BPZ Resources, Inc. - Shareholder.com

BPZ Resources, Inc. - Shareholder.com

BPZ Resources, Inc. - Shareholder.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

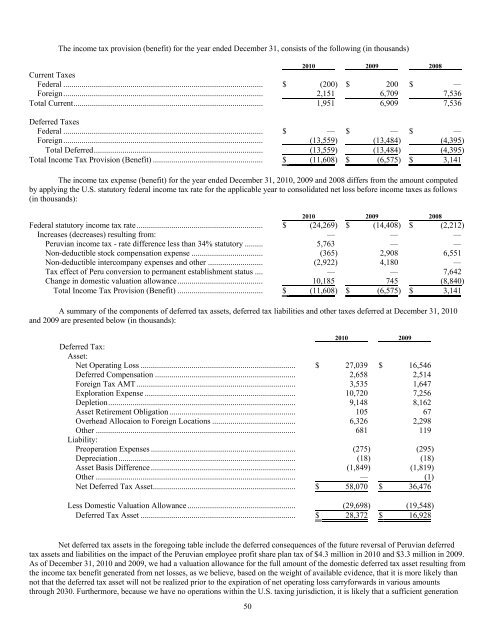

The in<strong>com</strong>e tax provision (benefit) for the year ended December 31, consists of the following (in thousands)<br />

50<br />

2010 2009 2008<br />

Current Taxes<br />

Federal .................................................................................................. $ (200) $ 200 $ —<br />

Foreign.................................................................................................. 2,151 6,709 7,536<br />

Total Current............................................................................................. 1,951 6,909 7,536<br />

Deferred Taxes<br />

Federal .................................................................................................. $ — $ — $ —<br />

Foreign.................................................................................................. (13,559) (13,484) (4,395)<br />

Total Deferred................................................................................... (13,559) (13,484) (4,395)<br />

Total <strong>Inc</strong>ome Tax Provision (Benefit) ...................................................... $ (11,608) $ (6,575) $ 3,141<br />

The in<strong>com</strong>e tax expense (benefit) for the year ended December 31, 2010, 2009 and 2008 differs from the amount <strong>com</strong>puted<br />

by applying the U.S. statutory federal in<strong>com</strong>e tax rate for the applicable year to consolidated net loss before in<strong>com</strong>e taxes as follows<br />

(in thousands):<br />

2010 2009 2008<br />

Federal statutory in<strong>com</strong>e tax rate.............................................................. $ (24,269) $ (14,408) $ (2,212)<br />

<strong>Inc</strong>reases (decreases) resulting from: — — —<br />

Peruvian in<strong>com</strong>e tax - rate difference less than 34% statutory ......... 5,763 — —<br />

Non-deductible stock <strong>com</strong>pensation expense ................................... (365) 2,908 6,551<br />

Non-deductible inter<strong>com</strong>pany expenses and other ........................... (2,922) 4,180 —<br />

Tax effect of Peru conversion to permanent establishment status .... — — 7,642<br />

Change in domestic valuation allowance.......................................... 10,185 745 (8,840)<br />

Total <strong>Inc</strong>ome Tax Provision (Benefit) .......................................... $ (11,608) $ (6,575) $ 3,141<br />

A summary of the <strong>com</strong>ponents of deferred tax assets, deferred tax liabilities and other taxes deferred at December 31, 2010<br />

and 2009 are presented below (in thousands):<br />

2010 2009<br />

Deferred Tax:<br />

Asset:<br />

Net Operating Loss ............................................................................ $ 27,039 $ 16,546<br />

Deferred Compensation ..................................................................... 2,658 2,514<br />

Foreign Tax AMT .............................................................................. 3,535 1,647<br />

Exploration Expense .......................................................................... 10,720 7,256<br />

Depletion............................................................................................ 9,148 8,162<br />

Asset Retirement Obligation .............................................................. 105 67<br />

Overhead Allocaion to Foreign Locations ......................................... 6,326 2,298<br />

Other .................................................................................................. 681 119<br />

Liability:<br />

Preoperation Expenses ....................................................................... (275) (295)<br />

Depreciation....................................................................................... (18) (18)<br />

Asset Basis Difference ....................................................................... (1,849) (1,819)<br />

Other .................................................................................................. — (1)<br />

Net Deferred Tax Asset...................................................................... $ 58,070 $ 36,476<br />

Less Domestic Valuation Allowance ..................................................... (29,698) (19,548)<br />

Deferred Tax Asset ............................................................................ $ 28,372 $ 16,928<br />

Net deferred tax assets in the foregoing table include the deferred consequences of the future reversal of Peruvian deferred<br />

tax assets and liabilities on the impact of the Peruvian employee profit share plan tax of $4.3 million in 2010 and $3.3 million in 2009.<br />

As of December 31, 2010 and 2009, we had a valuation allowance for the full amount of the domestic deferred tax asset resulting from<br />

the in<strong>com</strong>e tax benefit generated from net losses, as we believe, based on the weight of available evidence, that it is more likely than<br />

not that the deferred tax asset will not be realized prior to the expiration of net operating loss carryforwards in various amounts<br />

through 2030. Furthermore, because we have no operations within the U.S. taxing jurisdiction, it is likely that a sufficient generation