ANNUAL REPORT - KORADO, as

ANNUAL REPORT - KORADO, as

ANNUAL REPORT - KORADO, as

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

68<br />

<strong>KORADO</strong> GROUP<br />

Notes to the Consolidated Financial Statements for the Year Ended 31 December 2010 (In thousand CZK)<br />

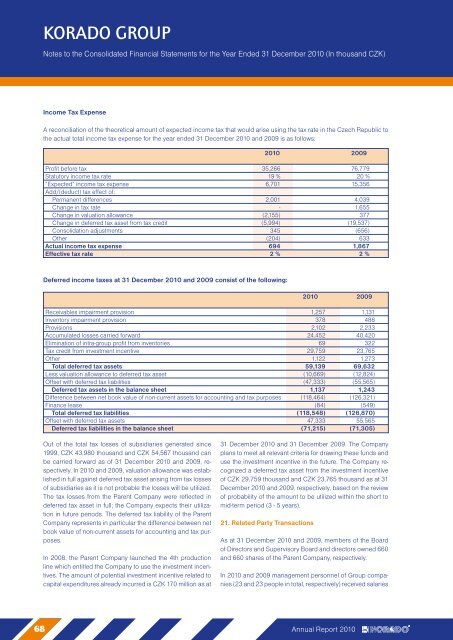

Income Tax Expense<br />

A reconciliation of the theoretical amount of expected income tax that would arise using the tax rate in the Czech Republic to<br />

the actual total income tax expense for the year ended 31 December 2010 and 2009 is <strong>as</strong> follows:<br />

2010 2009<br />

Profit before tax 35,266 76,779<br />

Statutory income tax rate 19 % 20 %<br />

“Expected” income tax expense 6,701 15,356<br />

Add/(deduct) tax effect of:<br />

Permanent differences 2,001 4,039<br />

Change in tax rate - 1,655<br />

Change in valuation allowance (2,155) 377<br />

Change in deferred tax <strong>as</strong>set from tax credit (5,994) (19,537)<br />

Consolidation adjustments 345 (656)<br />

Other (204) 633<br />

Actual income tax expense 694 1,867<br />

Effective tax rate 2 % 2 %<br />

Deferred income taxes at 31 December 2010 and 2009 consist of the following:<br />

2010 2009<br />

Receivables impairment provision 1,257 1,131<br />

Inventory impairment provision 378 488<br />

Provisions 2,102 2,233<br />

Accumulated losses carried forward 24,452 40,420<br />

Elimination of intra-group profit from inventories 69 322<br />

Tax credit from investment incentive 29,759 23,765<br />

Other 1,122 1,273<br />

Total deferred tax <strong>as</strong>sets 59,139 69,632<br />

Less valuation allowance to deferred tax <strong>as</strong>set (10,669) (12,824)<br />

Offset with deferred tax liabilities (47,333) (55,565)<br />

Deferred tax <strong>as</strong>sets in the balance sheet 1,137 1,243<br />

Difference between net book value of non-current <strong>as</strong>sets for accounting and tax purposes (118,464) (126,321)<br />

Finance le<strong>as</strong>e (84) (549)<br />

Total deferred tax liabilities (118,548) (126,870)<br />

Offset with deferred tax <strong>as</strong>sets 47,333 55,565<br />

Deferred tax liabilities in the balance sheet (71,215) (71,305)<br />

Out of the total tax losses of subsidiaries generated since<br />

1999, CZK 43,980 thousand and CZK 54,567 thousand can<br />

be carried forward <strong>as</strong> of 31 December 2010 and 2009, respectively.<br />

In 2010 and 2009, valuation allowance w<strong>as</strong> established<br />

in full against deferred tax <strong>as</strong>set arising from tax losses<br />

of subsidiaries <strong>as</strong> it is not probable the losses will be utilized.<br />

The tax losses from the Parent Company were reflected in<br />

deferred tax <strong>as</strong>set in full; the Company expects their utilization<br />

in future periods. The deferred tax liability of the Parent<br />

Company represents in particular the difference between net<br />

book value of non-current <strong>as</strong>sets for accounting and tax purposes.<br />

In 2008, the Parent Company launched the 4th production<br />

line which entitled the Company to use the investment incentives.<br />

The amount of potential investment incentive related to<br />

capital expenditures already incurred is CZK 170 million <strong>as</strong> at<br />

31 December 2010 and 31 December 2009. The Company<br />

plans to meet all relevant criteria for drawing these funds and<br />

use the investment incentive in the future. The Company recognized<br />

a deferred tax <strong>as</strong>set from the investment incentive<br />

of CZK 29,759 thousand and CZK 23,765 thousand <strong>as</strong> at 31<br />

December 2010 and 2009, respectively, b<strong>as</strong>ed on the review<br />

of probability of the amount to be utilized within the short to<br />

mid-term period (3 - 5 years).<br />

21. Related Party Transactions<br />

As at 31 December 2010 and 2009, members of the Board<br />

of Directors and Supervisory Board and directors owned 660<br />

and 660 shares of the Parent Company, respectively.<br />

In 2010 and 2009 management personnel of Group companies<br />

(23 and 23 people in total, respectively) received salaries<br />

Annual Report 2010