ANNUAL REPORT - KORADO, as

ANNUAL REPORT - KORADO, as

ANNUAL REPORT - KORADO, as

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>KORADO</strong>, a.s.<br />

Financial Statements for the year ended 31 December 2010<br />

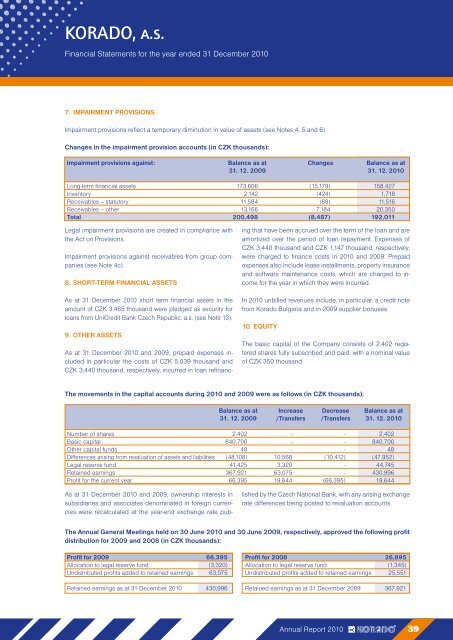

7. IMPAIRMENT PROVISIONS<br />

Impairment provisions reflect a temporary diminution in value of <strong>as</strong>sets (see Notes 4, 5 and 6).<br />

Changes in the impairment provision accounts (in CZK thousands):<br />

Impairment provisions against: Balance <strong>as</strong> at Changes Balance <strong>as</strong> at<br />

31. 12. 2009 31. 12. 2010<br />

Long-term financial <strong>as</strong>sets 173,606 (15,179) 158,427<br />

Inventory 2,142 (424) 1,718<br />

Receivables – statutory 11,584 (68) 11,516<br />

Receivables – other 13,166 7,184 20,350<br />

Total 200,498 (8,487) 192,011<br />

Legal impairment provisions are created in compliance with<br />

the Act on Provisions.<br />

Impairment provisions against receivables from group companies<br />

(see Note 4c).<br />

8. SHORT-TERM FINANCIAL ASSETS<br />

As at 31 December 2010 short term financial <strong>as</strong>sets in the<br />

amount of CZK 3,465 thousand were pledged <strong>as</strong> security for<br />

loans from UniCredit Bank Czech Republic, a.s. (see Note 13).<br />

9. OTHER ASSETS<br />

As at 31 December 2010 and 2009, prepaid expenses included<br />

in particular the costs of CZK 5,039 thousand and<br />

CZK 3,440 thousand, respectively, incurred in loan refinanc-<br />

The movements in the capital accounts during 2010 and 2009 were <strong>as</strong> follows (in CZK thousands):<br />

Balance <strong>as</strong> at Incre<strong>as</strong>e Decre<strong>as</strong>e Balance <strong>as</strong> at<br />

31. 12. 2009 /Transfers /Transfers 31. 12. 2010<br />

Number of shares 2,402 - - 2,402<br />

B<strong>as</strong>ic capital 840,700 - - 840,700<br />

Other capital funds 48 - - 48<br />

Differences arising from revaluation of <strong>as</strong>sets and liabilities (48,108) 10,568 (10,412) (47,952)<br />

Legal reserve fund 41,425 3,320 - 44,745<br />

Retained earnings 367,921 63,075 - 430,996<br />

Profit for the current year 66,395 19,644 (66,395) 19,644<br />

As at 31 December 2010 and 2009, ownership interests in<br />

subsidiaries and <strong>as</strong>sociates denominated in foreign currencies<br />

were recalculated at the year-end exchange rate pub-<br />

ing that have been accrued over the term of the loan and are<br />

amortized over the period of loan repayment. Expenses of<br />

CZK 3,440 thousand and CZK 1,147 thousand, respectively,<br />

were charged to finance costs in 2010 and 2009. Prepaid<br />

expenses also include le<strong>as</strong>e installments, property insurance<br />

and software maintenance costs, which are charged to income<br />

for the year in which they were incurred.<br />

In 2010 unbilled revenues include, in particular, a credit note<br />

from Korado Bulgaria and in 2009 supplier bonuses.<br />

10. EQUITY<br />

The b<strong>as</strong>ic capital of the Company consists of 2,402 registered<br />

shares fully subscribed and paid, with a nominal value<br />

of CZK 350 thousand.<br />

lished by the Czech National Bank, with any arising exchange<br />

rate differences being posted to revaluation accounts.<br />

The Annual General Meetings held on 30 June 2010 and 30 June 2009, respectively, approved the following profit<br />

distribution for 2009 and 2008 (in CZK thousands):<br />

Profit for 2009 66,395 Profit for 2008 26,895<br />

Allocation to legal reserve fund (3,320) Allocation to legal reserve fund (1,345)<br />

Undistributed profits added to retained earnings 63,075 Undistributed profits added to retained earnings 25,551<br />

Retained earnings <strong>as</strong> at 31 December 2010 430,996 Retained earnings <strong>as</strong> at 31 December 2009 367,921<br />

Annual Report 2010 39