ANNUAL REPORT - KORADO, as

ANNUAL REPORT - KORADO, as

ANNUAL REPORT - KORADO, as

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>KORADO</strong> GROUP<br />

Notes to the Consolidated Financial Statements for the Year Ended 31 December 2010 (In thousand CZK)<br />

and bonuses including social and health insurance of CZK<br />

78,810 thousand and CZK 92,391 thousand, respectively.<br />

In 2010 and 2009 members of Board of Directors and Supervisory<br />

Board of the Parent Company received remuneration<br />

of CZK 916 thousand and CZK 924 thousand, respectively.<br />

For receivables from <strong>KORADO</strong> Croatia d.o.o. see Note 8.<br />

In 2010 and 2009 there were no transactions with related<br />

parties controlled by the Ministry of Finance of the Czech<br />

Republic or European Bank for Reconstruction and Development.<br />

Credit risk<br />

The Group h<strong>as</strong> no uncovered significant concentration of<br />

credit risk with any single counter-party or group of counterparties<br />

having similar characteristics.<br />

Credit risk arises from the possibility that customers may not<br />

be able to settle obligations to the Group within the normal<br />

terms of trade. To manage this risk the Group periodically<br />

<strong>as</strong>sesses the financial viability of customers.<br />

Since the Group experienced significant weaknesses in its<br />

credit management in the p<strong>as</strong>t, new procedures were established<br />

to manage credit risk, such <strong>as</strong> control by the application<br />

of credit approvals, limits and monitoring procedures.<br />

The maximum exposure to the credit risk is represented by<br />

the carrying amount of each financial <strong>as</strong>set in the balance<br />

sheet. The Group considers that its maximum exposure is<br />

equal to the amount of c<strong>as</strong>h and c<strong>as</strong>h equivalents, loans<br />

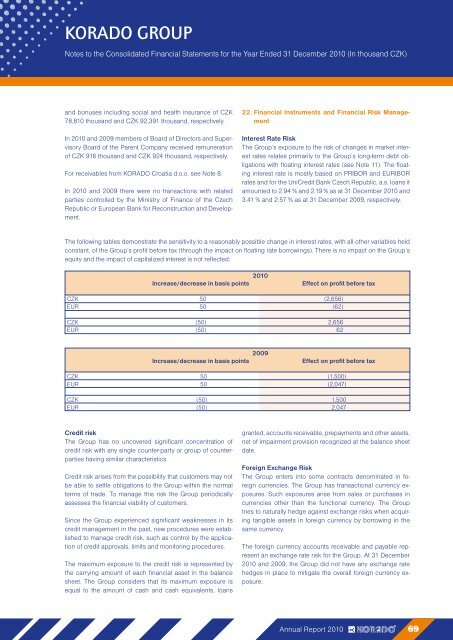

22. Financial Instruments and Financial Risk Management<br />

Interest Rate Risk<br />

The Group’s exposure to the risk of changes in market interest<br />

rates relates primarily to the Group’s long-term debt obligations<br />

with floating interest rates (see Note 11). The floating<br />

interest rate is mostly b<strong>as</strong>ed on PRIBOR and EURIBOR<br />

rates and for the UniCredit Bank Czech Republic, a.s. loans it<br />

amounted to 2.94 % and 2.19 % <strong>as</strong> at 31 December 2010 and<br />

3.41 % and 2.57 % <strong>as</strong> at 31 December 2009, respectively.<br />

The following tables demonstrate the sensitivity to a re<strong>as</strong>onably possible change in interest rates, with all other variables held<br />

constant, of the Group’s profit before tax (through the impact on floating rate borrowings). There is no impact on the Group’s<br />

equity and the impact of capitalized interest is not reflected:<br />

2010<br />

Incre<strong>as</strong>e/decre<strong>as</strong>e in b<strong>as</strong>is points Effect on profit before tax<br />

CZK 50 (2,656)<br />

EUR 50 (62)<br />

CZK (50) 2,656<br />

EUR (50) 62<br />

2009<br />

Incre<strong>as</strong>e/decre<strong>as</strong>e in b<strong>as</strong>is points Effect on profit before tax<br />

CZK 50 (1,500)<br />

EUR 50 (2,047)<br />

CZK (50) 1,500<br />

EUR (50) 2,047<br />

granted, accounts receivable, prepayments and other <strong>as</strong>sets,<br />

net of impairment provision recognized at the balance sheet<br />

date.<br />

Foreign Exchange Risk<br />

The Group enters into some contracts denominated in foreign<br />

currencies. The Group h<strong>as</strong> transactional currency exposures.<br />

Such exposures arise from sales or purch<strong>as</strong>es in<br />

currencies other than the functional currency. The Group<br />

tries to naturally hedge against exchange risks when acquiring<br />

tangible <strong>as</strong>sets in foreign currency by borrowing in the<br />

same currency.<br />

The foreign currency accounts receivable and payable represent<br />

an exchange rate risk for the Group. At 31 December<br />

2010 and 2009, the Group did not have any exchange rate<br />

hedges in place to mitigate the overall foreign currency exposure.<br />

Annual Report 2010 69