ANNUAL REPORT - KORADO, as

ANNUAL REPORT - KORADO, as

ANNUAL REPORT - KORADO, as

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>KORADO</strong>, a.s.<br />

Financial Statements for the year ended 31 December 2010<br />

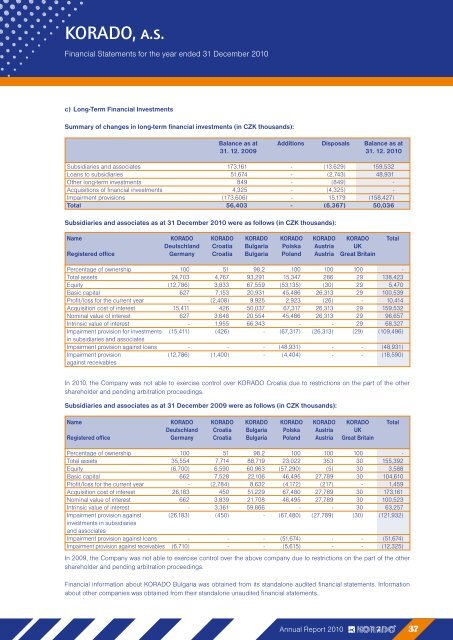

c) Long-Term Financial Investments<br />

Summary of changes in long-term financial investments (in CZK thousands):<br />

Balance <strong>as</strong> at Additions Disposals Balance <strong>as</strong> at<br />

31. 12. 2009 31. 12. 2010<br />

Subsidiaries and <strong>as</strong>sociates 173,161 - (13,629) 159,532<br />

Loans to subsidiaries 51,674 - (2,743) 48,931<br />

Other long-term investments 849 - (849) -<br />

Acquisitions of financial investments 4,325 - (4,325) -<br />

Impairment provisions (173,606) - 15,179 (158,427)<br />

Total 56,403 - (6,367) 50,036<br />

Subsidiaries and <strong>as</strong>sociates <strong>as</strong> at 31 December 2010 were <strong>as</strong> follows (in CZK thousands):<br />

Name <strong>KORADO</strong> <strong>KORADO</strong> <strong>KORADO</strong> <strong>KORADO</strong> <strong>KORADO</strong> <strong>KORADO</strong> Total<br />

Deutschland Croatia Bulgaria Polska Austria UK<br />

Registered office Germany Croatia Bulgaria Poland Austria Great Britain<br />

Percentage of ownership 100 51 98.2 100 100 100 -<br />

Total <strong>as</strong>sets 24,703 4,767 93,291 15,347 286 29 138,423<br />

Equity (12,786) 3,833 67,559 (53,135) (30) 29 5,470<br />

B<strong>as</strong>ic capital 627 7,153 20,931 45,486 26,313 29 100,539<br />

Profit/loss for the current year - (2,408) 9,925 2,923 (26) - 10,414<br />

Acquisition cost of interest 15,411 426 50,037 67,317 26,313 29 159,532<br />

Nominal value of interest 627 3,648 20,554 45,486 26,313 29 96,657<br />

Intrinsic value of interest - 1,955 66,343 - - 29 68,327<br />

Impairment provision for investments (15,411) (426) - (67,317) (26,313) (29) (109,496)<br />

in subsidiaries and <strong>as</strong>sociates<br />

Impairment provision against loans - - - (48,931) - - (48,931)<br />

Impairment provision (12,786) (1,400) - (4,404) - - (18,590)<br />

against receivables<br />

In 2010, the Company w<strong>as</strong> not able to exercise control over <strong>KORADO</strong> Croatia due to restrictions on the part of the other<br />

shareholder and pending arbitration proceedings.<br />

Subsidiaries and <strong>as</strong>sociates <strong>as</strong> at 31 December 2009 were <strong>as</strong> follows (in CZK thousands):<br />

Name <strong>KORADO</strong> <strong>KORADO</strong> <strong>KORADO</strong> <strong>KORADO</strong> <strong>KORADO</strong> <strong>KORADO</strong> Total<br />

Deutschland Croatia Bulgaria Polska Austria UK<br />

Registered office Germany Croatia Bulgaria Poland Austria Great Britain<br />

Percentage of ownership 100 51 98.2 100 100 100 -<br />

Total <strong>as</strong>sets 35,554 7,714 88,719 23,022 353 30 155,392<br />

Equity (6,700) 6,590 60,963 (57,290) (5) 30 3,588<br />

B<strong>as</strong>ic capital 662 7,528 22,106 46,495 27,789 30 104,610<br />

Profit/loss for the current year - (2,784) 8,632 (4,172) (217) - 1,459<br />

Acquisition cost of interest 26,183 450 51,229 67,480 27,789 30 173,161<br />

Nominal value of interest 662 3,839 21,708 46,495 27,789 30 100,523<br />

Intrinsic value of interest - 3,361 59,866 - - 30 63,257<br />

Impairment provision against (26,183) (450) - (67,480) (27,789) (30) (121,932)<br />

investments in subsidiaries<br />

and <strong>as</strong>sociates<br />

Impairment provision against loans - - - (51,674) - - (51,674)<br />

Impairment provision against receivables (6,710) - - (5,615) - - (12,325)<br />

In 2009, the Company w<strong>as</strong> not able to exercise control over the above company due to restrictions on the part of the other<br />

shareholder and pending arbitration proceedings.<br />

Financial information about <strong>KORADO</strong> Bulgaria w<strong>as</strong> obtained from its standalone audited financial statements. Information<br />

about other companies w<strong>as</strong> obtained from their standalone unaudited financial statements..<br />

Annual Report 2010 37