ANNUAL REPORT - KORADO, as

ANNUAL REPORT - KORADO, as

ANNUAL REPORT - KORADO, as

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

38<br />

<strong>KORADO</strong>, a.s.<br />

Financial Statements for the year ended 31 December 2010<br />

The intrinsic value of interest represents the Company’s<br />

share in the equity of individual companies (positive number<br />

or nil).<br />

The nominal value of interest represents the Company’s<br />

share in the b<strong>as</strong>ic capital of individual companies.<br />

Financial information of certain subsidiaries indicates that<br />

their equity is lower than the acquisition cost of interest. If<br />

the management <strong>as</strong>sumes that a future settlement of the difference<br />

is uncertain, an impairment provision w<strong>as</strong> created<br />

against these financial investments in subsidiaries (see Note<br />

7) on the b<strong>as</strong>is of the difference between the acquisition<br />

cost and the value of interest in equity (intrinsic value of interest).<br />

Full impairment provision w<strong>as</strong> created against financial<br />

investments in subsidiaries and <strong>as</strong>sociates whose equity is<br />

negative or where another uncertainty exists in the recoverability<br />

of investment; an impairment provision w<strong>as</strong> established<br />

against loans provided to and receivables from a subsidiary<br />

with negative equity up to the negative equity (see Note 7).<br />

On 19 October 2010, the Annual General Meetings of KO-<br />

RADO Deutschland decided on the payment of additional<br />

charge amounting to EUR 374 thousand relating to the decre<strong>as</strong>e<br />

of b<strong>as</strong>ic capital of the company in 2008.<br />

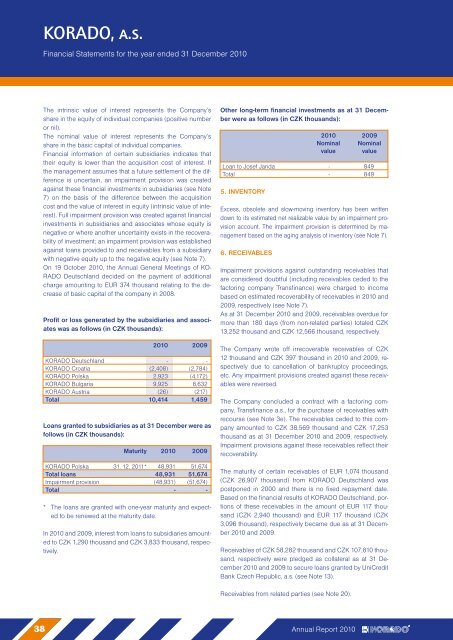

Profit or loss generated by the subsidiaries and <strong>as</strong>sociates<br />

w<strong>as</strong> <strong>as</strong> follows (in CZK thousands):<br />

2010 2009<br />

<strong>KORADO</strong> Deutschland - -<br />

<strong>KORADO</strong> Croatia (2,408) (2,784)<br />

<strong>KORADO</strong> Polska 2,923 (4,172)<br />

<strong>KORADO</strong> Bulgaria 9,925 8,632<br />

<strong>KORADO</strong> Austria (26) (217)<br />

Total 10,414 1,459<br />

Loans granted to subsidiaries <strong>as</strong> at 31 December were <strong>as</strong><br />

follows (in CZK thousands):<br />

Maturity 2010 2009<br />

<strong>KORADO</strong> Polska 31. 12. 2011* 48,931 51,674<br />

Total loans 48,931 51,674<br />

Impairment provision (48,931) (51,674)<br />

Total - -<br />

* The loans are granted with one-year maturity and expected<br />

to be renewed at the maturity date.<br />

In 2010 and 2009, interest from loans to subsidiaries amounted<br />

to CZK 1,290 thousand and CZK 3,833 thousand, respectively.<br />

Other long-term financial investments <strong>as</strong> at 31 December<br />

were <strong>as</strong> follows (in CZK thousands):<br />

2010 2009<br />

Nominal Nominal<br />

value value<br />

Loan to Josef Janda - 849<br />

Total - 849<br />

5. INVENTORY<br />

Excess, obsolete and slow-moving inventory h<strong>as</strong> been written<br />

down to its estimated net realizable value by an impairment provision<br />

account. The impairment provision is determined by management<br />

b<strong>as</strong>ed on the aging analysis of inventory (see Note 7).<br />

6. RECEIVABLES<br />

Impairment provisions against outstanding receivables that<br />

are considered doubtful (including receivables ceded to the<br />

factoring company Transfinance) were charged to income<br />

b<strong>as</strong>ed on estimated recoverability of receivables in 2010 and<br />

2009, respectively (see Note 7).<br />

As at 31 December 2010 and 2009, receivables overdue for<br />

more than 180 days (from non-related parties) totaled CZK<br />

13,252 thousand and CZK 12,566 thousand, respectively.<br />

The Company wrote off irrecoverable receivables of CZK<br />

12 thousand and CZK 397 thousand in 2010 and 2009, respectively<br />

due to cancellation of bankruptcy proceedings,<br />

etc. Any impairment provisions created against these receivables<br />

were reversed.<br />

The Company concluded a contract with a factoring company,<br />

Transfinance a.s., for the purch<strong>as</strong>e of receivables with<br />

recourse (see Note 3e). The receivables ceded to this company<br />

amounted to CZK 38,569 thousand and CZK 17,253<br />

thousand <strong>as</strong> at 31 December 2010 and 2009, respectively.<br />

Impairment provisions against these receivables reflect their<br />

recoverability.<br />

The maturity of certain receivables of EUR 1,074 thousand<br />

(CZK 26,907 thousand) from <strong>KORADO</strong> Deutschland w<strong>as</strong><br />

postponed in 2000 and there is no fixed repayment date.<br />

B<strong>as</strong>ed on the financial results of <strong>KORADO</strong> Deutschland, portions<br />

of these receivables in the amount of EUR 117 thousand<br />

(CZK 2,940 thousand) and EUR 117 thousand (CZK<br />

3,096 thousand), respectively became due <strong>as</strong> at 31 December<br />

2010 and 2009.<br />

Receivables of CZK 58,282 thousand and CZK 107,810 thousand,<br />

respectively were pledged <strong>as</strong> collateral <strong>as</strong> at 31 December<br />

2010 and 2009 to secure loans granted by UniCredit<br />

Bank Czech Republic, a.s. (see Note 13).<br />

Receivables from related parties (see Note 20).<br />

Annual Report 2010