ANNUAL REPORT - KORADO, as

ANNUAL REPORT - KORADO, as

ANNUAL REPORT - KORADO, as

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>KORADO</strong> GROUP<br />

Notes to the Consolidated Financial Statements for the Year Ended 31 December 2010 (In thousand CZK)<br />

banks and Bulbank were fully repaid on 30 November 2010<br />

and replaced solely by loans from UniCredit Bank Czech Republic,<br />

a.s.<br />

The new investment loans are denominated in Czech crowns.<br />

An exchange rate gain from refinancing of CZK 26,377 thousand<br />

is included in the consolidated statement of comprehensive<br />

income.<br />

The UniCredit Bank Czech Republic, a.s. loan agreement<br />

includes covenants: equity ratio and net debt to EBITDA ratio<br />

(see Note 11 for detailed calculations) to be fulfilled by<br />

the Company so that the loan structure and interest can be<br />

maintained.<br />

Payables to factoring company represent payables relating to<br />

factoring company, Transfinance a.s., that pays an advance<br />

As at 31 December 2010, the Company failed to meet the Net<br />

Debt/EBITDA ratio. After the year-end the Company received<br />

a statement approving the breach of the ratio in question.<br />

Since the statement provided by the bank w<strong>as</strong> received after<br />

the balance sheet date, in accordance with IAS 1, Presentation<br />

of Financial Statements, the Company recorded the entire<br />

loan provided by UniCredit Bank Czech Republic, a.s., in<br />

current liabilities <strong>as</strong> at 31 December 2010.<br />

As at 31 December 2009, the loan covenants were fulfilled<br />

and the bank loans are cl<strong>as</strong>sified according to their contracted<br />

maturities.<br />

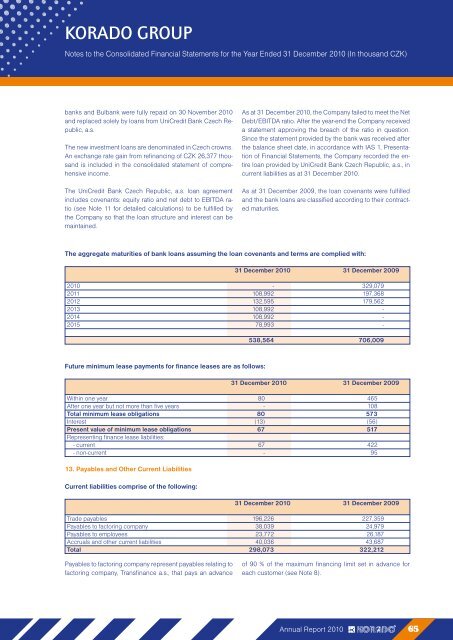

The aggregate maturities of bank loans <strong>as</strong>suming the loan covenants and terms are complied with:<br />

31 December 2010 31 December 2009<br />

2010 - 329,079<br />

2011 108,992 197,368<br />

2012 132,595 179,562<br />

2013 108,992 -<br />

2014 108,992 -<br />

2015 78,993 -<br />

Future minimum le<strong>as</strong>e payments for finance le<strong>as</strong>es are <strong>as</strong> follows:<br />

538,564 706,009<br />

31 December 2010 31 December 2009<br />

Within one year 80 465<br />

After one year but not more than five years - 108<br />

Total minimum le<strong>as</strong>e obligations 80 573<br />

Interest (13) (56)<br />

Present value of minimum le<strong>as</strong>e obligations 67 517<br />

Representing finance le<strong>as</strong>e liabilities:<br />

- current 67 422<br />

- non-current - 95<br />

13. Payables and Other Current Liabilities<br />

Current liabilities comprise of the following:<br />

31 December 2010 31 December 2009<br />

Trade payables 196,226 227,359<br />

Payables to factoring company 38,039 24,979<br />

Payables to employees 23,772 26,187<br />

Accruals and other current liabilities 40,036 43,687<br />

Total 298,073 322,212<br />

of 90 % of the maximum financing limit set in advance for<br />

each customer (see Note 8).<br />

Annual Report 2010 65