BPZ Resources, Inc. - Shareholder.com

BPZ Resources, Inc. - Shareholder.com

BPZ Resources, Inc. - Shareholder.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

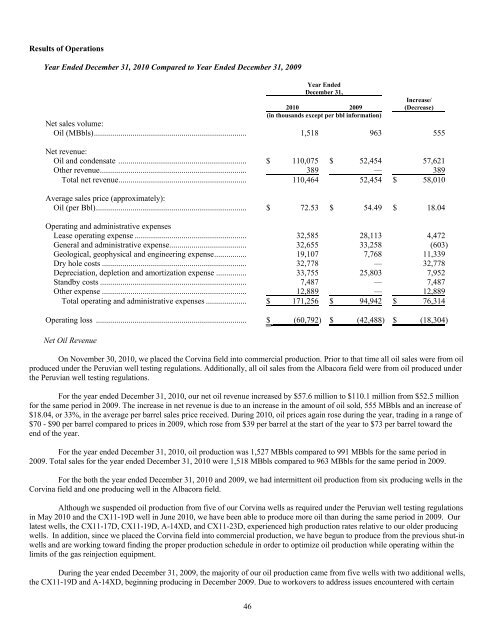

Results of Operations<br />

Year Ended December 31, 2010 Compared to Year Ended December 31, 2009<br />

46<br />

Year Ended<br />

December 31,<br />

2010 2009<br />

(in thousands except per bbl information)<br />

<strong>Inc</strong>rease/<br />

(Decrease)<br />

Net sales volume:<br />

Oil (MBbls)........................................................................... 1,518 963 555<br />

Net revenue:<br />

Oil and condensate ............................................................... $ 110,075 $ 52,454 57,621<br />

Other revenue........................................................................ 389 — 389<br />

Total net revenue............................................................... 110,464 52,454 $ 58,010<br />

Average sales price (approximately):<br />

Oil (per Bbl).......................................................................... $ 72.53 $ 54.49 $ 18.04<br />

Operating and administrative expenses<br />

Lease operating expense ....................................................... 32,585 28,113 4,472<br />

General and administrative expense...................................... 32,655 33,258 (603)<br />

Geological, geophysical and engineering expense................ 19,107 7,768 11,339<br />

Dry hole costs ....................................................................... 32,778 — 32,778<br />

Depreciation, depletion and amortization expense ............... 33,755 25,803 7,952<br />

Standby costs ........................................................................ 7,487 — 7,487<br />

Other expense ....................................................................... 12,889 — 12,889<br />

Total operating and administrative expenses .................... $ 171,256 $ 94,942 $ 76,314<br />

Operating loss .......................................................................... $ (60,792) $ (42,488) $ (18,304)<br />

Net Oil Revenue<br />

On November 30, 2010, we placed the Corvina field into <strong>com</strong>mercial production. Prior to that time all oil sales were from oil<br />

produced under the Peruvian well testing regulations. Additionally, all oil sales from the Albacora field were from oil produced under<br />

the Peruvian well testing regulations.<br />

For the year ended December 31, 2010, our net oil revenue increased by $57.6 million to $110.1 million from $52.5 million<br />

for the same period in 2009. The increase in net revenue is due to an increase in the amount of oil sold, 555 MBbls and an increase of<br />

$18.04, or 33%, in the average per barrel sales price received. During 2010, oil prices again rose during the year, trading in a range of<br />

$70 - $90 per barrel <strong>com</strong>pared to prices in 2009, which rose from $39 per barrel at the start of the year to $73 per barrel toward the<br />

end of the year.<br />

For the year ended December 31, 2010, oil production was 1,527 MBbls <strong>com</strong>pared to 991 MBbls for the same period in<br />

2009. Total sales for the year ended December 31, 2010 were 1,518 MBbls <strong>com</strong>pared to 963 MBbls for the same period in 2009.<br />

For the both the year ended December 31, 2010 and 2009, we had intermittent oil production from six producing wells in the<br />

Corvina field and one producing well in the Albacora field.<br />

Although we suspended oil production from five of our Corvina wells as required under the Peruvian well testing regulations<br />

in May 2010 and the CX11-19D well in June 2010, we have been able to produce more oil than during the same period in 2009. Our<br />

latest wells, the CX11-17D, CX11-19D, A-14XD, and CX11-23D, experienced high production rates relative to our older producing<br />

wells. In addition, since we placed the Corvina field into <strong>com</strong>mercial production, we have begun to produce from the previous shut-in<br />

wells and are working toward finding the proper production schedule in order to optimize oil production while operating within the<br />

limits of the gas reinjection equipment.<br />

During the year ended December 31, 2009, the majority of our oil production came from five wells with two additional wells,<br />

the CX11-19D and A-14XD, beginning producing in December 2009. Due to workovers to address issues encountered with certain