ANNUAL REPORT - KORADO, as

ANNUAL REPORT - KORADO, as

ANNUAL REPORT - KORADO, as

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>KORADO</strong>, a.s.<br />

Financial Statements for the year ended 31 December 2010<br />

Bank loans extended by UniCredit Bank Czech Republic, a.s.<br />

are secured by the pledge of movable and immovable <strong>as</strong>sets<br />

(see Note 4b), by the pledge of trade receivables (see Note<br />

6), by the pledge of short-term financial <strong>as</strong>sets (see Note 8)<br />

and by the cession of receivables from property insurance<br />

benefits exceeding CZK 5,000 thousand per insurance<br />

claim.<br />

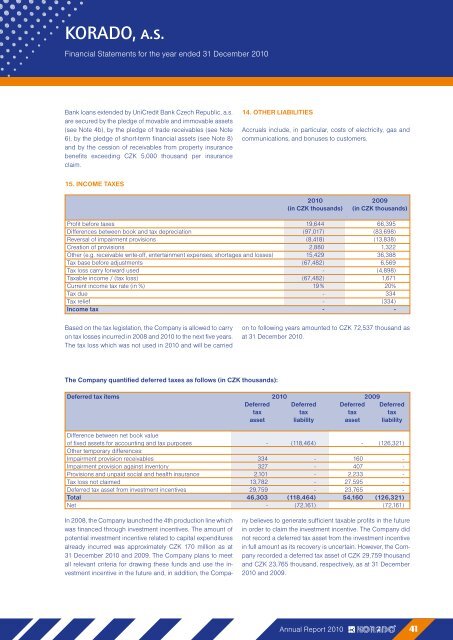

15. INCOME TAXES<br />

B<strong>as</strong>ed on the tax legislation, the Company is allowed to carry<br />

on tax losses incurred in 2008 and 2010 to the next five years.<br />

The tax loss which w<strong>as</strong> not used in 2010 and will be carried<br />

In 2008, the Company launched the 4th production line which<br />

w<strong>as</strong> financed through investment incentives. The amount of<br />

potential investment incentive related to capital expenditures<br />

already incurred w<strong>as</strong> approximately CZK 170 million <strong>as</strong> at<br />

31 December 2010 and 2009. The Company plans to meet<br />

all relevant criteria for drawing these funds and use the investment<br />

incentive in the future and, in addition, the Compa-<br />

14. OTHER LIABILITIES<br />

Accruals include, in particular, costs of electricity, g<strong>as</strong> and<br />

communications, and bonuses to customers.<br />

2010 2009<br />

(in CZK thousands) (in CZK thousands)<br />

Profit before taxes 19,644 66,395<br />

Differences between book and tax depreciation (97,017) (83,698)<br />

Reversal of impairment provisions (8,418) (13,838)<br />

Creation of provisions 2,880 1,322<br />

Other (e.g. receivable write-off, entertainment expenses, shortages and losses) 15,429 36,388<br />

Tax b<strong>as</strong>e before adjustments (67,482) 6,569<br />

Tax loss carry forward used - (4,898)<br />

Taxable income / (tax loss) (67,482) 1,671<br />

Current income tax rate (in %) 19 % 20%<br />

Tax due - 334<br />

Tax relief - (334)<br />

Income tax - -<br />

The Company quantified deferred taxes <strong>as</strong> follows (in CZK thousands):<br />

on to following years amounted to CZK 72,537 thousand <strong>as</strong><br />

at 31 December 2010.<br />

Deferred tax items 2010 2009<br />

Deferred Deferred Deferred Deferred<br />

tax tax tax tax<br />

<strong>as</strong>set liability <strong>as</strong>set liability<br />

Difference between net book value<br />

of fixed <strong>as</strong>sets for accounting and tax purposes - (118,464) - (126,321)<br />

Other temporary differences:<br />

Impairment provision receivables 334 - 160 -<br />

Impairment provision against inventory 327 - 407 -<br />

Provisions and unpaid social and health insurance 2,101 - 2,233 -<br />

Tax loss not claimed 13,782 - 27,595 -<br />

Deferred tax <strong>as</strong>set from investment incentives 29,759 - 23,765 -<br />

Total 46,303 (118,464) 54,160 (126,321)<br />

Net - (72,161) (72,161)<br />

ny believes to generate sufficient taxable profits in the future<br />

in order to claim the investment incentive. The Company did<br />

not record a deferred tax <strong>as</strong>set from the investment incentive<br />

in full amount <strong>as</strong> its recovery is uncertain. However, the Company<br />

recorded a deferred tax <strong>as</strong>set of CZK 29,759 thousand<br />

and CZK 23,765 thousand, respectively, <strong>as</strong> at 31 December<br />

2010 and 2009.<br />

Annual Report 2010 41