BPZ Resources, Inc. - Shareholder.com

BPZ Resources, Inc. - Shareholder.com

BPZ Resources, Inc. - Shareholder.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

taxable in<strong>com</strong>e over the periods in which the deferred tax assets are deductible, along with the transition into the <strong>com</strong>mercial phase<br />

under the Block Z-1 License Contract, we believed it is more likely than not that we will realize the benefits of the these deductible<br />

differences at December 31, 2009. As a result, we recognized a deferred tax asset of $16.9 million as of December 31, 2009.<br />

Estimated interest and penalties related to potential underpayment on unrecognized tax benefits, if any, are classified as a<br />

<strong>com</strong>ponent of tax expense in the Consolidated Statement of Operations. As of the date of adoption of FIN 48, now codified under<br />

ASC Topic 740, “<strong>Inc</strong>ome Taxes”, we did not have any accrued interest or penalties associated with any unrecognized tax benefits, nor<br />

were any interest expense recognized during the year. Additionally, the adoption had no effect on our financial position or results of<br />

operations. We did not have any uncertain tax positions generated from unrecognized tax benefits resulting from differences between<br />

positions taken in tax returns and amounts recognized in the financial statement as of December 31, 2009 or December 31, 2008.<br />

For the year ended December 31, 2009, our net loss increased $26.2 million to a net loss of $35.8 million or ($0.35) per basic<br />

and diluted share from a net loss of $9.6 million or ($0.12) per basic and diluted share for the same period in 2008.<br />

Liquidity, Capital <strong>Resources</strong> and Capital Expenditures<br />

At December 31, 2010, we had cash and cash equivalents of $11.8 million and current accounts receivable related to our<br />

December oil sales of $11.2 million, all of which was collected in early January 2011. We also had $28.4 million in the current portion<br />

of our value-added tax receivable, which we will collect over time as we invoice our oil sales.<br />

At December 31, 2010, we had trade accounts payable and accrued liabilities of $51.8 million.<br />

At December 31, 2010, our outstanding long-term debt and short-term debt consisted of a $12.5 million IFC Facility bearing<br />

interest at LIBOR plus 2.75% due December 31, 2012 and 2015 Convertible Notes whose net amount of $140.8 million includes the<br />

$170.9 million of principal reduced by $30.1 million of the remaining unamortized discount. At December 31, 2010, the current and<br />

long-term portions of our capital lease obligations, primarily related to the barges used in our marine operations were $4.2 million and<br />

$3.4 million, respectively.<br />

We had a working capital surplus at December 31, 2010 of $22.7 million.<br />

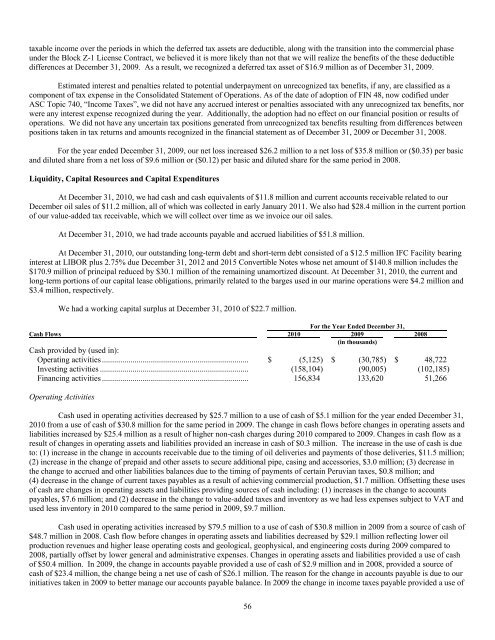

For the Year Ended December 31,<br />

Cash Flows 2010 2009 2008<br />

(in thousands)<br />

Cash provided by (used in):<br />

Operating activities ........................................................................ $ (5,125) $ (30,785) $ 48,722<br />

Investing activities ......................................................................... (158,104) (90,005) (102,185)<br />

Financing activities ........................................................................ 156,834 133,620 51,266<br />

Operating Activities<br />

Cash used in operating activities decreased by $25.7 million to a use of cash of $5.1 million for the year ended December 31,<br />

2010 from a use of cash of $30.8 million for the same period in 2009. The change in cash flows before changes in operating assets and<br />

liabilities increased by $25.4 million as a result of higher non-cash charges during 2010 <strong>com</strong>pared to 2009. Changes in cash flow as a<br />

result of changes in operating assets and liabilities provided an increase in cash of $0.3 million. The increase in the use of cash is due<br />

to: (1) increase in the change in accounts receivable due to the timing of oil deliveries and payments of those deliveries, $11.5 million;<br />

(2) increase in the change of prepaid and other assets to secure additional pipe, casing and accessories, $3.0 million; (3) decrease in<br />

the change to accrued and other liabilities balances due to the timing of payments of certain Peruvian taxes, $0.8 million; and<br />

(4) decrease in the change of current taxes payables as a result of achieving <strong>com</strong>mercial production, $1.7 million. Offsetting these uses<br />

of cash are changes in operating assets and liabilities providing sources of cash including: (1) increases in the change to accounts<br />

payables, $7.6 million; and (2) decrease in the change to value-added taxes and inventory as we had less expenses subject to VAT and<br />

used less inventory in 2010 <strong>com</strong>pared to the same period in 2009, $9.7 million.<br />

Cash used in operating activities increased by $79.5 million to a use of cash of $30.8 million in 2009 from a source of cash of<br />

$48.7 million in 2008. Cash flow before changes in operating assets and liabilities decreased by $29.1 million reflecting lower oil<br />

production revenues and higher lease operating costs and geological, geophysical, and engineering costs during 2009 <strong>com</strong>pared to<br />

2008, partially offset by lower general and administrative expenses. Changes in operating assets and liabilities provided a use of cash<br />

of $50.4 million. In 2009, the change in accounts payable provided a use of cash of $2.9 million and in 2008, provided a source of<br />

cash of $23.4 million, the change being a net use of cash of $26.1 million. The reason for the change in accounts payable is due to our<br />

initiatives taken in 2009 to better manage our accounts payable balance. In 2009 the change in in<strong>com</strong>e taxes payable provided a use of<br />

56