2024 March/April Marina World

The magazine for the marina industry

The magazine for the marina industry

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

BUYING & SELLING MARINAS<br />

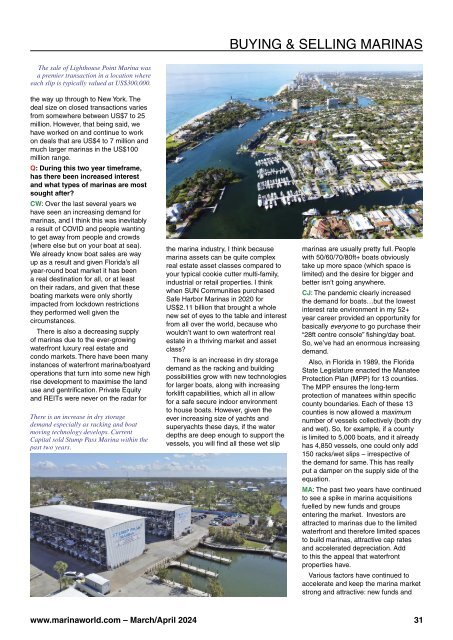

The sale of Lighthouse Point <strong>Marina</strong> was<br />

a premier transaction in a location where<br />

each slip is typically valued at US$300,000.<br />

the way up through to New York. The<br />

deal size on closed transactions varies<br />

from somewhere between US$7 to 25<br />

million. However, that being said, we<br />

have worked on and continue to work<br />

on deals that are US$4 to 7 million and<br />

much larger marinas in the US$100<br />

million range.<br />

Q: During this two year timeframe,<br />

has there been increased interest<br />

and what types of marinas are most<br />

sought after?<br />

CW: Over the last several years we<br />

have seen an increasing demand for<br />

marinas, and I think this was inevitably<br />

a result of COVID and people wanting<br />

to get away from people and crowds<br />

(where else but on your boat at sea).<br />

We already know boat sales are way<br />

up as a result and given Florida’s all<br />

year-round boat market it has been<br />

a real destination for all, or at least<br />

on their radars, and given that these<br />

boating markets were only shortly<br />

impacted from lockdown restrictions<br />

they performed well given the<br />

circumstances.<br />

There is also a decreasing supply<br />

of marinas due to the ever-growing<br />

waterfront luxury real estate and<br />

condo markets. There have been many<br />

instances of waterfront marina/boatyard<br />

operations that turn into some new high<br />

rise development to maximise the land<br />

use and gentrification. Private Equity<br />

and REITs were never on the radar for<br />

There is an increase in dry storage<br />

demand especially as racking and boat<br />

moving technology develops. Current<br />

Capital sold Stump Pass <strong>Marina</strong> within the<br />

past two years.<br />

the marina industry, I think because<br />

marina assets can be quite complex<br />

real estate asset classes compared to<br />

your typical cookie cutter multi-family,<br />

industrial or retail properties. I think<br />

when SUN Communities purchased<br />

Safe Harbor <strong>Marina</strong>s in 2020 for<br />

US$2.11 billion that brought a whole<br />

new set of eyes to the table and interest<br />

from all over the world, because who<br />

wouldn’t want to own waterfront real<br />

estate in a thriving market and asset<br />

class?<br />

There is an increase in dry storage<br />

demand as the racking and building<br />

possibilities grow with new technologies<br />

for larger boats, along with increasing<br />

forklift capabilities, which all in allow<br />

for a safe secure indoor environment<br />

to house boats. However, given the<br />

ever increasing size of yachts and<br />

superyachts these days, if the water<br />

depths are deep enough to support the<br />

vessels, you will find all these wet slip<br />

marinas are usually pretty full. People<br />

with 50/60/70/80ft+ boats obviously<br />

take up more space (which space is<br />

limited) and the desire for bigger and<br />

better isn’t going anywhere.<br />

CJ: The pandemic clearly increased<br />

the demand for boats…but the lowest<br />

interest rate environment in my 52+<br />

year career provided an opportunity for<br />

basically everyone to go purchase their<br />

“28ft centre console” fishing/day boat.<br />

So, we’ve had an enormous increasing<br />

demand.<br />

Also, in Florida in 1989, the Florida<br />

State Legislature enacted the Manatee<br />

Protection Plan (MPP) for 13 counties.<br />

The MPP ensures the long-term<br />

protection of manatees within specific<br />

county boundaries. Each of these 13<br />

counties is now allowed a maximum<br />

number of vessels collectively (both dry<br />

and wet). So, for example, if a county<br />

is limited to 5,000 boats, and it already<br />

has 4,850 vessels, one could only add<br />

150 racks/wet slips – irrespective of<br />

the demand for same. This has really<br />

put a damper on the supply side of the<br />

equation.<br />

MA: The past two years have continued<br />

to see a spike in marina acquisitions<br />

fuelled by new funds and groups<br />

entering the market. Investors are<br />

attracted to marinas due to the limited<br />

waterfront and therefore limited spaces<br />

to build marinas, attractive cap rates<br />

and accelerated depreciation. Add<br />

to this the appeal that waterfront<br />

properties have.<br />

Various factors have continued to<br />

accelerate and keep the marina market<br />

strong and attractive: new funds and<br />

www.marinaworld.com – <strong>March</strong>/<strong>April</strong> <strong>2024</strong><br />

31