BPZ Resources, Inc. - Shareholder.com

BPZ Resources, Inc. - Shareholder.com

BPZ Resources, Inc. - Shareholder.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

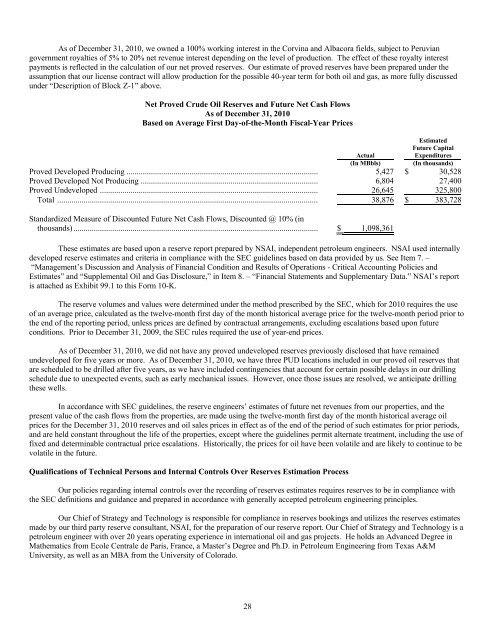

As of December 31, 2010, we owned a 100% working interest in the Corvina and Albacora fields, subject to Peruvian<br />

government royalties of 5% to 20% net revenue interest depending on the level of production. The effect of these royalty interest<br />

payments is reflected in the calculation of our net proved reserves. Our estimate of proved reserves have been prepared under the<br />

assumption that our license contract will allow production for the possible 40-year term for both oil and gas, as more fully discussed<br />

under “Description of Block Z-1” above.<br />

Net Proved Crude Oil Reserves and Future Net Cash Flows<br />

As of December 31, 2010<br />

Based on Average First Day-of-the-Month Fiscal-Year Prices<br />

Actual<br />

Estimated<br />

Future Capital<br />

Expenditures<br />

(In MBbls) (In thousands)<br />

Proved Developed Producing .............................................................................................. 5,427 $ 30,528<br />

Proved Developed Not Producing ....................................................................................... 6,804 27,400<br />

Proved Undeveloped ........................................................................................................... 26,645 325,800<br />

Total ................................................................................................................................ 38,876 $ 383,728<br />

Standardized Measure of Discounted Future Net Cash Flows, Discounted @ 10% (in<br />

thousands) ........................................................................................................................ $ 1,098,361<br />

These estimates are based upon a reserve report prepared by NSAI, independent petroleum engineers. NSAI used internally<br />

developed reserve estimates and criteria in <strong>com</strong>pliance with the SEC guidelines based on data provided by us. See Item 7. –<br />

“Management’s Discussion and Analysis of Financial Condition and Results of Operations - Critical Accounting Policies and<br />

Estimates” and “Supplemental Oil and Gas Disclosure,” in Item 8. – “Financial Statements and Supplementary Data.” NSAI’s report<br />

is attached as Exhibit 99.1 to this Form 10-K.<br />

The reserve volumes and values were determined under the method prescribed by the SEC, which for 2010 requires the use<br />

of an average price, calculated as the twelve-month first day of the month historical average price for the twelve-month period prior to<br />

the end of the reporting period, unless prices are defined by contractual arrangements, excluding escalations based upon future<br />

conditions. Prior to December 31, 2009, the SEC rules required the use of year-end prices.<br />

As of December 31, 2010, we did not have any proved undeveloped reserves previously disclosed that have remained<br />

undeveloped for five years or more. As of December 31, 2010, we have three PUD locations included in our proved oil reserves that<br />

are scheduled to be drilled after five years, as we have included contingencies that account for certain possible delays in our drilling<br />

schedule due to unexpected events, such as early mechanical issues. However, once those issues are resolved, we anticipate drilling<br />

these wells.<br />

In accordance with SEC guidelines, the reserve engineers’ estimates of future net revenues from our properties, and the<br />

present value of the cash flows from the properties, are made using the twelve-month first day of the month historical average oil<br />

prices for the December 31, 2010 reserves and oil sales prices in effect as of the end of the period of such estimates for prior periods,<br />

and are held constant throughout the life of the properties, except where the guidelines permit alternate treatment, including the use of<br />

fixed and determinable contractual price escalations. Historically, the prices for oil have been volatile and are likely to continue to be<br />

volatile in the future.<br />

Qualifications of Technical Persons and Internal Controls Over Reserves Estimation Process<br />

Our policies regarding internal controls over the recording of reserves estimates requires reserves to be in <strong>com</strong>pliance with<br />

the SEC definitions and guidance and prepared in accordance with generally accepted petroleum engineering principles.<br />

Our Chief of Strategy and Technology is responsible for <strong>com</strong>pliance in reserves bookings and utilizes the reserves estimates<br />

made by our third party reserve consultant, NSAI, for the preparation of our reserve report. Our Chief of Strategy and Technology is a<br />

petroleum engineer with over 20 years operating experience in international oil and gas projects. He holds an Advanced Degree in<br />

Mathematics from Ecole Centrale de Paris, France, a Master’s Degree and Ph.D. in Petroleum Engineering from Texas A&M<br />

University, as well as an MBA from the University of Colorado.<br />

28