Download latest annual report - HT Media

Download latest annual report - HT Media

Download latest annual report - HT Media

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

OVERVIEW OF INDUSTRY<br />

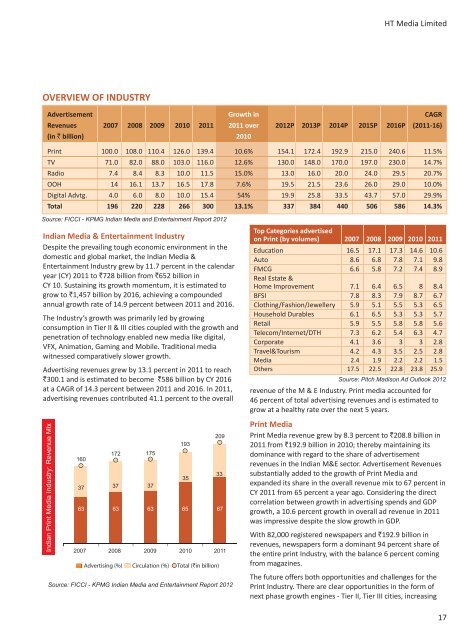

Advertisement Growth in<br />

CAGR<br />

Revenues 2007 2008 2009 2010 2011 2011 over 2012P 2013P 2014P 2015P 2016P (2011-16)<br />

(in ` billion)<br />

2010<br />

Print 100.0 108.0 110.4 126.0 139.4 10.6% 154.1 172.4 192.9 215.0 240.6 11.5%<br />

TV 71.0 82.0 88.0 103.0 116.0 12.6% 130.0 148.0 170.0 197.0 230.0 14.7%<br />

Radio 7.4 8.4 8.3 10.0 11.5 15.0% 13.0 16.0 20.0 24.0 29.5 20.7%<br />

OOH 14 16.1 13.7 16.5 17.8 7.6% 19.5 21.5 23.6 26.0 29.0 10.0%<br />

Digital Advtg. 4.0 6.0 8.0 10.0 15.4 54% 19.9 25.8 33.5 43.7 57.0 29.9%<br />

Total 196 220 228 266 300 13.1% 337 384 440 506 586 14.3%<br />

Source: FICCI - KPMG Indian <strong>Media</strong> and Entertainment Report 2012<br />

Indian <strong>Media</strong> & Entertainment Industry<br />

Despite the prevailing tough economic environment in the<br />

domestic and global market, the Indian <strong>Media</strong> &<br />

Entertainment Industry grew by 11.7 percent in the calendar<br />

year (CY) 2011 to `728 billion from `652 billion in<br />

CY 10. Sustaining its growth momentum, it is estimated to<br />

grow to `1,457 billion by 2016, achieving a compounded<br />

<strong>annual</strong> growth rate of 14.9 percent between 2011 and 2016.<br />

The Industry’s growth was primarily led by growing<br />

consumption in Tier II & III cities coupled with the growth and<br />

penetration of technology enabled new media like digital,<br />

VFX, Animation, Gaming and Mobile. Traditional media<br />

witnessed comparatively slower growth.<br />

Advertising revenues grew by 13.1 percent in 2011 to reach<br />

`300.1 and is estimated to become `586 billion by CY 2016<br />

at a CAGR of 14.3 percent between 2011 and 2016. In 2011,<br />

advertising revenues contributed 41.1 percent to the overall<br />

Indian Print <strong>Media</strong> Industry: Revenue Mix<br />

160<br />

2007<br />

172 175<br />

37 37 37<br />

2008<br />

193<br />

209<br />

63 63 63 65 67<br />

Advertising (%) Circulation (%)<br />

2009 2010 2011<br />

Source: FICCI - KPMG Indian <strong>Media</strong> and Entertainment Report 2012<br />

35<br />

Total (`in billion)<br />

33<br />

Top Categories advertised<br />

on Print (by volumes) 2007 2008 2009 2010 2011<br />

Education 16.5 17.1 17.3 14.6 10.6<br />

Auto 8.6 6.8 7.8 7.1 9.8<br />

FMCG<br />

Real Estate &<br />

6.6 5.8 7.2 7.4 8.9<br />

Home Improvement 7.1 6.4 6.5 8 8.4<br />

BFSI 7.8 8.3 7.9 8.7 6.7<br />

Clothing/Fashion/Jewellery 5.9 5.1 5.5 5.3 6.5<br />

Household Durables 6.1 6.5 5.3 5.3 5.7<br />

Retail 5.9 5.5 5.8 5.8 5.6<br />

Telecom/Internet/DTH 7.3 6.2 5.4 6.3 4.7<br />

Corporate 4.1 3.6 3 3 2.8<br />

Travel&Tourism 4.2 4.3 3.5 2.5 2.8<br />

<strong>Media</strong> 2.4 1.9 2.2 2.2 1.5<br />

Others 17.5 22.5 22.8 23.8 25.9<br />

Source: Pitch Madison Ad Outlook 2012<br />

revenue of the M & E Industry. Print media accounted for<br />

46 percent of total advertising revenues and is estimated to<br />

grow at a healthy rate over the next 5 years.<br />

Print <strong>Media</strong><br />

Print <strong>Media</strong> revenue grew by 8.3 percent to `208.8 billion in<br />

2011 from `192.9 billion in 2010; thereby maintaining its<br />

dominance with regard to the share of advertisement<br />

revenues in the Indian M&E sector. Advertisement Revenues<br />

substantially added to the growth of Print <strong>Media</strong> and<br />

expanded its share in the overall revenue mix to 67 percent in<br />

CY 2011 from 65 percent a year ago. Considering the direct<br />

correlation between growth in advertising spends and GDP<br />

growth, a 10.6 percent growth in overall ad revenue in 2011<br />

was impressive despite the slow growth in GDP.<br />

With 82,000 registered newspapers and `192.9 billion in<br />

revenues, newspapers form a dominant 94 percent share of<br />

the entire print Industry, with the balance 6 percent coming<br />

from magazines.<br />

The future offers both opportunities and challenges for the<br />

Print Industry. There are clear opportunities in the form of<br />

next phase growth engines - Tier II, Tier III cities, increasing<br />

17