BPZ Resources, Inc. - Shareholder.com

BPZ Resources, Inc. - Shareholder.com

BPZ Resources, Inc. - Shareholder.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

options exercised during the year ended December 31, 2010. Cash received from stock option exercises for the year ended<br />

December 31, 2009 and 2008 was $0.6 million and $2.4 million, respectively.<br />

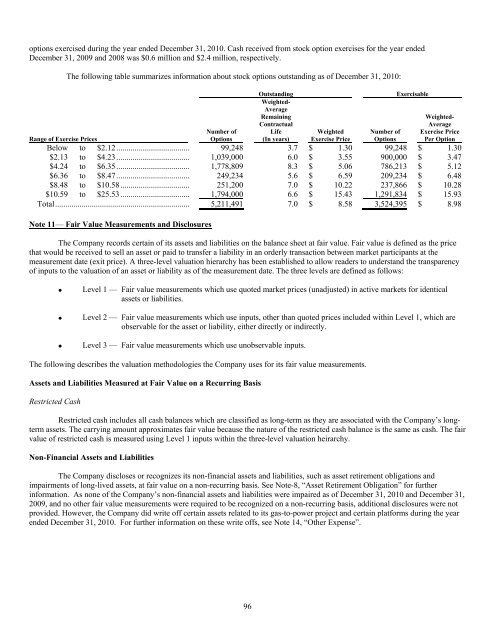

The following table summarizes information about stock options outstanding as of December 31, 2010:<br />

Outstanding Exercisable<br />

Weighted-<br />

Average<br />

Remaining Weighted-<br />

Contractual Average<br />

Number of Life Weighted Number of Exercise Price<br />

Range of Exercise Prices Options (In years) Exercise Price Options Per Option<br />

Below to $2.12.................................... 99,248 3.7 $ 1.30 99,248 $ 1.30<br />

$2.13 to $4.23.................................... 1,039,000 6.0 $ 3.55 900,000 $ 3.47<br />

$4.24 to $6.35.................................... 1,778,809 8.3 $ 5.06 786,213 $ 5.12<br />

$6.36 to $8.47.................................... 249,234 5.6 $ 6.59 209,234 $ 6.48<br />

$8.48 to $10.58.................................. 251,200 7.0 $ 10.22 237,866 $ 10.28<br />

$10.59 to $25.53.................................. 1,794,000 6.6 $ 15.43 1,291,834 $ 15.93<br />

Total.................................................................. 5,211,491 7.0 $ 8.58 3,524,395 $ 8.98<br />

Note 11— Fair Value Measurements and Disclosures<br />

The Company records certain of its assets and liabilities on the balance sheet at fair value. Fair value is defined as the price<br />

that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the<br />

measurement date (exit price). A three-level valuation hierarchy has been established to allow readers to understand the transparency<br />

of inputs to the valuation of an asset or liability as of the measurement date. The three levels are defined as follows:<br />

• Level 1 — Fair value measurements which use quoted market prices (unadjusted) in active markets for identical<br />

assets or liabilities.<br />

• Level 2 — Fair value measurements which use inputs, other than quoted prices included within Level 1, which are<br />

observable for the asset or liability, either directly or indirectly.<br />

• Level 3 — Fair value measurements which use unobservable inputs.<br />

The following describes the valuation methodologies the Company uses for its fair value measurements.<br />

Assets and Liabilities Measured at Fair Value on a Recurring Basis<br />

Restricted Cash<br />

Restricted cash includes all cash balances which are classified as long-term as they are associated with the Company’s longterm<br />

assets. The carrying amount approximates fair value because the nature of the restricted cash balance is the same as cash. The fair<br />

value of restricted cash is measured using Level 1 inputs within the three-level valuation heirarchy.<br />

Non-Financial Assets and Liabilities<br />

The Company discloses or recognizes its non-financial assets and liabilities, such as asset retirement obligations and<br />

impairments of long-lived assets, at fair value on a non-recurring basis. See Note-8, “Asset Retirement Obligation” for further<br />

information. As none of the Company’s non-financial assets and liabilities were impaired as of December 31, 2010 and December 31,<br />

2009, and no other fair value measurements were required to be recognized on a non-recurring basis, additional disclosures were not<br />

provided. However, the Company did write off certain assets related to its gas-to-power project and certain platforms during the year<br />

ended December 31, 2010. For further information on these write offs, see Note 14, “Other Expense”.<br />

96