BPZ Resources, Inc. - Shareholder.com

BPZ Resources, Inc. - Shareholder.com

BPZ Resources, Inc. - Shareholder.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Performance Bonds<br />

As of December 31, 2010, we have restricted cash deposits of $5.8 million. In connection with our properties in Peru, we<br />

have obtained four performance bonds totaling $5.3 million that are partially collateralized by restricted cash deposits of $3.1 million<br />

to insure certain performance obligations and <strong>com</strong>mitments under the license contracts for Blocks Z-1, XIX, XXII and XXIII.<br />

Additionally, we have $2.0 million of restricted cash to collateralize insurance bonds for import duties related to the Don Fernando,<br />

our construction barge, and $0.6 million of restricted cash to insure certain performance obligations and <strong>com</strong>mitments at our gas-topower<br />

project site near Tumbes. In addition, we have an unsecured performance bond of $0.1 million to guarantee our performance<br />

under an office lease agreement in Peru.<br />

All of the performance and insurance bonds are issued by Peruvian banks and their terms are governed by the corresponding<br />

license contracts, customs laws, legal requirements or rental practices.<br />

2011 Estimated Capital Expenditures Budget<br />

We estimate our 2011 capital expenditures budget to be approximately $50 million for the continued development of our<br />

assets in northwest Peru. The majority of the capital budget is expected to be spent on offshore Block Z-1, primarily for the design and<br />

construction of an additional production platform for the Corvina oil field, as well as, for injection equipment to be installed on the<br />

platform in the Albacora oil field by year-end 2011. The new platform in Corvina, along with the injection equipment for Albacora, is<br />

budgeted at approximately $40 million for 2011. The new platform for Corvina is expected to be installed with the production and<br />

injection equipment in 2012. We have also budgeted approximately $10 million for two automatic crude oil custody transfer units,<br />

improvements to the supply dock at Caleta Cruz and other capital projects.<br />

In addition to capital expenditures, we plan to spend and expense approximately $18 million on seismic acquisition in Block Z-1<br />

and $4 million to <strong>com</strong>plete the seismic acquisitions in Blocks XXII and XXIII. At the CX-11 platform in Corvina, we plan two or<br />

three workovers of existing wells to optimize oil production. Workovers are expected to <strong>com</strong>mence in the second quarter, and are<br />

budgeted at $3 million each. We may work over two or three of the existing oil wells at the Albacora platform in the fourth quarter of<br />

2011 and these are also budgeted at $3 million each.<br />

Liquidity Outlook<br />

Our major sources of funding to date have been through oil sales, equity raises, convertible debt issuances and, to a lesser<br />

extent, debt financing activities. With our current cash balance, current and prospective Corvina and Albacora oil development cash<br />

flow, our recent debt issuance, our recent debt facility and other potential third-party financing and potential financing from future<br />

equity raises, we believe we will have sufficient capital resources to execute our planned Corvina and Albacora oil development<br />

projects as well as service our current obligations.<br />

We have hired a financial advisor to help us in pursuing joint venture partnerships and/or, farm-outs for some or all of our<br />

assets and options for financing our operations in northwest Peru. While there will be options discussed that could provide us with<br />

additional liquidity or funding, we cannot predict the out<strong>com</strong>e of this review.<br />

Off-Balance Sheet Arrangements<br />

As of December 31, 2010, we had no transactions, agreements or other contractual arrangements with unconsolidated entities<br />

or financial partnerships, often referred to as special purpose entities, which generally are established for the purpose of facilitating<br />

off-balance sheet arrangements.<br />

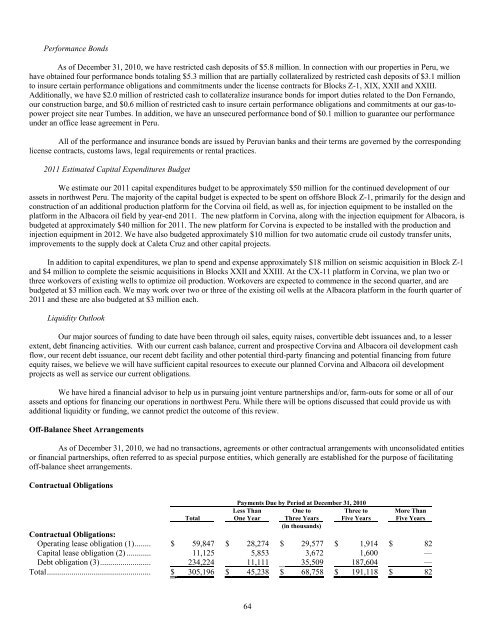

Contractual Obligations<br />

Total<br />

Payments Due by Period at December 31, 2010<br />

Less Than One to<br />

Three to<br />

One Year Three Years<br />

(in thousands)<br />

Five Years<br />

64<br />

More Than<br />

Five Years<br />

Contractual Obligations:<br />

Operating lease obligation (1)........ $ 59,847 $ 28,274 $ 29,577 $ 1,914 $ 82<br />

Capital lease obligation (2) ............ 11,125 5,853 3,672 1,600 —<br />

Debt obligation (3)......................... 234,224 11,111 35,509 187,604 —<br />

Total................................................... $ 305,196 $ 45,238 $ 68,758 $ 191,118 $ 82