ANNUAL REPORT - KORADO, as

ANNUAL REPORT - KORADO, as

ANNUAL REPORT - KORADO, as

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>KORADO</strong>, a.s.<br />

Financial Statements for the year ended 31 December 2010<br />

As at 31 December 2010 and 2009, ownership interests in<br />

subsidiaries and <strong>as</strong>sociates were recalculated at the yearend<br />

exchange rate published by the Czech National Bank,<br />

with any arising exchange rate differences being posted to<br />

account gain or loss on revaluation of <strong>as</strong>sets and liabilities.<br />

j) Recognition of Revenues and Expenses<br />

Revenues and expenses are recognized on an accrual b<strong>as</strong>is,<br />

that is, they are recognized in the periods in which the actual<br />

flow of the related goods or services occurs, regardless of<br />

when the related monetary flow arises.<br />

The Company recognizes <strong>as</strong> an expense any additions to<br />

provisions or impairment provisions against risks, losses or<br />

physical damage that are known <strong>as</strong> at the financial statements’<br />

date.<br />

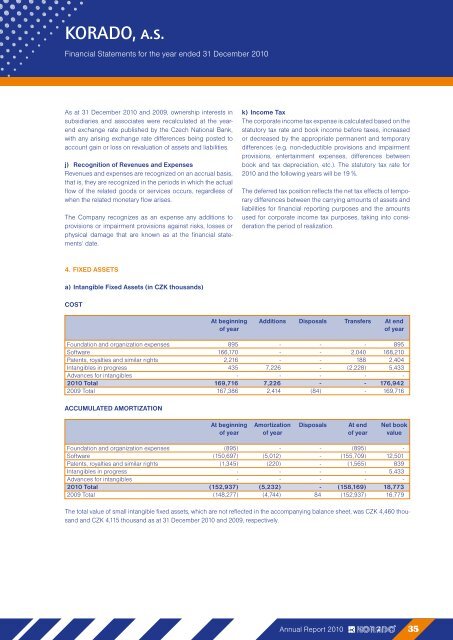

4. FIXED ASSETS<br />

a) Intangible Fixed Assets (in CZK thousands)<br />

COST<br />

k) Income Tax<br />

The corporate income tax expense is calculated b<strong>as</strong>ed on the<br />

statutory tax rate and book income before taxes, incre<strong>as</strong>ed<br />

or decre<strong>as</strong>ed by the appropriate permanent and temporary<br />

differences (e.g. non-deductible provisions and impairment<br />

provisions, entertainment expenses, differences between<br />

book and tax depreciation, etc.). The statutory tax rate for<br />

2010 and the following years will be 19 %.<br />

The deferred tax position reflects the net tax effects of temporary<br />

differences between the carrying amounts of <strong>as</strong>sets and<br />

liabilities for financial reporting purposes and the amounts<br />

used for corporate income tax purposes, taking into consideration<br />

the period of realization.<br />

At beginning Additions Disposals Transfers At end<br />

of year of year<br />

Foundation and organization expenses 895 - - - 895<br />

Software 166,170 - - 2,040 168,210<br />

Patents, royalties and similar rights 2,216 - - 188 2,404<br />

Intangibles in progress 435 7,226 - (2,228) 5,433<br />

Advances for intangibles - - - - -<br />

2010 Total 169,716 7,226 - - 176,942<br />

2009 Total 167,386 2,414 (84) - 169,716<br />

ACCUMULATED AMORTIZATION<br />

At beginning Amortization Disposals At end Net book<br />

of year of year of year value<br />

Foundation and organization expenses (895) - - (895) -<br />

Software (150,697) (5,012) - (155,709) 12,501<br />

Patents, royalties and similar rights (1,345) (220) - (1,565) 839<br />

Intangibles in progress - - - - 5,433<br />

Advances for intangibles - - - - -<br />

2010 Total (152,937) (5,232) - (158,169) 18,773<br />

2009 Total (148,277) (4,744) 84 (152,937) 16,779<br />

The total value of small intangible fixed <strong>as</strong>sets, which are not reflected in the accompanying balance sheet, w<strong>as</strong> CZK 4,460 thousand<br />

and CZK 4,115 thousand <strong>as</strong> at 31 December 2010 and 2009, respectively.<br />

Annual Report 2010 35