ANNUAL REPORT - KORADO, as

ANNUAL REPORT - KORADO, as

ANNUAL REPORT - KORADO, as

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

70<br />

<strong>KORADO</strong> GROUP<br />

Notes to the Consolidated Financial Statements for the Year Ended 31 December 2010 (In thousand CZK)<br />

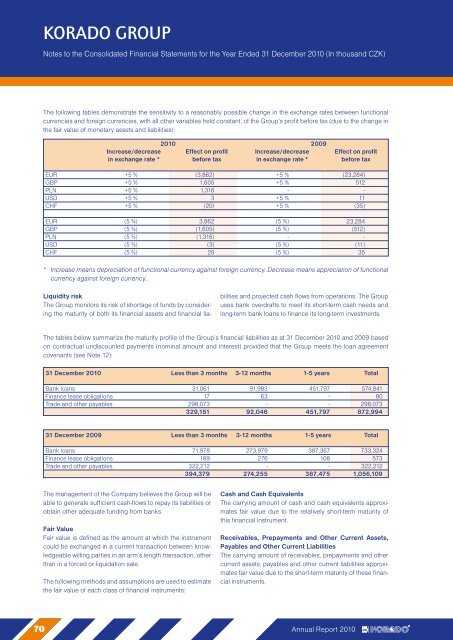

The following tables demonstrate the sensitivity to a re<strong>as</strong>onably possible change in the exchange rates between functional<br />

currencies and foreign currencies, with all other variables held constant, of the Group’s profit before tax (due to the change in<br />

the fair value of monetary <strong>as</strong>sets and liabilities):<br />

2010 2009<br />

Incre<strong>as</strong>e/decre<strong>as</strong>e Effect on profit Incre<strong>as</strong>e/decre<strong>as</strong>e Effect on profit<br />

in exchange rate * before tax in exchange rate * before tax<br />

EUR +5 % (3,862) +5 % (23,284)<br />

GBP +5 % 1,605 +5 % 512<br />

PLN +5 % 1,316 - -<br />

USD +5 % 3 +5 % 11<br />

CHF +5 % (20) +5 % (35)<br />

EUR (5 %) 3,862 (5 %) 23,284<br />

GBP (5 %) (1,605) (5 %) (512)<br />

PLN (5 %) (1,316) - -<br />

USD (5 %) (3) (5 %) (11)<br />

CHF (5 %) 20 (5 %) 35<br />

* Incre<strong>as</strong>e means depreciation of functional currency against foreign currency. Decre<strong>as</strong>e means appreciation of functional<br />

currency against foreign currency..<br />

Liquidity risk<br />

The Group monitors its risk of shortage of funds by considering<br />

the maturity of both its financial <strong>as</strong>sets and financial lia-<br />

bilities and projected c<strong>as</strong>h flows from operations. The Group<br />

uses bank overdrafts to meet its short-term c<strong>as</strong>h needs and<br />

long-term bank loans to finance its long-term investments.<br />

The tables below summarize the maturity profile of the Group’s financial liabilities <strong>as</strong> at 31 December 2010 and 2009 b<strong>as</strong>ed<br />

on contractual undiscounted payments (nominal amount and interest) provided that the Group meets the loan agreement<br />

covenants (see Note 12):<br />

31 December 2010 Less than 3 months 3-12 months 1-5 years Total<br />

Bank loans 31,061 91,983 451,797 574,841<br />

Finance le<strong>as</strong>e obligations 17 63 - 80<br />

Trade and other payables 298,073 - - 298,073<br />

329,151 92,046 451,797 872,994<br />

31 December 2009 Less than 3 months 3-12 months 1-5 years Total<br />

Bank loans 71,978 273,979 387,367 733,324<br />

Finance le<strong>as</strong>e obligations 189 276 108 573<br />

Trade and other payables 322,212 - - 322,212<br />

394,379 274,255 387,475 1,056,109<br />

The management of the Company believes the Group will be<br />

able to generate sufficient c<strong>as</strong>h-flows to repay its liabilities or<br />

obtain other adequate funding from banks.<br />

Fair Value<br />

Fair value is defined <strong>as</strong> the amount at which the instrument<br />

could be exchanged in a current transaction between knowledgeable<br />

willing parties in an arm’s length transaction, other<br />

than in a forced or liquidation sale.<br />

The following methods and <strong>as</strong>sumptions are used to estimate<br />

the fair value of each cl<strong>as</strong>s of financial instruments:<br />

C<strong>as</strong>h and C<strong>as</strong>h Equivalents<br />

The carrying amount of c<strong>as</strong>h and c<strong>as</strong>h equivalents approximates<br />

fair value due to the relatively short-term maturity of<br />

this financial instrument.<br />

Receivables, Prepayments and Other Current Assets,<br />

Payables and Other Current Liabilities<br />

The carrying amount of receivables, prepayments and other<br />

current <strong>as</strong>sets, payables and other current liabilities approximates<br />

fair value due to the short-term maturity of these financial<br />

instruments.<br />

Annual Report 2010