BPZ Resources, Inc. - Shareholder.com

BPZ Resources, Inc. - Shareholder.com

BPZ Resources, Inc. - Shareholder.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Inc</strong>ludes the monthly lease expense for one of the Company’s oil transportation vessels whose lease is set to expire in February 2012<br />

and storage vessel whose lease is set to expire in February 2013.<br />

Note 21 — Subsequent Events<br />

The Company and its subsidiaries <strong>com</strong>pleted a credit agreement with Credit Suisse on January 27, 2011 where Credit Suisse<br />

provided $40.0 million of secured financing and utilized a portion of the proceeds to retire the existing debt with IFC. For further<br />

information, see Note 9 “Long-Term Debt and Capital Lease Obligations”.<br />

The initial conversion rate on the $170.9 Million Convertible Notes due 2015 was adjusted on February 3, 2011. The<br />

conversion rate and conversion price changed to 169.0082 and $5.9169, respectively. For further information, see Note 9 “Long-Term<br />

Debt and Capital Lease Obligations”.<br />

On January 24, 2011, production from the A14-XD well was shut-in under the EWT program. On February 10, 2011, the<br />

Company received notice that its application for EWT testing for the A-14XD well was denied. For further information, see Note-18,<br />

“Commitment and Contingencies”.<br />

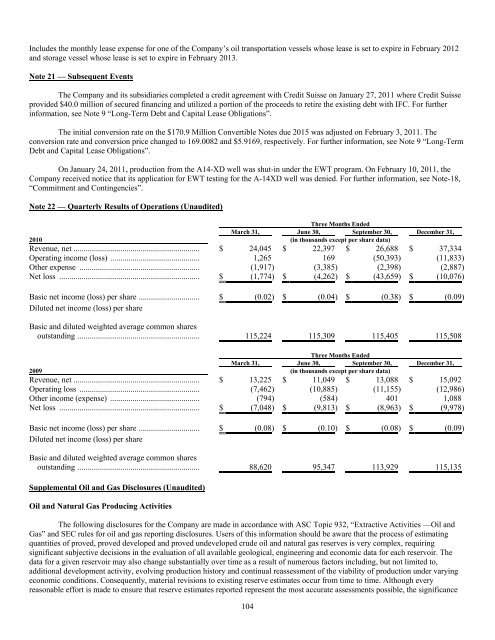

Note 22 — Quarterly Results of Operations (Unaudited)<br />

Three Months Ended<br />

March 31, June 30, September 30, December 31,<br />

2010 (in thousands except per share data)<br />

Revenue, net .............................................................. $ 24,045 $ 22,397 $ 26,688 $ 37,334<br />

Operating in<strong>com</strong>e (loss) ............................................ 1,265 169 (50,393) (11,833)<br />

Other expense ........................................................... (1,917) (3,385) (2,398) (2,887)<br />

Net loss ..................................................................... $ (1,774) $ (4,262) $ (43,659) $ (10,076)<br />

Basic net in<strong>com</strong>e (loss) per share .............................. $ (0.02) $ (0.04) $ (0.38) $ (0.09)<br />

Diluted net in<strong>com</strong>e (loss) per share<br />

Basic and diluted weighted average <strong>com</strong>mon shares<br />

outstanding ............................................................ 115,224 115,309 115,405 115,508<br />

Three Months Ended<br />

March 31, June 30, September 30, December 31,<br />

2009 (in thousands except per share data)<br />

Revenue, net .............................................................. $ 13,225 $ 11,049 $ 13,088 $ 15,092<br />

Operating loss ........................................................... (7,462) (10,885) (11,155) (12,986)<br />

Other in<strong>com</strong>e (expense) ............................................ (794) (584) 401 1,088<br />

Net loss ..................................................................... $ (7,048) $ (9,813) $ (8,963) $ (9,978)<br />

Basic net in<strong>com</strong>e (loss) per share .............................. $ (0.08) $ (0.10) $ (0.08) $ (0.09)<br />

Diluted net in<strong>com</strong>e (loss) per share<br />

Basic and diluted weighted average <strong>com</strong>mon shares<br />

outstanding ............................................................ 88,620 95,347 113,929 115,135<br />

Supplemental Oil and Gas Disclosures (Unaudited)<br />

Oil and Natural Gas Producing Activities<br />

The following disclosures for the Company are made in accordance with ASC Topic 932, “Extractive Activities —Oil and<br />

Gas” and SEC rules for oil and gas reporting disclosures. Users of this information should be aware that the process of estimating<br />

quantities of proved, proved developed and proved undeveloped crude oil and natural gas reserves is very <strong>com</strong>plex, requiring<br />

significant subjective decisions in the evaluation of all available geological, engineering and economic data for each reservoir. The<br />

data for a given reservoir may also change substantially over time as a result of numerous factors including, but not limited to,<br />

additional development activity, evolving production history and continual reassessment of the viability of production under varying<br />

economic conditions. Consequently, material revisions to existing reserve estimates occur from time to time. Although every<br />

reasonable effort is made to ensure that reserve estimates reported represent the most accurate assessments possible, the significance<br />

104