Features: - Tanker Operator

Features: - Tanker Operator

Features: - Tanker Operator

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

INDUSTRY - MARKETS<br />

Daily Rate (Bareboat Basis, USD / d)<br />

soft freight market windows, the<br />

shipowner/lessee would had the opportunity to<br />

trade the vessel profitably on the spot market<br />

and on one and three year firm contracts and<br />

would had made an operating profit. Of<br />

course, the shipowner/lessee would have been<br />

exposed to the market risk of either renewing<br />

the short-term firm employment contract until<br />

fully covering the leaseback term, or risk the<br />

spot market. However, in such strong markets<br />

06<br />

$80,000<br />

$70,000<br />

$60,000<br />

$50,000<br />

$40,000<br />

$30,000<br />

$20,000<br />

$10,000<br />

$0<br />

2000-01<br />

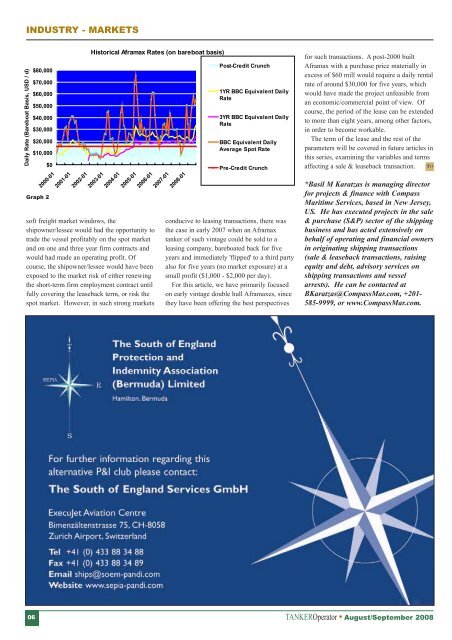

Graph 2<br />

2001-01<br />

2002-01<br />

Historical Aframax Rates (on bareboat basis)<br />

2003-01<br />

2004-01<br />

2005-01<br />

2006-01<br />

2007-01<br />

2008-01<br />

Post-Credit Crunch<br />

1YR BBC Equivalent Daily<br />

Rate<br />

3YR BBC Equivalent Daily<br />

Rate<br />

BBC Equivalent Daily<br />

Average Spot Rate<br />

Pre-Credit Crunch<br />

conducive to leasing transactions, there was<br />

the case in early 2007 when an Aframax<br />

tanker of such vintage could be sold to a<br />

leasing company, bareboated back for five<br />

years and immediately 'flipped' to a third party<br />

also for five years (no market exposure) at a<br />

small profit ($1,000 - $2,000 per day).<br />

For this article, we have primarily focused<br />

on early vintage double hull Aframaxes, since<br />

they have been offering the best perspectives<br />

for such transactions. A post-2000 built<br />

Aframax with a purchase price materially in<br />

excess of $60 mill would require a daily rental<br />

rate of around $30,000 for five years, which<br />

would have made the project unfeasible from<br />

an economic/commercial point of view. Of<br />

course, the period of the lease can be extended<br />

to more than eight years, among other factors,<br />

in order to become workable.<br />

The term of the lease and the rest of the<br />

parameters will be covered in future articles in<br />

this series, examining the variables and terms<br />

affecting a sale & leaseback transaction. TO<br />

*Basil M Karatzas is managing director<br />

for projects & finance with Compass<br />

Maritime Services, based in New Jersey,<br />

US. He has executed projects in the sale<br />

& purchase (S&P) sector of the shipping<br />

business and has acted extensively on<br />

behalf of operating and financial owners<br />

in originating shipping transactions<br />

(sale & leaseback transactions, raising<br />

equity and debt, advisory services on<br />

shipping transactions and vessel<br />

arrests). He can be contacted at<br />

BKaratzas@CompassMar.com, +201-<br />

585-9999, or www.CompassMar.com.<br />

TANKER<strong>Operator</strong> � August/September 2008