BPZ Resources, Inc. - Shareholder.com

BPZ Resources, Inc. - Shareholder.com

BPZ Resources, Inc. - Shareholder.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

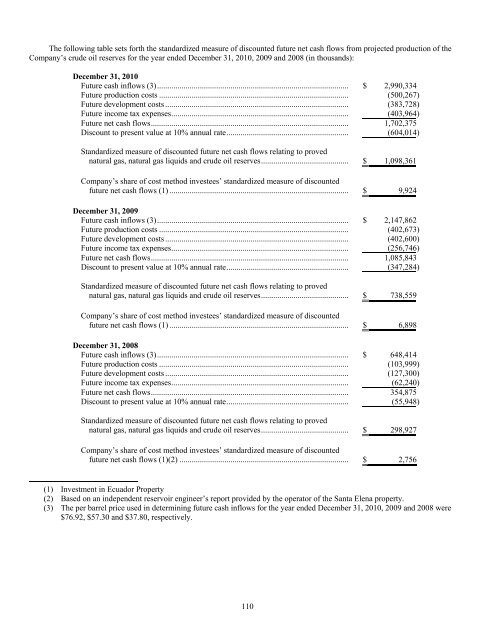

The following table sets forth the standardized measure of discounted future net cash flows from projected production of the<br />

Company’s crude oil reserves for the year ended December 31, 2010, 2009 and 2008 (in thousands):<br />

December 31, 2010<br />

Future cash inflows (3).............................................................................................. $ 2,990,334<br />

Future production costs ............................................................................................. (500,267)<br />

Future development costs .......................................................................................... (383,728)<br />

Future in<strong>com</strong>e tax expenses....................................................................................... (403,964)<br />

Future net cash flows................................................................................................. 1,702,375<br />

Discount to present value at 10% annual rate............................................................ (604,014)<br />

Standardized measure of discounted future net cash flows relating to proved<br />

natural gas, natural gas liquids and crude oil reserves........................................... $ 1,098,361<br />

Company’s share of cost method investees’ standardized measure of discounted<br />

future net cash flows (1) ........................................................................................ $ 9,924<br />

December 31, 2009<br />

Future cash inflows (3).............................................................................................. $ 2,147,862<br />

Future production costs ............................................................................................. (402,673)<br />

Future development costs .......................................................................................... (402,600)<br />

Future in<strong>com</strong>e tax expenses....................................................................................... (256,746)<br />

Future net cash flows................................................................................................. 1,085,843<br />

Discount to present value at 10% annual rate............................................................ (347,284)<br />

Standardized measure of discounted future net cash flows relating to proved<br />

natural gas, natural gas liquids and crude oil reserves........................................... $ 738,559<br />

Company’s share of cost method investees’ standardized measure of discounted<br />

future net cash flows (1) ........................................................................................ $ 6,898<br />

December 31, 2008<br />

Future cash inflows (3).............................................................................................. $ 648,414<br />

Future production costs ............................................................................................. (103,999)<br />

Future development costs .......................................................................................... (127,300)<br />

Future in<strong>com</strong>e tax expenses....................................................................................... (62,240)<br />

Future net cash flows................................................................................................. 354,875<br />

Discount to present value at 10% annual rate............................................................ (55,948)<br />

Standardized measure of discounted future net cash flows relating to proved<br />

natural gas, natural gas liquids and crude oil reserves........................................... $ 298,927<br />

Company’s share of cost method investees’ standardized measure of discounted<br />

future net cash flows (1)(2) ................................................................................... $ 2,756<br />

(1) Investment in Ecuador Property<br />

(2) Based on an independent reservoir engineer’s report provided by the operator of the Santa Elena property.<br />

(3) The per barrel price used in determining future cash inflows for the year ended December 31, 2010, 2009 and 2008 were<br />

$76.92, $57.30 and $37.80, respectively.<br />

110