Berger Paints Initiating Coverage - Myiris.com

Berger Paints Initiating Coverage - Myiris.com

Berger Paints Initiating Coverage - Myiris.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Trading at 38% discount to<br />

Asian <strong>Paints</strong>… expect the gap<br />

to narrow<br />

Comparative valuations<br />

<strong>Berger</strong> <strong>Paints</strong> <strong>Initiating</strong> <strong>Coverage</strong><br />

Valuation and Re<strong>com</strong>mendation<br />

Second obvious option… cannot be ignored<br />

<strong>Berger</strong> <strong>Paints</strong> is the second largest player (17% market share) in the decorative paints<br />

market and has recorded healthy revenue run-rate of 18% CAGR over FY05-11. <strong>Berger</strong><br />

<strong>Paints</strong>, with a strong presence in the eastern markets with strategically located plants there,<br />

is increasing its reach in the southern markets through the franchisee stores. Moreover, it<br />

has a strong distribution network of 14,000 dealers with 7,700 tinting machines across<br />

India. With a strong second position in the decorative paints market, we believe <strong>Berger</strong><br />

<strong>Paints</strong> cannot be ignored.<br />

Gaining scale and size…<br />

<strong>Berger</strong> <strong>Paints</strong> is increasing its capacity by 52% over the next two years, which provides<br />

healthy volume growth visibility in the future. Moreover, the inherent growth in the paints<br />

industry coupled with the <strong>com</strong>pany’s aggression to expand its geographical reach will help<br />

<strong>Berger</strong> <strong>Paints</strong> attain reasonable revenue size of Rs 33 bn by FY13E.<br />

…with healthy growth momentum<br />

We forecast 19% revenue CAGR over FY11-13E driven by 15% volume growth and 5%<br />

price-led growth. While high raw material costs continue to keep pressure on profitability<br />

and will lead to a flat operating margin over this period, we expect the <strong>com</strong>pany to post<br />

earnings CAGR of 20% over FY11-13E.<br />

Valuation gap to Asian <strong>Paints</strong> to narrow…<br />

At the current market price, the stock is trading at 19.9x FY12E EPS of Rs 5.0/share and<br />

16.0x FY13E EPS of Rs 6.2/share. At 16.0 x FY13E EPS, it is trading at 38% discount to the<br />

market leader, Asian <strong>Paints</strong>. Historically, the <strong>com</strong>pany has traded at an average discount of<br />

40% to Asian <strong>Paints</strong>’ one-year forward mean PER. We believe that going forward; this<br />

discount should narrow due to the following reasons:<br />

� Gaining considerable size with a revenue CAGR of 19% over FY11-13E<br />

� Product mix shifting towards higher growth and better margin business of water-based<br />

emulsion paints<br />

� Increasing presence across India with rising penetration in the south<br />

…Initiate with ACCUMULATE and target price of Rs 109/share<br />

We have valued <strong>Berger</strong> <strong>Paints</strong> at 17.5x FY13E earnings, a 30% discount to Asian <strong>Paints</strong><br />

target PER multiple of 25x. This gives us a fair price of Rs 109/share, which provides 9.5%<br />

upside from the current levels . Hence, we initiate coverage on the stock with an<br />

ACCUMULATE rating and a target price of Rs 109/share.<br />

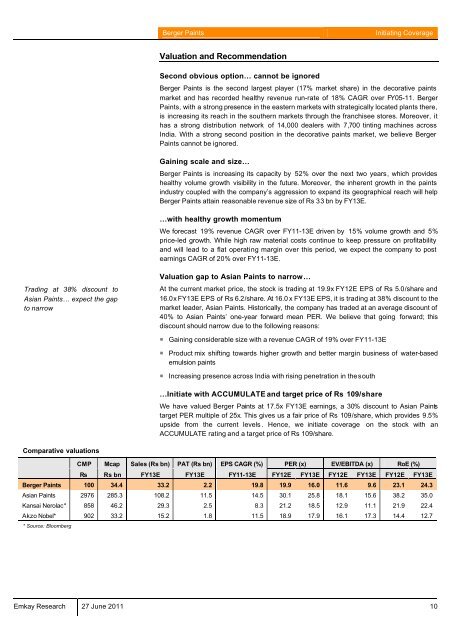

CMP Mcap Sales (Rs bn) PAT (Rs bn) EPS CAGR (%) PER (x) EV/EBITDA (x) RoE (%)<br />

Rs Rs bn FY13E FY13E FY11-13E FY12E FY13E FY12E FY13E FY12E FY13E<br />

<strong>Berger</strong> <strong>Paints</strong> 100 34.4 33.2 2.2 19.8 19.9 16.0 11.6 9.6 23.1 24.3<br />

Asian <strong>Paints</strong> 2976 285.3 108.2 11.5 14.5 30.1 25.8 18.1 15.6 38.2 35.0<br />

Kansai Nerolac* 858 46.2 29.3 2.5 8.3 21.2 18.5 12.9 11.1 21.9 22.4<br />

Akzo Nobel* 902 33.2 15.2 1.8 11.5 18.9 17.9 16.1 17.3 14.4 12.7<br />

* Source: Bloomberg<br />

Emkay Research 27 June 2011 10