation performed in compliance with International<br />

Financial Reporting Standards (IFRS) is consolidated<br />

equity at the amount of CZK 1,314,243 thousand, consolidated<br />

profit of CZK 34,572 thousand and total consolidated<br />

<strong>as</strong>sets of CZK 2,239,298 thousand <strong>as</strong> at 31 December 2010.<br />

Explanation Added for Translation into English<br />

These financial statements are presented on the b<strong>as</strong>is of<br />

accounting principles and standards generally accepted in the<br />

Czech Republic. Certain accounting practices applied by the<br />

Company that conform with generally accepted accounting principles<br />

and standards in the Czech Republic may not conform with<br />

generally accepted accounting principles in other countries.<br />

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES<br />

The accounting policies applied by the Company in preparing<br />

the 2010 and 2009 financial statements are <strong>as</strong> follows:<br />

a) Intangible Fixed Assets<br />

Intangible fixed <strong>as</strong>sets are recorded at their acquisition cost<br />

and related expenses.<br />

Intangible fixed <strong>as</strong>sets with a cost exceeding CZK 60 thousand<br />

are amortized over their useful economic lives (which<br />

may not exceed five years).<br />

b) Tangible Fixed Assets<br />

Tangible fixed <strong>as</strong>sets with a cost exceeding CZK 40 thousand<br />

are recorded at their acquisition cost, which consists<br />

of purch<strong>as</strong>e price, freight, customs duties and other related<br />

costs. Interest and other financial expenses incurred in the<br />

construction of tangible fixed <strong>as</strong>sets are also capitalized.<br />

The costs of technical improvements are capitalized. Repairs<br />

and maintenance expenses are expensed <strong>as</strong> incurred.<br />

Depreciation<br />

Depreciation is calculated b<strong>as</strong>ed on the acquisition cost and<br />

the estimated useful life of the related <strong>as</strong>set.<br />

The useful economic lives are <strong>as</strong> follows:<br />

Assets Years<br />

Buildings 30 - 50<br />

Machinery and equipment 8 - 20<br />

Vehicles 4 - 8<br />

Other tangible fixed <strong>as</strong>sets 2 - 4<br />

Annual Report 2010 33