Download latest annual report - HT Media

Download latest annual report - HT Media

Download latest annual report - HT Media

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Annual Report 2011-12<br />

Merger of Radio business as per the approved Scheme. Consequently an amount of `767.52 lacs (Previous year `765.44 lacs)<br />

has been debited to the Securities Premium Account in the current year.<br />

39. One of the subsidiary, <strong>HT</strong> Burda <strong>Media</strong> Limited, has appointed independent consultants for conducting a Transfer pricing study<br />

to determine whether the transactions with associated enterprises were undertaken at “arms length basis”. The management<br />

confirms that all international transactions with associated enterprises are undertaken at negotiated contracted prices on usual<br />

commercial terms. Further there has been no change in the terms of such international transactions till March 31, 2012<br />

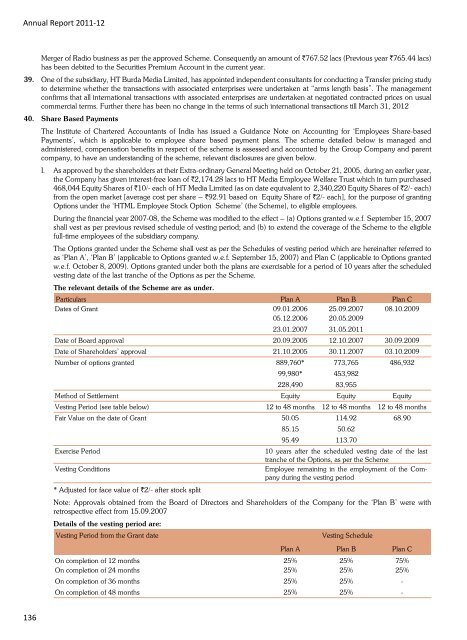

40. Share Based Payments<br />

The Institute of Chartered Accountants of India has issued a Guidance Note on Accounting for ‘Employees Share-based<br />

Payments’, which is applicable to employee share based payment plans. The scheme detailed below is managed and<br />

administered, compensation benefits in respect of the scheme is assessed and accounted by the Group Company and parent<br />

company, to have an understanding of the scheme, relevant disclosures are given below.<br />

I. As approved by the shareholders at their Extra-ordinary General Meeting held on October 21, 2005, during an earlier year,<br />

the Company has given interest-free loan of `2,174.28 lacs to <strong>HT</strong> <strong>Media</strong> Employee Welfare Trust which in turn purchased<br />

468,044 Equity Shares of `10/- each of <strong>HT</strong> <strong>Media</strong> Limited (as on date equivalent to 2,340,220 Equity Shares of `2/- each)<br />

from the open market [average cost per share – `92.91 based on Equity Share of `2/- each], for the purpose of granting<br />

Options under the ‘<strong>HT</strong>ML Employee Stock Option Scheme’ (the Scheme), to eligible employees.<br />

During the financial year 2007-08, the Scheme was modified to the effect – (a) Options granted w.e.f. September 15, 2007<br />

shall vest as per previous revised schedule of vesting period; and (b) to extend the coverage of the Scheme to the eligible<br />

full-time employees of the subsidiary company.<br />

The Options granted under the Scheme shall vest as per the Schedules of vesting period which are hereinafter referred to<br />

as ‘Plan A’, ‘Plan B’ (applicable to Options granted w.e.f. September 15, 2007) and Plan C (applicable to Options granted<br />

w.e.f. October 8, 2009). Options granted under both the plans are exercisable for a period of 10 years after the scheduled<br />

vesting date of the last tranche of the Options as per the Scheme.<br />

The relevant details of the Scheme are as under.<br />

Particulars Plan A Plan B Plan C<br />

Dates of Grant 09.01.2006 25.09.2007 08.10.2009<br />

05.12.2006 20.05.2009<br />

23.01.2007 31.05.2011<br />

Date of Board approval 20.09.2005 12.10.2007 30.09.2009<br />

Date of Shareholders’ approval 21.10.2005 30.11.2007 03.10.2009<br />

Number of options granted 889,760* 773,765 486,932<br />

99,980* 453,982<br />

228,490 83,955<br />

Method of Settlement Equity Equity Equity<br />

Vesting Period (see table below) 12 to 48 months 12 to 48 months 12 to 48 months<br />

Fair Value on the date of Grant 50.05 114.92 68.90<br />

85.15 50.62<br />

95.49 113.70<br />

Exercise Period 10 years after the scheduled vesting date of the last<br />

tranche of the Options, as per the Scheme<br />

Vesting Conditions<br />

* Adjusted for face value of `2/- after stock split<br />

Employee remaining in the employment of the Company<br />

during the vesting period<br />

Note: Approvals obtained from the Board of Directors and Shareholders of the Company for the ‘Plan B’ were with<br />

retrospective effect from 15.09.2007<br />

Details of the vesting period are:<br />

Vesting Period from the Grant date Vesting Schedule<br />

136<br />

Plan A Plan B Plan C<br />

On completion of 12 months 25% 25% 75%<br />

On completion of 24 months 25% 25% 25%<br />

On completion of 36 months 25% 25% -<br />

On completion of 48 months 25% 25% -