You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

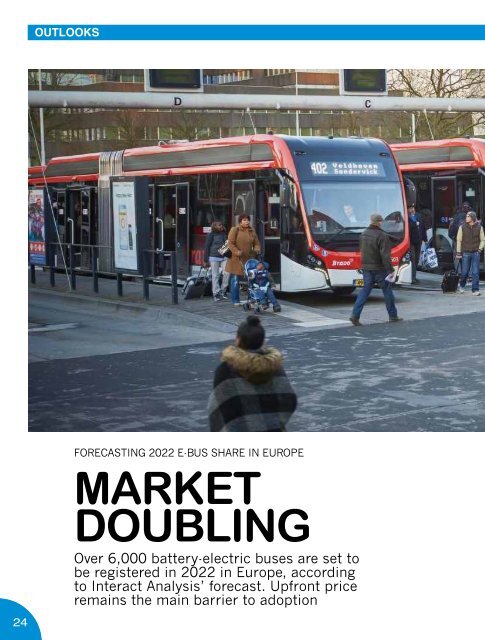

OUTLOOKS<br />

Interact Analysis is a<br />

market research firm with<br />

a specific department for<br />

truck, bus and off-highway<br />

electrification. Here on<br />

Sustainable Bus Magazine<br />

we host a contribution<br />

from the research analyst<br />

Jamie Fox.<br />

FORECASTING <strong>2022</strong> E-<strong>BUS</strong> SHARE IN EUROPE<br />

MARKET<br />

DOUBLING<br />

Over 6,000 battery-electric buses are set to<br />

be registered in <strong>2022</strong> in Europe, according<br />

to Interact Analysis’ forecast. Upfront price<br />

remains the main barrier to adoption<br />

In 2021, we estimate that 3,471 urban<br />

BEV buses were registered in Europe,<br />

22% of the total of 15,923 buses. That’s<br />

far behind China but far ahead of most<br />

of the rest of the world. According to our<br />

country level database from our report on<br />

Hybrid and Electric Trucks and Buses the<br />

UK and the Scandinavian countries were<br />

well ahead of that 22% figure, while much<br />

of the rest of Europe was behind. The leaders<br />

in BEV sales in 2021 were Germany<br />

with 575 BEV buses, the UK with 550 and<br />

France with 512.<br />

The Netherlands has already moved to close<br />

to 100% electric buses as well, but its lower<br />

total bus market means that, even so, its<br />

BEV shipments are still far behind those of<br />

France and Germany.<br />

<strong>2022</strong> was already expected to be a strong<br />

year for electric buses, but the effects of<br />

the Russian invasion of Ukraine have given<br />

the market a boost as countries in Europe<br />

seek energy independence in addition<br />

to existing goals around air pollution and<br />

climate change.<br />

E-bus market to grow 100% in ‘22<br />

We currently project 6,155 BEV buses<br />

in Europe in <strong>2022</strong>, or 39.5% of a total of<br />

15,591. This assumes a significant number<br />

of orders in the second half of the year (considering<br />

that the registrations from January<br />

to June were 1,768, see page 6) and assumes<br />

that there will not be a (major) recession in<br />

the second half of the year.<br />

The above numbers do not include fuel cell<br />

vehicles, which are currently about 1% of<br />

the total and growing. They also don’t include<br />

intercity buses, where BEV has a<br />

much smaller penetration.<br />

The majority of buses will still be fossil fuels<br />

in <strong>2022</strong> for various reasons. One is available<br />

supply: the production of electric vehicles<br />

cannot be tripled overnight. Battery gigafactories<br />

do not go from design to mass production<br />

in a matter of months, either. Companies<br />

are clearly planning for big increases but this<br />

will play out steadily over the next 3-4 years.<br />

Supply chains in <strong>2022</strong> have been difficult,<br />

slowing down production. A second reason<br />

is that the dependency on Russian fossil<br />

fuel is, especially for some countries such<br />

as Germany, more a dependency on gas<br />

than oil. While less diesel buses reduces de-<br />

24<br />

25