Fic rEcommEndationS - Eurobank EFG

Fic rEcommEndationS - Eurobank EFG

Fic rEcommEndationS - Eurobank EFG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TAX<br />

A. CORPORATE INCOME TAX<br />

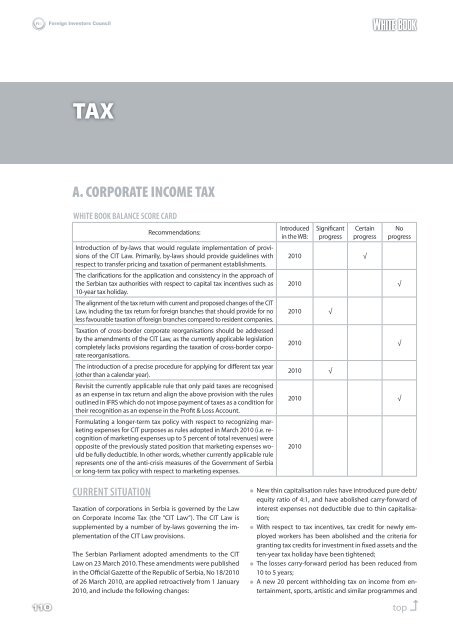

WHitE BooK BaLancE ScorE card<br />

cUrrEnt SitUation<br />

Recommendations:<br />

Introduction of by-laws that would regulate implementation of provisions<br />

of the CIT Law. Primarily, by-laws should provide guidelines with<br />

respect to transfer pricing and taxation of permanent establishments.<br />

The clarifications for the application and consistency in the approach of<br />

the Serbian tax authorities with respect to capital tax incentives such as<br />

10-year tax holiday.<br />

The alignment of the tax return with current and proposed changes of the CIT<br />

Law, including the tax return for foreign branches that should provide for no<br />

less favourable taxation of foreign branches compared to resident companies.<br />

Taxation of cross-border corporate reorganisations should be addressed<br />

by the amendments of the CIT Law, as the currently applicable legislation<br />

completely lacks provisions regarding the taxation of cross-border corporate<br />

reorganisations.<br />

The introduction of a precise procedure for applying for different tax year<br />

(other than a calendar year).<br />

Revisit the currently applicable rule that only paid taxes are recognised<br />

as an expense in tax return and align the above provision with the rules<br />

outlined in IFRS which do not impose payment of taxes as a condition for<br />

their recognition as an expense in the Profit & Loss Account.<br />

Formulating a longer-term tax policy with respect to recognizing marketing<br />

expenses for CIT purposes as rules adopted in March 2010 (i.e. recognition<br />

of marketing expenses up to 5 percent of total revenues) were<br />

opposite of the previously stated position that marketing expenses would<br />

be fully deductible. In other words, whether currently applicable rule<br />

represents one of the anti-crisis measures of the Government of Serbia<br />

or long-term tax policy with respect to marketing expenses.<br />

Taxation of corporations in Serbia is governed by the Law<br />

on Corporate Income Tax (the “CIT Law”). The CIT Law is<br />

supplemented by a number of by-laws governing the implementation<br />

of the CIT Law provisions.<br />

The Serbian Parliament adopted amendments to the CIT<br />

Law on 23 March 2010. These amendments were published<br />

in the Official Gazette of the Republic of Serbia, No 18/2010<br />

of 26 March 2010, are applied retroactively from 1 January<br />

2010, and include the following changes:<br />

Introduced<br />

in the WB:<br />

Significant<br />

progress<br />

Certain<br />

progress<br />

2010 √<br />

No<br />

progress<br />

2010 √<br />

2010 √<br />

2010 √<br />

2010 √<br />

2010 √<br />

New thin capitalisation rules have introduced pure debt/<br />

equity ratio of 4:1, and have abolished carry-forward of<br />

interest expenses not deductible due to thin capitalisation;<br />

With respect to tax incentives, tax credit for newly employed<br />

workers has been abolished and the criteria for<br />

granting tax credits for investment in fixed assets and the<br />

ten-year tax holiday have been tightened;<br />

The losses carry-forward period has been reduced from<br />

10 to 5 years;<br />

A new 20 percent withholding tax on income from entertainment,<br />

sports, artistic and similar programmes and<br />

110 top �<br />

2010