Download latest annual report - HT Media

Download latest annual report - HT Media

Download latest annual report - HT Media

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

As per our <strong>report</strong> of even date<br />

For S. R. Batliboi & Co.<br />

Firm Registration Number: 301003E<br />

Chartered Accountants<br />

For and on behalf of the Board of Directors of <strong>HT</strong> <strong>Media</strong> Limited<br />

per Manoj Gupta Shobhana Bhartia Rajiv Verma<br />

Partner Chairperson & Chief Executive Officer<br />

Membership No. 83906 Editorial Director & Whole Time Director<br />

Dinesh Mittal Piyush Gupta<br />

Place : New Delhi Group General Counsel Group Chief Financial<br />

Date : May 18, 2012 & Company Secretary Officer<br />

<strong>HT</strong> <strong>Media</strong> Limited<br />

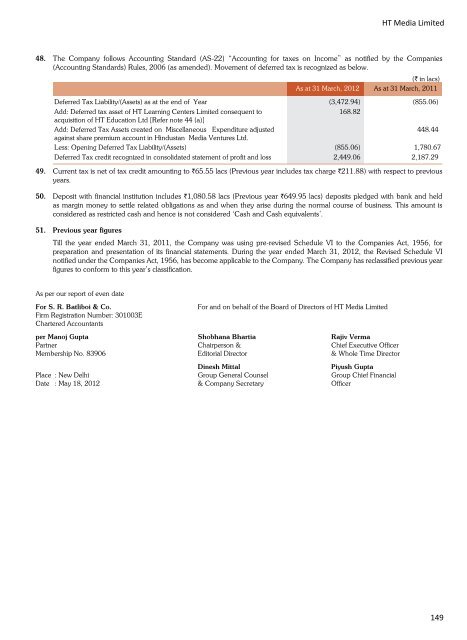

48. The Company follows Accounting Standard (AS-22) “Accounting for taxes on Income” as notified by the Companies<br />

(Accounting Standards) Rules, 2006 (as amended). Movement of deferred tax is recognized as below.<br />

(` in lacs)<br />

As at 31 March, 2012 As at 31 March, 2011<br />

Deferred Tax Liability/(Assets) as at the end of Year (3,472.94) (855.06)<br />

Add: Deferred tax asset of <strong>HT</strong> Learning Centers Limited consequent to<br />

acquisition of <strong>HT</strong> Education Ltd [Refer note 44 (a)]<br />

168.82<br />

Add: Deferred Tax Assets created on Miscellaneous Expenditure adjusted<br />

448.44<br />

against share premium account in Hindustan <strong>Media</strong> Ventures Ltd.<br />

Less: Opening Deferred Tax Liability/(Assets) (855.06) 1,780.67<br />

Deferred Tax credit recognized in consolidated statement of profit and loss 2,449.06 2,187.29<br />

49. Current tax is net of tax credit amounting to `65.55 lacs (Previous year includes tax charge `211.88) with respect to previous<br />

years.<br />

50. Deposit with financial institution includes `1,080.58 lacs (Previous year `649.95 lacs) deposits pledged with bank and held<br />

as margin money to settle related obligations as and when they arise during the normal course of business. This amount is<br />

considered as restricted cash and hence is not considered ‘Cash and Cash equivalents’.<br />

51. Previous year figures<br />

Till the year ended March 31, 2011, the Company was using pre-revised Schedule VI to the Companies Act, 1956, for<br />

preparation and presentation of its financial statements. During the year ended March 31, 2012, the Revised Schedule VI<br />

notified under the Companies Act, 1956, has become applicable to the Company. The Company has reclassified previous year<br />

figures to conform to this year’s classification.<br />

149