SHILL Issue 78

Solana ecosystem magazine.

Solana ecosystem magazine.

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

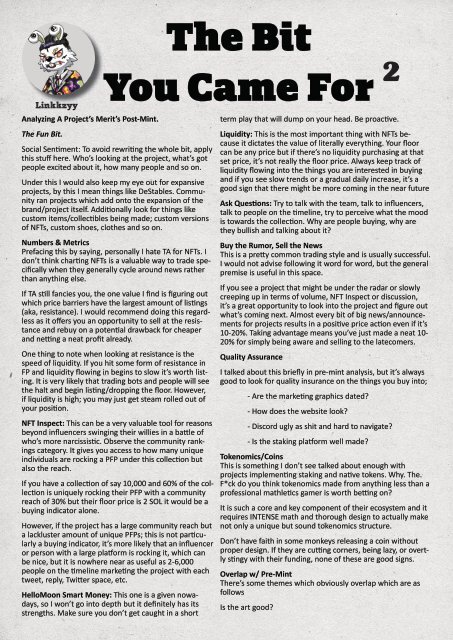

2<br />

Linkkzyy<br />

Analyzing A Project’s Merit’s Post-Mint.<br />

The Fun Bit.<br />

Social Sentiment: To avoid rewriting the whole bit, apply<br />

this stuff here. Who’s looking at the project, what’s got<br />

people excited about it, how many people and so on.<br />

Under this I would also keep my eye out for expansive<br />

projects, by this I mean things like DeStables. Community<br />

ran projects which add onto the expansion of the<br />

brand/project itself. Additionally look for things like<br />

custom items/collectibles being made; custom versions<br />

of NFTs, custom shoes, clothes and so on.<br />

Numbers & Metrics<br />

Prefacing this by saying, personally I hate TA for NFTs. I<br />

don’t think charting NFTs is a valuable way to trade specifically<br />

when they generally cycle around news rather<br />

than anything else.<br />

If TA still fancies you, the one value I find is figuring out<br />

which price barriers have the largest amount of listings<br />

(aka, resistance). I would recommend doing this regardless<br />

as it offers you an opportunity to sell at the resistance<br />

and rebuy on a potential drawback for cheaper<br />

and netting a neat profit already.<br />

One thing to note when looking at resistance is the<br />

speed of liquidity. If you hit some form of resistance in<br />

FP and liquidity flowing in begins to slow it’s worth listing.<br />

It is very likely that trading bots and people will see<br />

the halt and begin listing/dropping the floor. However,<br />

if liquidity is high; you may just get steam rolled out of<br />

your position.<br />

NFT Inspect: This can be a very valuable tool for reasons<br />

beyond influencers swinging their willies in a battle of<br />

who’s more narcissistic. Observe the community rankings<br />

category. It gives you access to how many unique<br />

individuals are rocking a PFP under this collection but<br />

also the reach.<br />

If you have a collection of say 10,000 and 60% of the collection<br />

is uniquely rocking their PFP with a community<br />

reach of 30% but their floor price is 2 SOL it would be a<br />

buying indicator alone.<br />

However, if the project has a large community reach but<br />

a lackluster amount of unique PFPs; this is not particularly<br />

a buying indicator, it’s more likely that an influencer<br />

or person with a large platform is rocking it, which can<br />

be nice, but it is nowhere near as useful as 2-6,000<br />

people on the timeline marketing the project with each<br />

tweet, reply, Twitter space, etc.<br />

HelloMoon Smart Money: This one is a given nowadays,<br />

so I won’t go into depth but it definitely has its<br />

strengths. Make sure you don’t get caught in a short<br />

term play that will dump on your head. Be proactive.<br />

Liquidity: This is the most important thing with NFTs because<br />

it dictates the value of literally everything. Your floor<br />

can be any price but if there’s no liquidity purchasing at that<br />

set price, it’s not really the floor price. Always keep track of<br />

liquidity flowing into the things you are interested in buying<br />

and if you see slow trends or a gradual daily increase, it’s a<br />

good sign that there might be more coming in the near future<br />

Ask Questions: Try to talk with the team, talk to influencers,<br />

talk to people on the timeline, try to perceive what the mood<br />

is towards the collection. Why are people buying, why are<br />

they bullish and talking about it?<br />

Buy the Rumor, Sell the News<br />

This is a pretty common trading style and is usually successful.<br />

I would not advise following it word for word, but the general<br />

premise is useful in this space.<br />

If you see a project that might be under the radar or slowly<br />

creeping up in terms of volume, NFT Inspect or discussion,<br />

it’s a great opportunity to look into the project and figure out<br />

what’s coming next. Almost every bit of big news/announcements<br />

for projects results in a positive price action even if it’s<br />

10-20%. Taking advantage means you’ve just made a neat 10-<br />

20% for simply being aware and selling to the latecomers.<br />

Quality Assurance<br />

I talked about this briefly in pre-mint analysis, but it’s always<br />

good to look for quality insurance on the things you buy into;<br />

- Are the marketing graphics dated?<br />

- How does the website look?<br />

- Discord ugly as shit and hard to navigate?<br />

- Is the staking platform well made?<br />

Tokenomics/Coins<br />

This is something I don’t see talked about enough with<br />

projects implementing staking and native tokens. Why. The.<br />

F*ck do you think tokenomics made from anything less than a<br />

professional mathletics gamer is worth betting on?<br />

It is such a core and key component of their ecosystem and it<br />

requires INTENSE math and thorough design to actually make<br />

not only a unique but sound tokenomics structure.<br />

Don’t have faith in some monkeys releasing a coin without<br />

proper design. If they are cutting corners, being lazy, or overtly<br />

stingy with their funding, none of these are good signs.<br />

Overlap w/ Pre-Mint<br />

There’s some themes which obviously overlap which are as<br />

follows<br />

Is the art good?